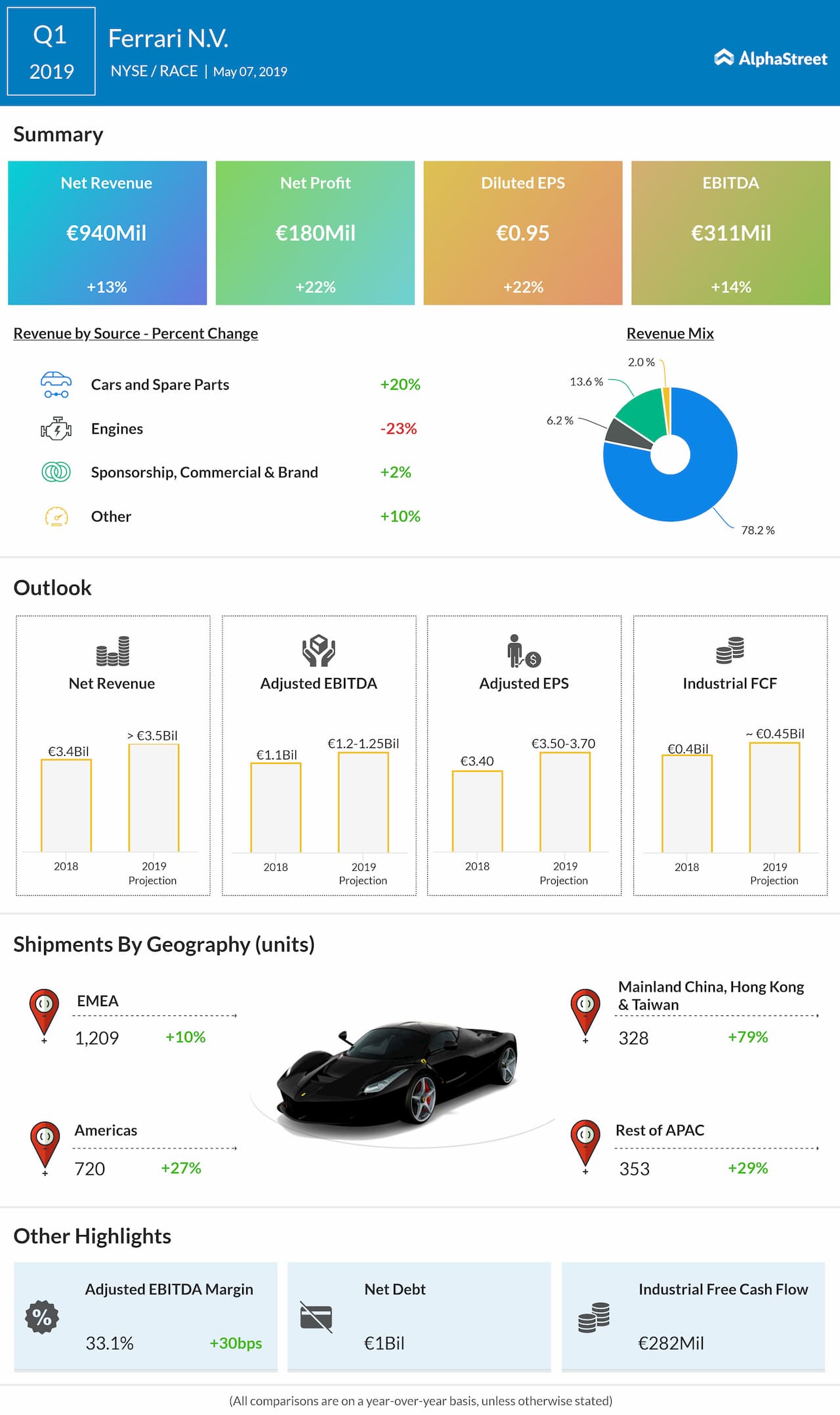

During the quarter, shipments grew across all regions with the highest growth of 79% in Mainland China, Hong Kong and Taiwan. Revenues grew 18% year-over-year in Cars and spare parts. However, revenue from Engines and Sponsorship, commercial and brand fell 23% and 1% respectively.

The company reaffirmed its guidance for the full year. For full-year 2019, net revenues are expected to grow over 3% to more than EUR 3.5 billion. Adjusted EPS is expected to grow around 6% to between EUR 3.50 and EUR 3.70. Industrial free cash flow is expected to grow over 10% to EUR 0.45 billion.

In September last year, Ferrari outlined its long-term financial targets. These include plans to increase its dividend payout ratio to 30%, along with a share repurchase program of EUR 1.5 billion to be executed over the 2019-2022 period in relation to the growth of its industrial free cash flow.