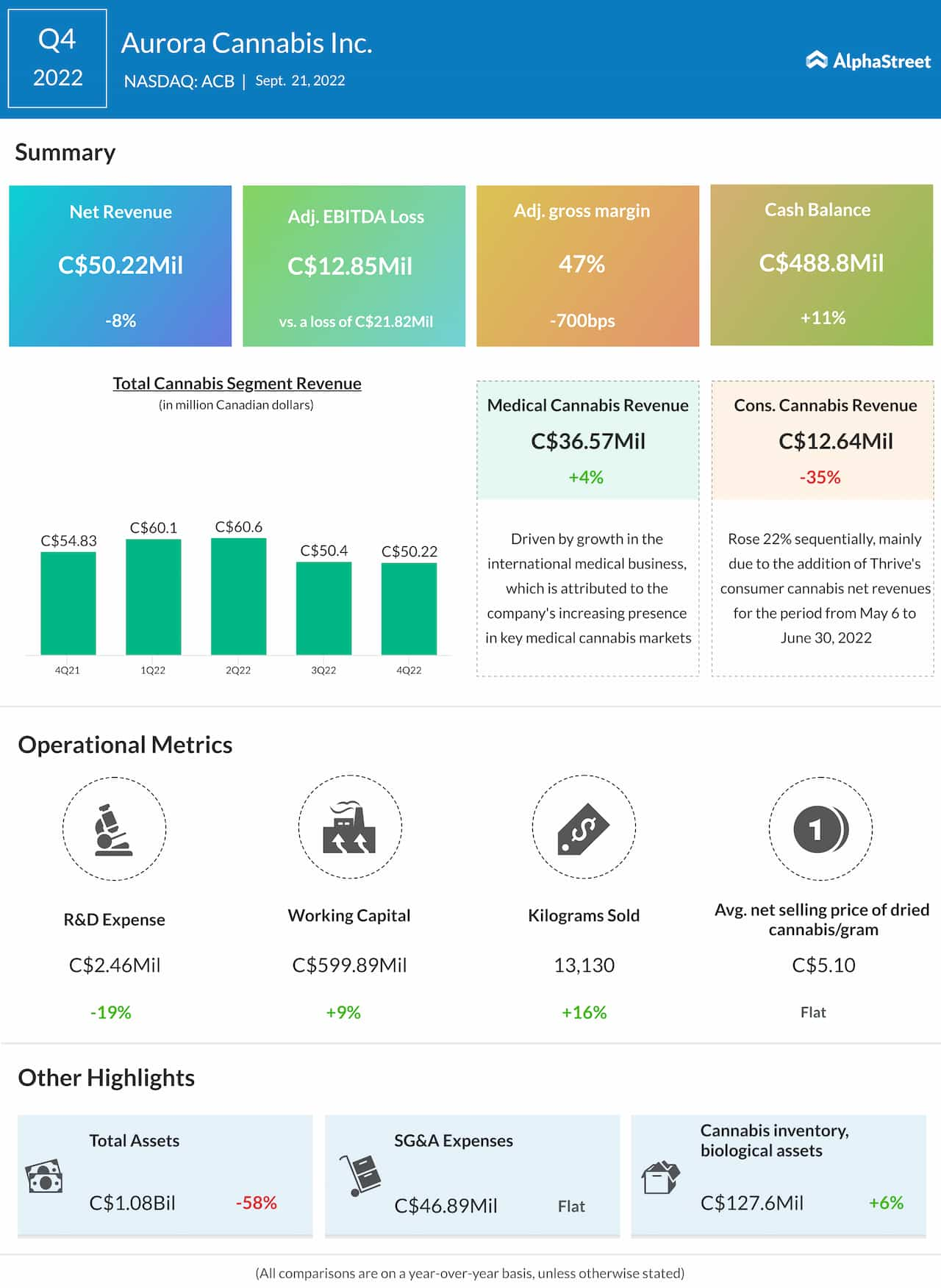

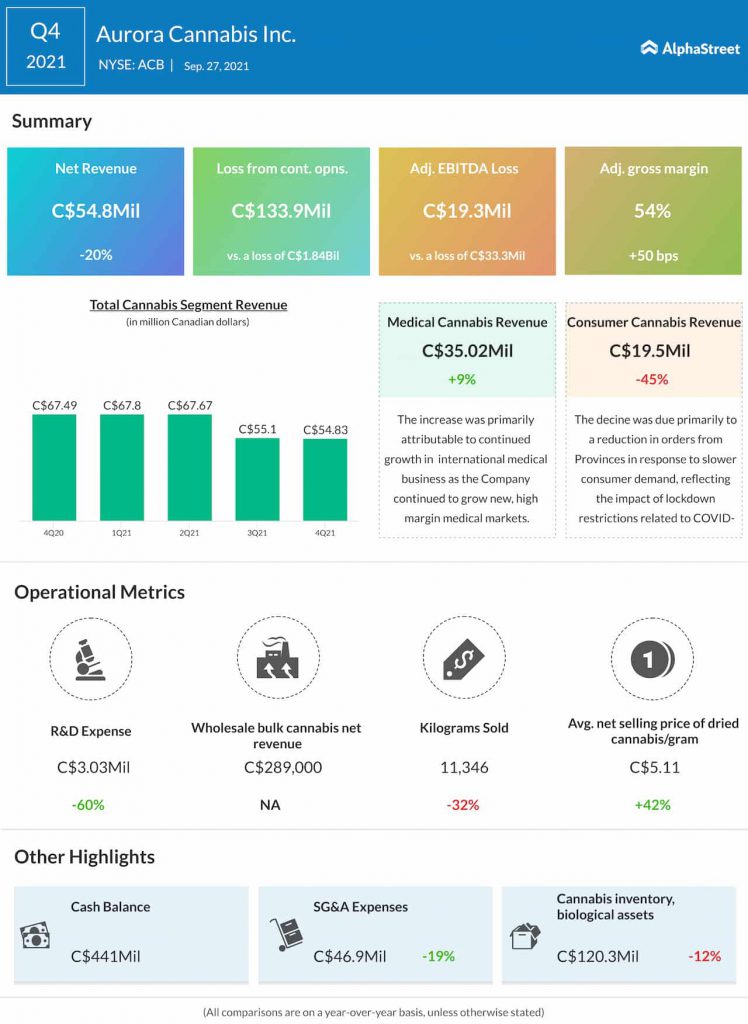

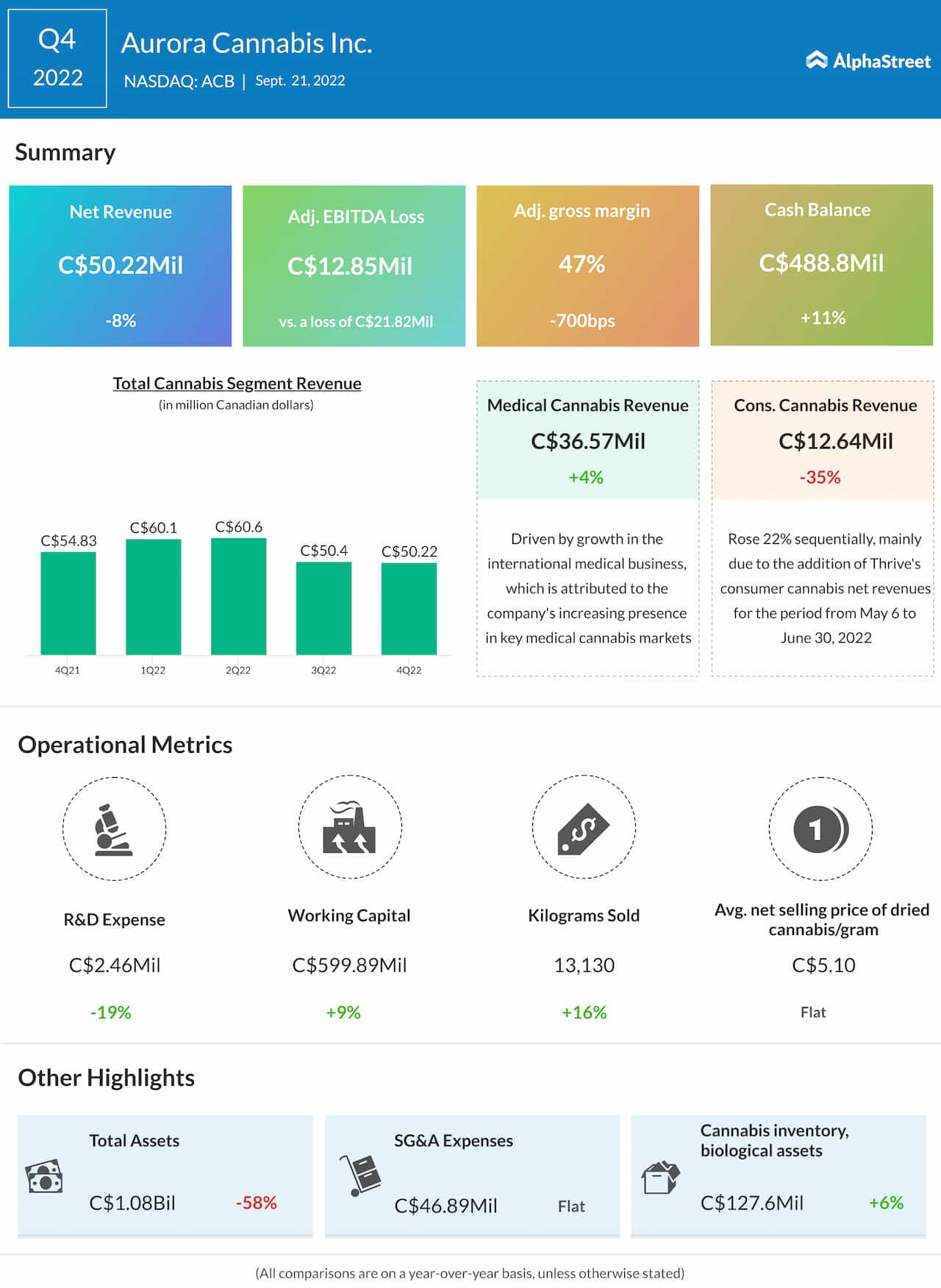

Aurora Cannabis, Inc. (NASDAQ: ACB) has reported a wider net loss for the fourth quarter of 2022, mainly due to the impact of non-cash impairment charges. The company’s revenues dropped 8% year-over-year during the quarter.

The Canada-based medical marijuana company reported a net loss of C$618.8 million for the fourth quarter, compared to a loss of C$134.0 million last year. Adjusted EBITDA loss was C$12.85 million, compared to a loss of C$21.82 million in the prior-year quarter. Total revenues decreased 8% annually to C$50.22 million.

“We continue to enhance the long-term value of our differentiated global cannabis business by quickly identifying highly profitable growth opportunities, deploying capital in a disciplined manner, and continuing to rationalize our cost structure. We remain the #1 Canadian LP in global medical cannabis revenues and expect this high margin, high growth segment to be a key driver for future profitability,” said Miguel Martin, chief executive officer of Aurora Cannabis.

Read management/analysts’ comments on Aurora’s Q4 results

Shares of Aurora Cannabis traded lower Friday afternoon on the Nasdaq stock market, extending the post-earnings losses. The stock has been languishing in the single-digit territory for quite some time.