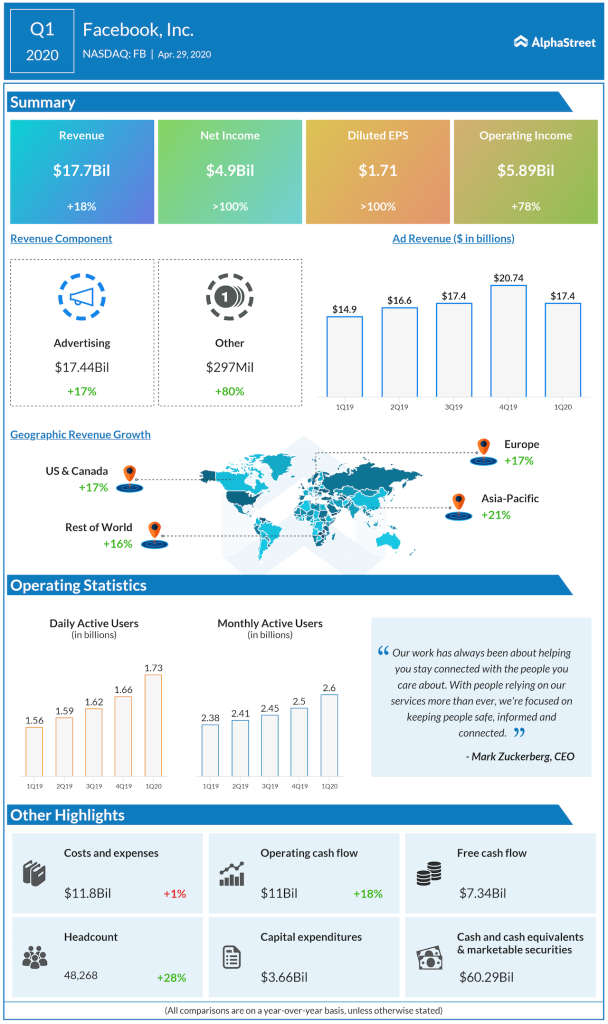

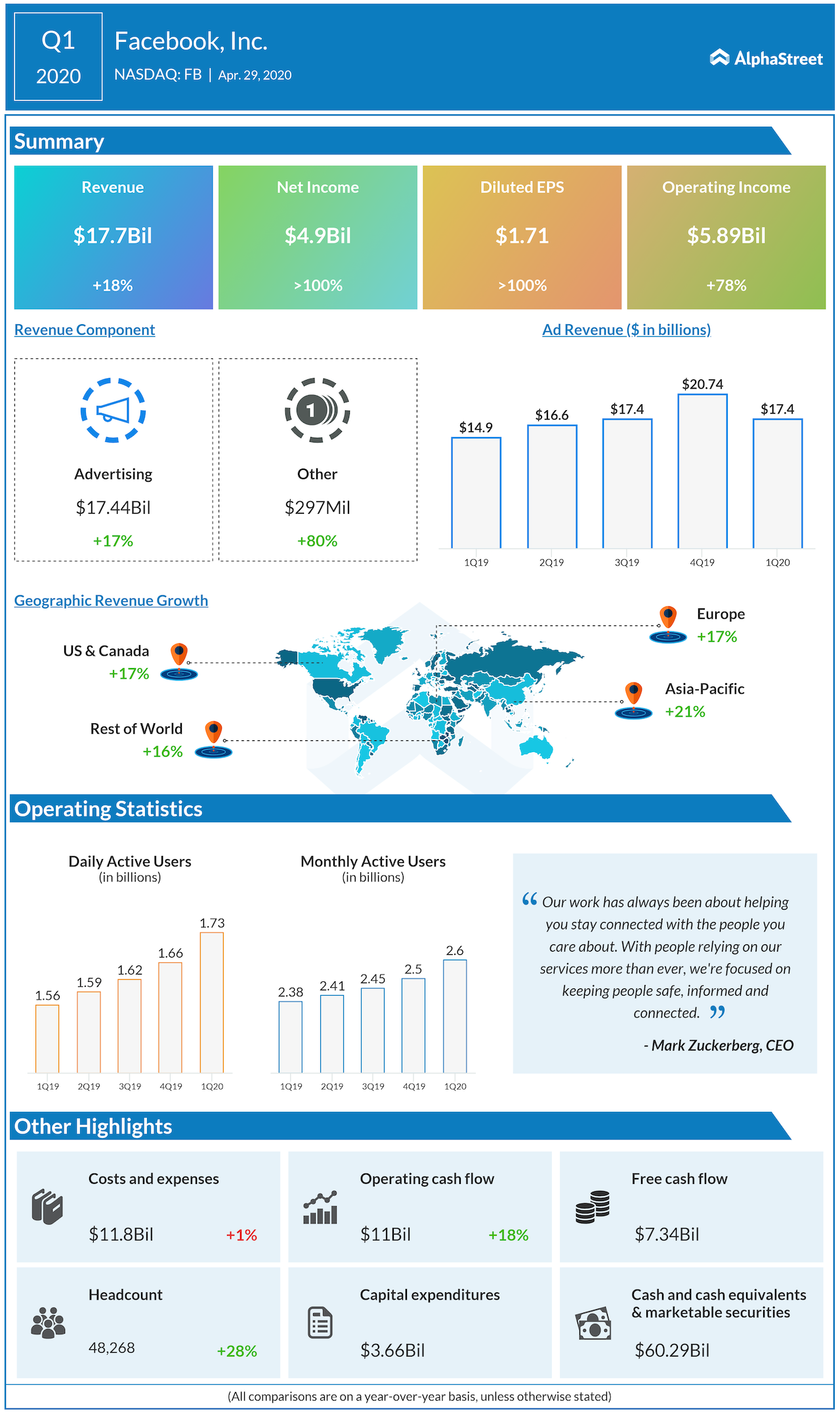

User growth and engagement

Facebook saw double-digit increases in its user metrics during the first quarter. Family daily active people, which measures the number of users who visited Facebook’s family of products (Facebook, Instagram, Messenger and WhatsApp) on a given day, increased 12% year-over-year. Family monthly active people increased 11%.

The company said there are currently over 3 billion people

actively using its products each month and this includes 2.6 billion people

using Facebook alone and over 2.3 billion people using at least one of its

services every day.

Facebook saw an increase in usage across all its services, especially

in markets that saw the heaviest impact from the virus. In several of these

areas, messaging volume has increased over 50% while voice and video calling

have more than doubled.

The company is also seeing good traction in live video with over

800 million daily actives engaging with livestreams across workout classes,

concerts and more every day. However, Facebook believes that there will be a

decline in the level of engagement once the pandemic subsides and people go

back to their normal routines.

Ad revenue

Total ad revenue for the first quarter increased 17% to

$17.4 billion. Facebook saw strength in advertising at the beginning of the

quarter but from the second week of March, the pandemic impacted the business

significantly.

Looking at the trends by vertical, the company witnessed

strong growth in gaming as well as stability in technology and ecommerce due to

the current shelter-in-place trends. During the last three weeks of March, the travel

and auto verticals were hit the hardest. These trends have continued into the

