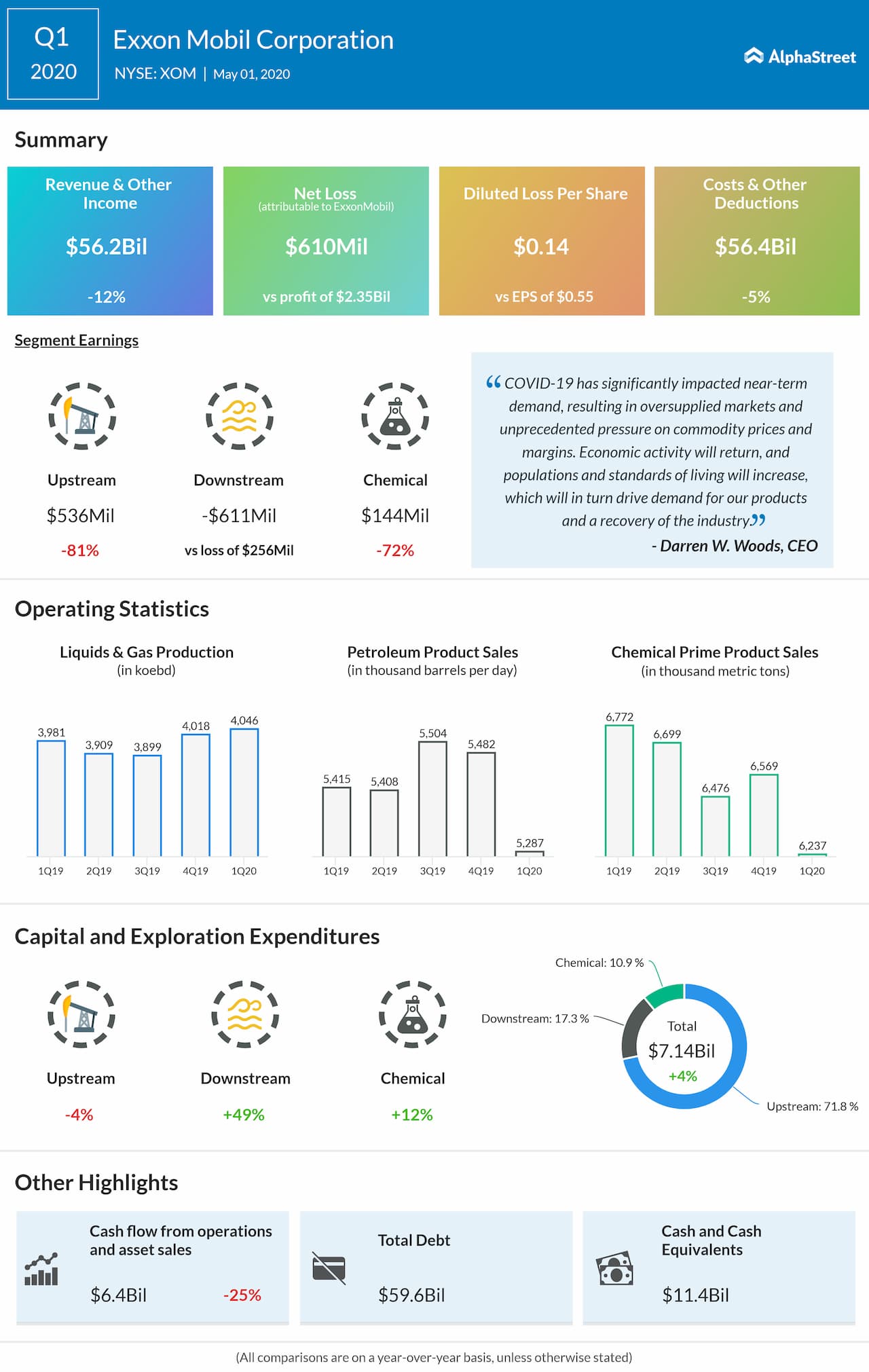

The company said the COVID-19 has significantly impacted near-term demand, resulting in oversupplied markets and unprecedented pressure on commodity prices and margins. ExxonMobil’s capital allocation priorities remain unchanged. The company’s objective is to continue investing in industry-advantaged projects to create value, preserve cash for the dividend, and make appropriate use of its balance sheet.

In response to market conditions, ExxonMobil is lowering 2020 capital spending by 30% and cash operating expenses by 15%. Capex is now expected to be about $23 billion for the year, down from the previously announced guidance of $33 billion.