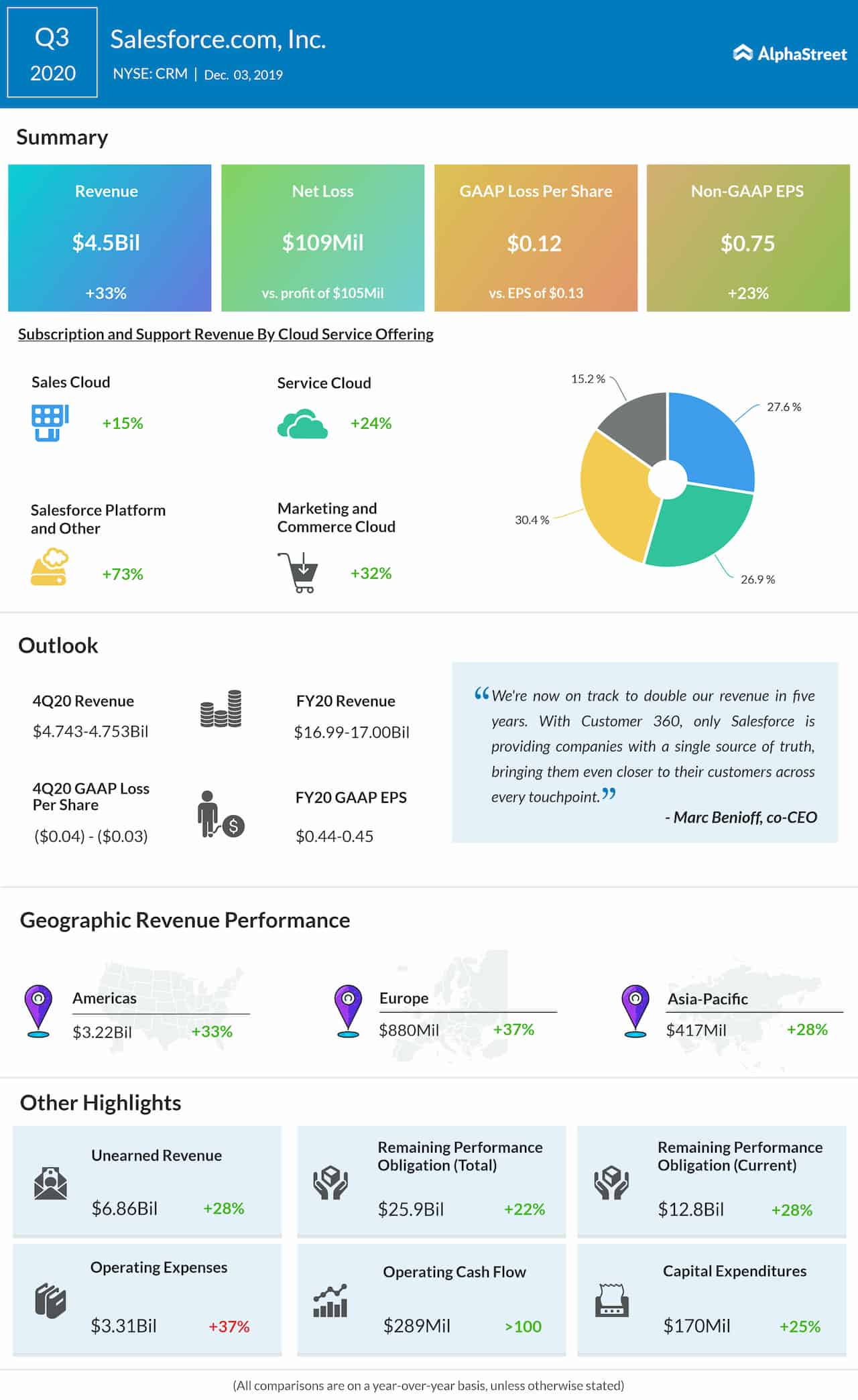

Salesforce (NYSE: CRM) is working to double its revenues in the next five years, which was announced by the management while reporting robust third-quarter results a few months ago. After setting new records consistently, the company’s stock reached an all-time high this week.

The customer relationship management firm is probably on track to achieving the ambitious goal, going by the 32% top-line growth analysts currently estimate for the fourth quarter of 2020. At $4.75 billion, the revenue outlook comes at the upper end of the management’s guidance range. Meanwhile, the market is looking for a 21% fall in earnings to $0.55 per share. The results will be out on February 25 at 4:05 pm ET.

There has been a steady increase in the demand for customer relationship management solutions. It is estimated that a significant number of enterprises switched to cloud-based solutions last year, which bodes well for Salesforce. The tech firm has been betting heavily on the popularity of Customer 360, a unique product that tracks customer information in a comprehensive manner.

Growing Client Base

Salesforce is a market leader in enterprise application software, with a rapidly growing client base. The company keeps pursuing strategic partnerships and innovates its product line constantly. That makes its products attractive to clients across the globe, including public sector entities.

Headwinds

Having said that, rising competition remains a challenge for Salesforce, especially from tech giants like Oracle (ORCL) and Microsoft (MSFT). Another headwind is the pressure on margins from rising costs, mainly due to investments in product development. The bottom-line might be impacted by unfavorable exchange rates also.

Looking Back

All the four business segments registered double-digit revenue growth in the third quarter, as they did in the first two quarters of the year. As a result, adjusted earnings climbed 23% year-over-year to $0.75 per share and topped the Street view. Contributions from Tableau, the data visualization software firm that joined the Salesforce fold in a $16-billion deal last year, should add to revenue growth in the fourth quarter.

Also read: Netflix Q4 earnings, revenue beat estimates

Salesforce’s stock gained about 20% in the past twelve months and 17% since the beginning of the year, outperforming both its peers and the general market. The shares reached an all-time high of $195 this week, before withdrawing to the pre-peak levels in the last session.