The bookrunners for the offering are led by BofA Securities, Citigroup, J.P. Morgan, Jefferies, Goldman Sachs, and UBS Investment Bank. The underwriters have the option to purchase up to 4.2 million additional shares of the company’s class-A stock from the selling stockholder at the offer price, less underwriting discounts and commissions.

The Company

Founded in 1894 by William Henry Merrill, Jr. — originally as Underwriters Electrical Bureau — UL Solutions operates under the business segments of Testing, Inspection & Certification, and Software & Advisory. As of December 2023, the company provided independent third-party testing, inspection, and certification services, and related software and advisory offerings to more than 80,000 customers in over 110 countries.

UL Solutions has invested a total of about $1.3 billion in 54 acquisitions between 2010 and 2023. The company ended 2023 with a total long-term debt of $904 million, consisting of $300 million in aggregate principal amount of its 6.5% senior notes due 2028 and a credit facility.

Financials

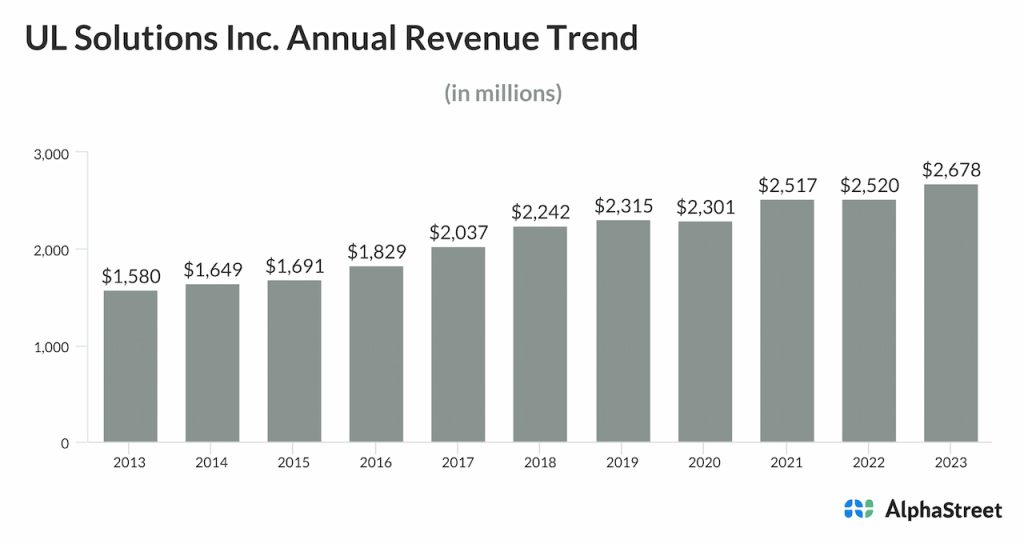

For the year ended December 2023, UL Solutions reported revenue of $2.68 billion, compared to $2.52 billion in the previous year. Industrial and Consumer revenues grew 10% and 4% respectively, while Software & Advisory revenue moved up 3%. Meanwhile, net income decreased to $276 million from $309 in 2022, reflecting higher expenses.