Facebook, Inc. (NASDAQ: FB) Wednesday reported an increase in fourth-quarter profit and revenues as the social media firm continued to expand its user base. The results also exceeded the market’s projection. However, the company’s shares traded lower during the extended trading session, immediately after the announcement.

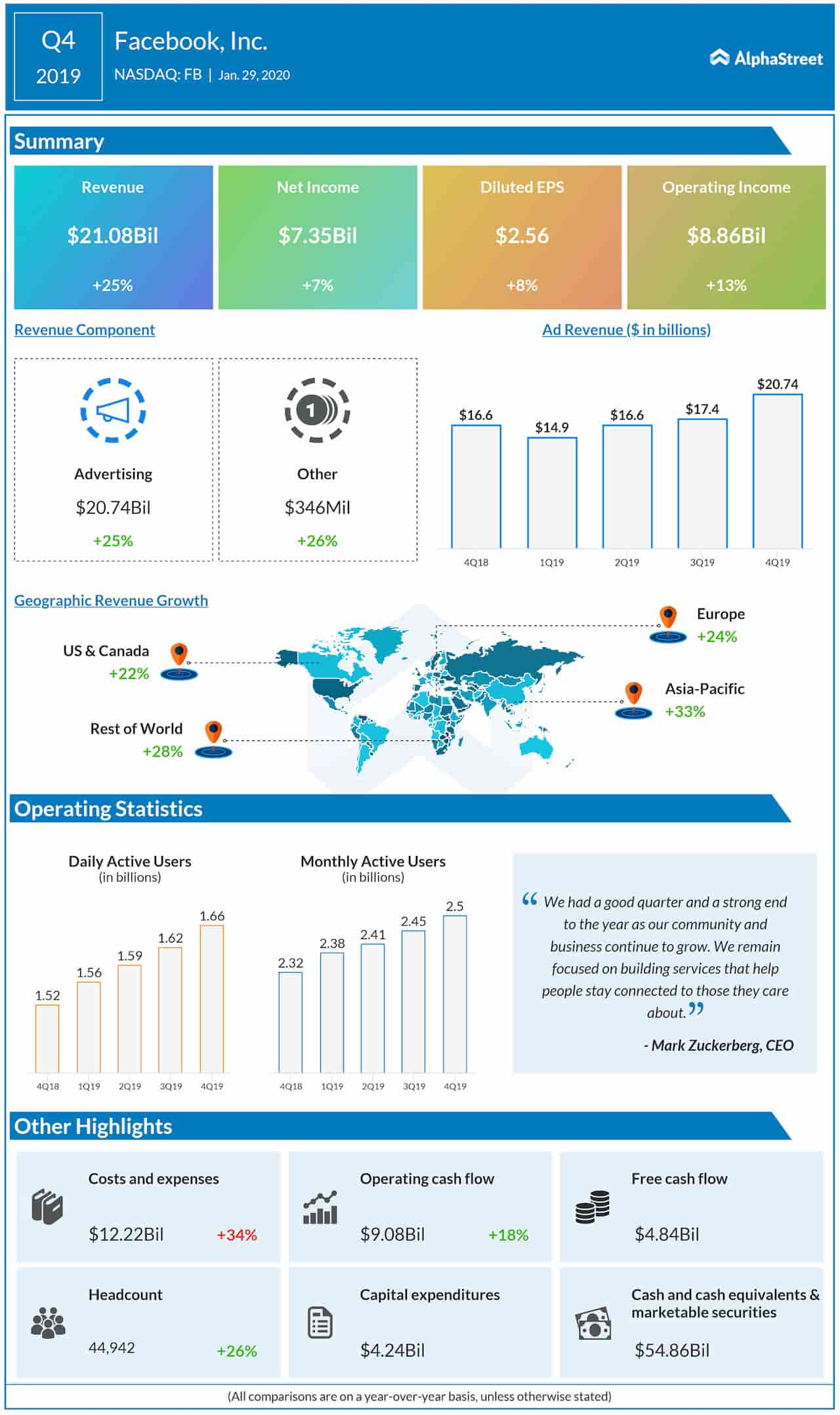

The number of daily active users rose 9% to 1.66 billion, while that of monthly active users advanced 8% to 2.5 billion. At $21.08 billion, December-quarter revenues were up 25% year-over-year.

Ad Revenue up 25%

Advertising revenues rose 25% to $20.7 billion and other revenues moved up 26% to $346 million. The top line benefited from the continued user growth and topped the Street view.

Net income was at $7.35 billion or $2.56 per share in the fourth quarter, up from $6.88 billion or $2.38 per share in the corresponding period of 2018. Analysts had predicted a slower bottom-line growth.

CapEx

During the quarter, capital expenditures, including principal payments on nance leases, came in at $4.24 billion.

“We had a good quarter and a strong end to the year as our community and business continue to grow. We remain focused on building services that help people stay connected to those they care about,” said Mark Zuckerberg, Facebook’s CEO.

Legal Tussle

The Silicon Valley firm has been reporting positive quarterly numbers consistently, despite being embroiled in multiple controversies related to data misuse and anti-competitive practices. It constantly remains on the radar of regulators and investigation agencies, due to allegations of unethical business practices.

Of late, the company has been shifting focus to diversifying the business into new areas such as video streaming, after launching its cryptocurrency named Libra.

Facebook shares had a positive start to 2020 and maintained the uptrend so far. They gained 45% in the past twelve months. Analysts’ consensus rating on the stock is buy, with an average price target of $245.74.