Comparable digital sales grew 29% in November/December fuelled by store-fulfilled digital sales growth. Target expects digital sales to grow more than 25% for the fifth consecutive year in 2018. Store Pickup plus Drive Up grew more than 60% during the period versus a year ago.

Target continues to invest in products, stores and technology. The company saw the strongest growth in toys, baby products and seasonal gift items during the holiday period. Target has also been taking measures to improve its delivery service, and the acquisition of Shipt has benefited the company in this area. However, these investments have resulted in higher costs, which are likely to hurt margins.

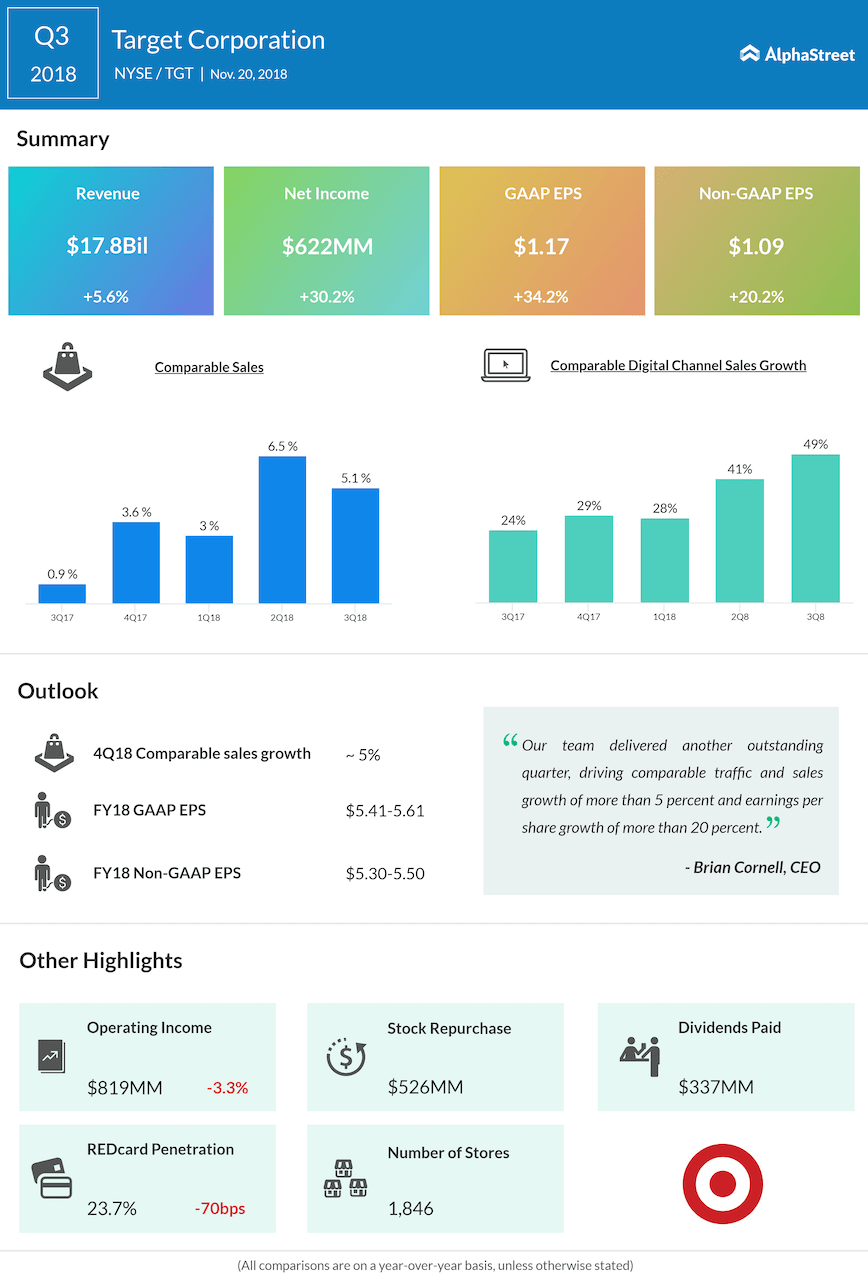

Target has guided for comparable sales growth of around 5% for the fourth quarter. For the full year of 2018, the company expects GAAP EPS to be $5.41 to $5.61 and adjusted EPS to be $5.30 to $5.50.

In the third quarter, Target reported better-than-expected revenues but missed earnings estimates, which hurt the stock at the time. Revenue grew over 5% to $17.8 billion while adjusted earnings rose 20% to $1.09.

Over the past three months, Target’s stock has gained over 2%. The majority of analysts have rated the stock as Hold while some have rated it a Strong Buy.