Dropbox (NASDAQ: DBX) ended the last fiscal quarter with more than 14 million paying subscribers, continuing the ongoing uptrend. Interestingly, the online file hosting company maintained stable subscription growth last year, despite an increase in prices.

It is scheduled to publish fourth-quarter earnings on Thursday after the closing bell. The overall outlook is positive, with analysts predicting an 18% annual growth in revenues to $443.1 million. Earnings are estimated to edge up to $0.14 per share from $0.10 per share reported last year.

New App

The management is encouraged by the positive response to a new desktop app launched last year. It was complemented by the introduction of Dropbox Spaces, which is designed to allow clients to build smart workspaces that mitigate distractions linked to the use of technology. It is estimated that December-quarter results benefited from the new launches.

Related: Why Dropbox might not be a good investment option

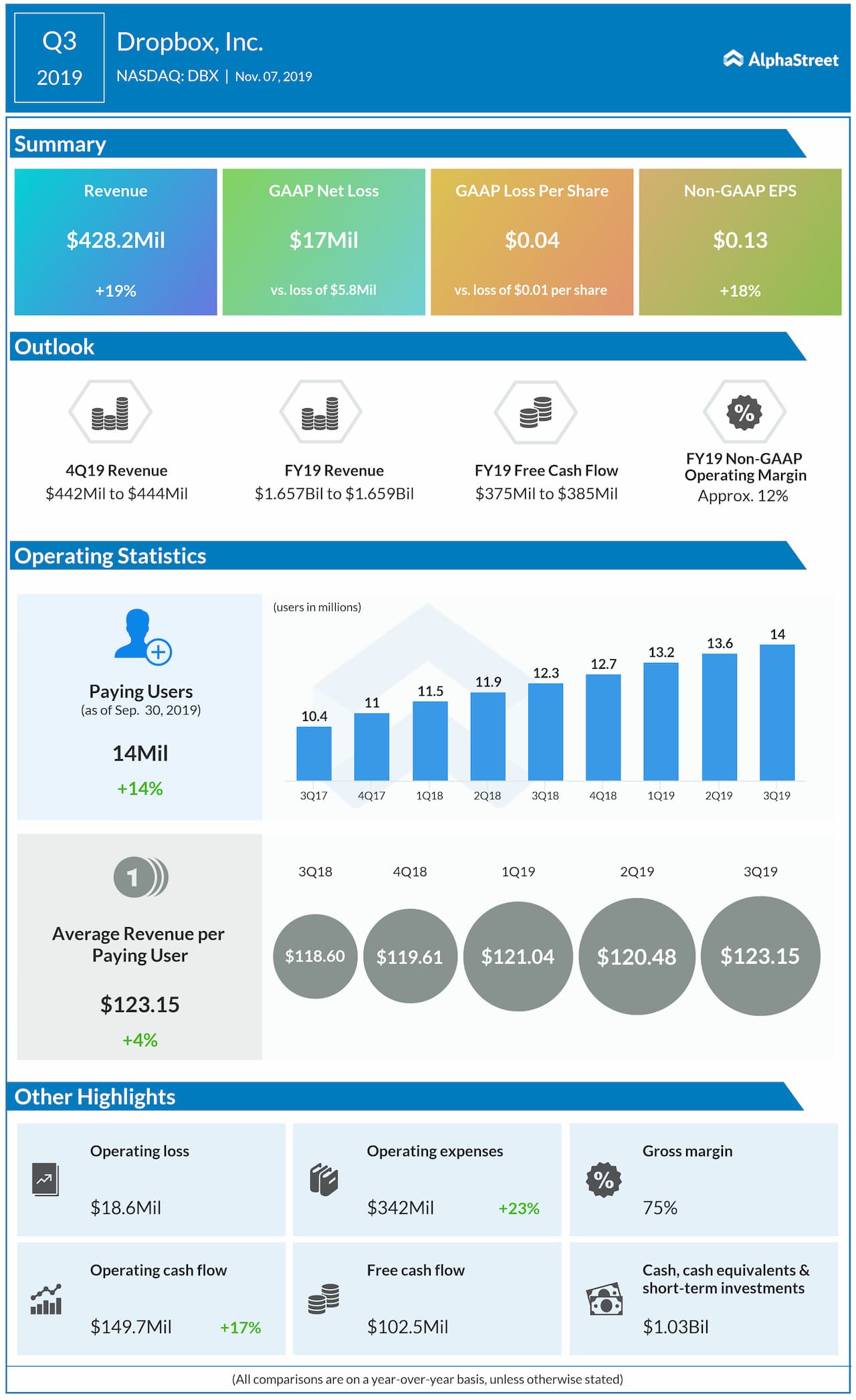

However, the growth initiatives require heavy investment and the high costs could be a drag on profitability. In the third quarter, adjusted earnings rose to $0.13 per share, aided by a double-digit increase in revenues. The results also surpassed analysts’ estimates.

Pros & Cons

Of late, Dropbox has been facing competition from free cloud storage providers like Microsoft (MSFT) and Google (GOOG), who are better positioned to serve customers in a full-fledged manner. Yet, the aggressive portfolio-revamp and introduction of new features give the company an edge over its rivals.

Recently, investor sentiment got a boost after Dropbox’s CEO Drew Houston joined the board of directors of Facebook (FB). According to some market-watchers, it is of no significance as far as Dropbox’s future prospects are concerned.

A recent study showed that the cloud storage service market is poised for a major expansion in the next few years, which bodes well for Dropbox.

Hold It!

Analysts, in general, recommend holding Dropbox’s stock, with a price target of $19 that represents a 2% upside from the last closing price.

Also see: Dropbox Q3 2019 Earnings Call Transcript

Dropbox’s shares have been in a downward spiral ever since the company went public two years ago. After experiencing a great deal of volatility, the stock shifted to recovery mode early this year. It has lost 21% in the past twelve months.

Most Popular

Infographic: Highlights of Halliburton’s (HAL) Q1 2024 earnings results

Energy giant Halliburton Company (NYSE: HAL) Tuesday announced financial results for the first quarter of 2024, reporting lower earnings and a modest increase in revenues. First-quarter revenue edged up 2%

UPS Earnings: United Parcel Service Q1 2024 revenue and earnings fall

United Parcel Service, Inc. (NYSE: UPS) Tuesday reported lower revenues and adjusted profit for the first quarter of 2024. The company reaffirmed its full-year 2024 guidance. On an adjusted basis,

Key highlights from Philip Morris’ (PM) Q1 2024 earnings results

Philip Morris International Inc. (NYSE: PM) reported first quarter 2024 earnings results today. Net revenues increased 9.7% year-over-year to $8.8 billion. Organic revenue growth was 11%. Net earnings attributable to