second quarter.

On a regional basis, ad revenue growth was strongest in

Asia-Pacific at 21% followed by US & Canada, Europe, and Rest of World at

16% each. But Facebook is generating sales at lower prices due to the overall

reduction in ad demand.

Jio investment

Facebook recently signed an agreement to invest approx. $5.7

billion into Jio Platforms in India. The company believes there is a massive

opportunity to serve small businesses and enable commerce over the long term in

India, which has the biggest Facebook and WhatsApp communities in the world.

Facebook hopes to immensely improve the shopping experience in

the country by bringing together JioMart, Jio’s small business initiative to

connect millions of shops across the region, and WhatsApp. Facebook sees

significant growth potential here and also hinted that it might look at similar

initiatives in other countries as well.

Outlook

Looking ahead, as advertisers continue to spend less and as

the business performs below expectations, the company plans to reduce spending

in certain areas such as travel and marketing, and also expects profit margins

to decline during the year. Total expenses in 2020 are expected to be $52-56

billion, down from the prior range of $54-59 billion.

After the initial decrease in ad revenues in March, Facebook saw signs of stability during the first three weeks of April, where advertising revenue has been approx. flat versus the same period a year ago. The April trends reflect weakness across all geographies as most of the major countries had imposed shelter-in-place rules.

Facebook remains cautious as most economists are forecasting a contraction in global GDP in the second quarter which indicates the potential for a more severe advertising industry contraction.