Facebook Inc. (NASDAQ: FB) is, without doubt, the leader in the social media space and despite the various controversies that plague it, the social media platform remains popular among its users. The ongoing coronavirus pandemic led to an increase in its usage as people sheltered at home and tried to stay connected with family and friends and keep themselves updated on the latest information.

Facebook sees tremendous growth opportunity in India, a country with a vast population and a large number of users, and the company is investing significantly in this region. Let’s take a look at the value that India presents for Facebook to grow and expand its services.

User growth

At the end of its most recent quarter, Facebook had 1.79 billion daily active users (DAUs) and 2.70 billion monthly active users (MAUs), both of which increased 12% year-over-year. Family daily active people increased 15% year-over-year to 2.47 billion while family monthly active people rose 14% to 3.14 billion.

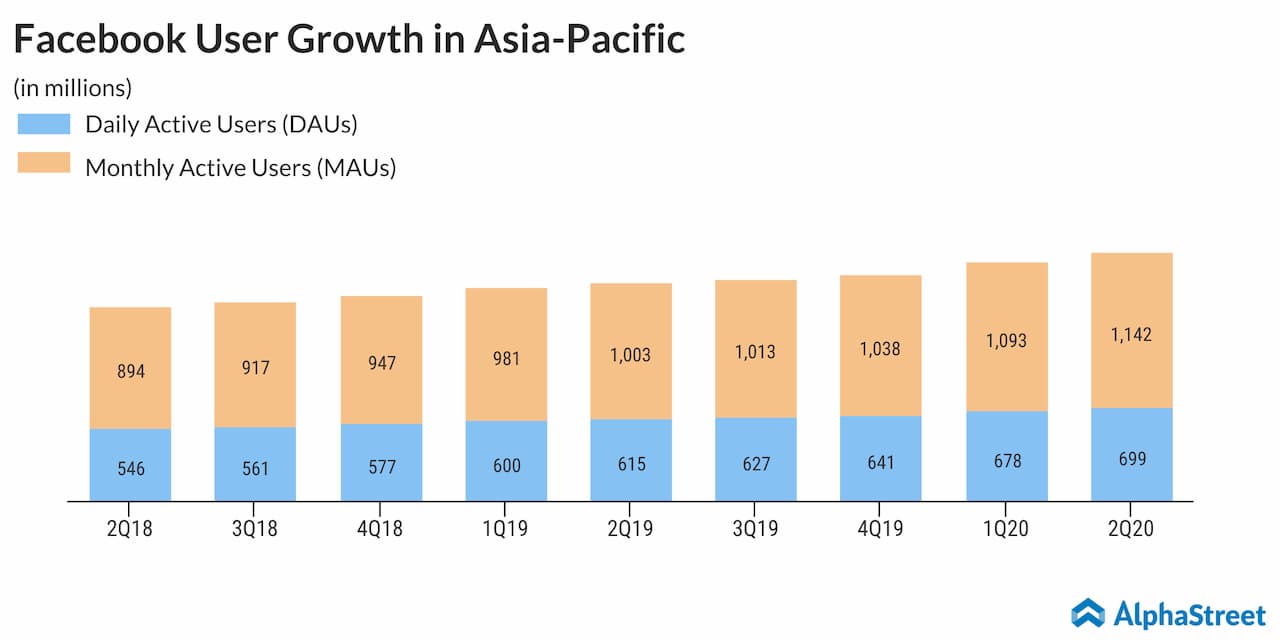

Of this, the Asia-Pacific region, which includes India, has seen steady growth in both DAUs and MAUs over the past two years. In Q2 2020, DAUs increased 13% year-over-year and 3% sequentially, while MAUs grew 13% year-over-year and 4% sequentially in Asia-Pacific.

Also read: Facebook calls for balanced approach in personalized ads

According to Statista, as of July 2020, there are 290 million Facebook users in India alone, making it the leader in terms of audience size. India is ahead of even the US, which stands at 190 million. The number of Facebook users in India amounted to 313.6 million in 2019. This number is expected to reach 444.2 million in 2023.

This shows the company has further scope to expand in the region and to offer its products and services to a wider base of users.

Jio investment

In April, Facebook invested $5.7 billion in Jio Platforms Ltd, owned by Reliance Industries Ltd. in India. This investment made Facebook the largest minority shareholder in Jio.

India is rapidly moving towards a digital transformation and in the past five years, over 560 million people have gained Internet access. Jio forms an important part of this trend, bringing more than 388 million people online in less than four years.

There are more than 60 million small businesses across India and Facebook aims to connect these businesses with a larger base of customers by bringing together Jio’s small business initiative, JioMart, and WhatsApp.

Facebook believes there is huge opportunity in the business space here to buy and sell things through WhatsApp.

WhatsApp Payments

Facebook is seeing a large number of small enterprises conduct a significant portion of their business over Messenger and WhatsApp. The company believes this trend will continue to increase as payments grow across Messenger and WhatsApp. A big part of the partnership with Jio involves getting thousands of small businesses in India onboarded to WhatsApp to do commerce and Facebook sees a large opportunity here.

In February, Facebook disclosed that WhatsApp supports 2 billion users worldwide. According to a report by Oberlo, India is currently the biggest market for WhatsApp with 340 million users.

As digital adoption increases in India, it provides Facebook the opportunity to gain more users and to provide its various products to a larger population and also to increase business connectivity across the country’s vast marketplace. These factors provide significant growth opportunities in India for Facebook and the company’s strategic investments will help in taking advantage of these opportunities.

Also read: Facebook Inc. Q2 2020 Earnings Call Transcript