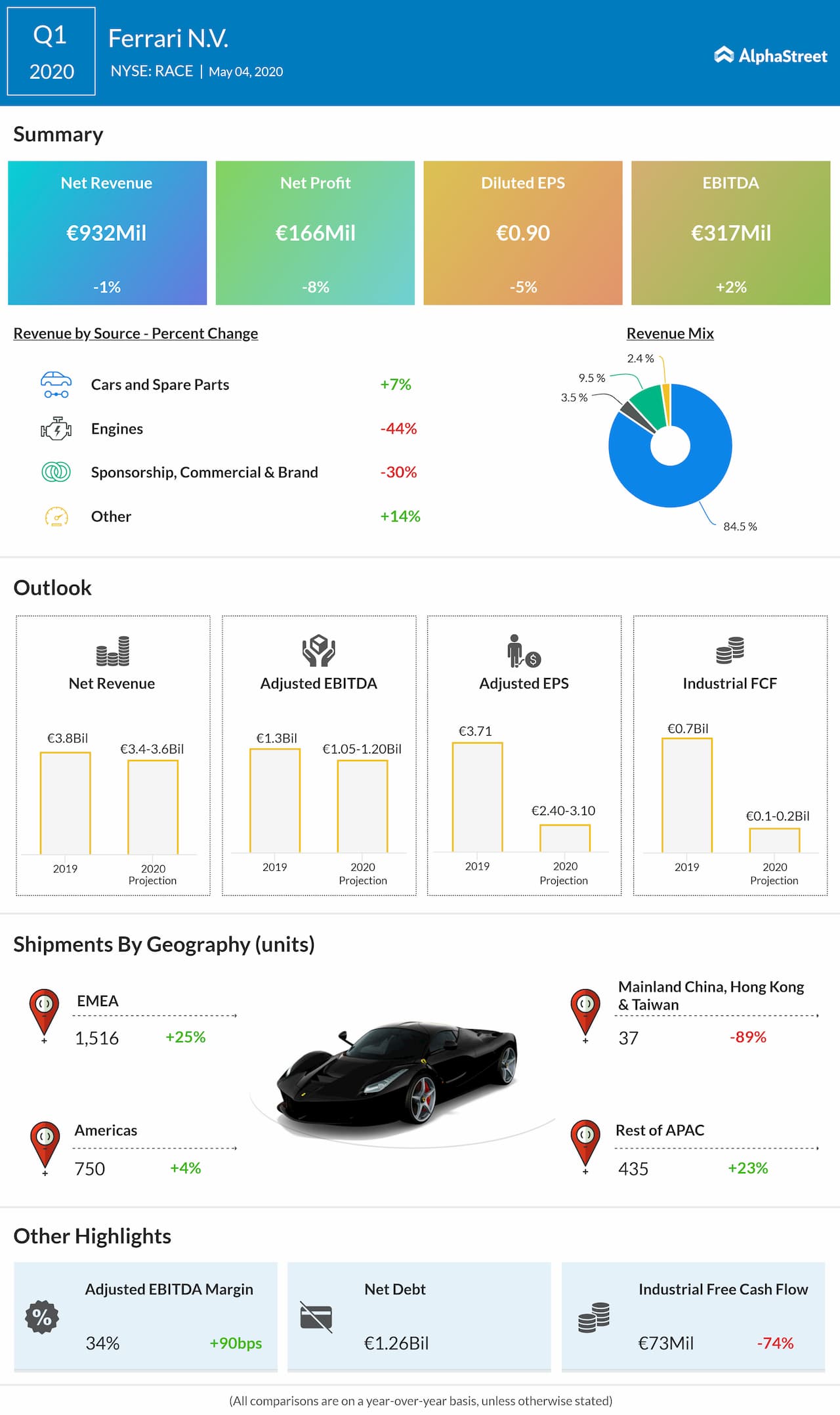

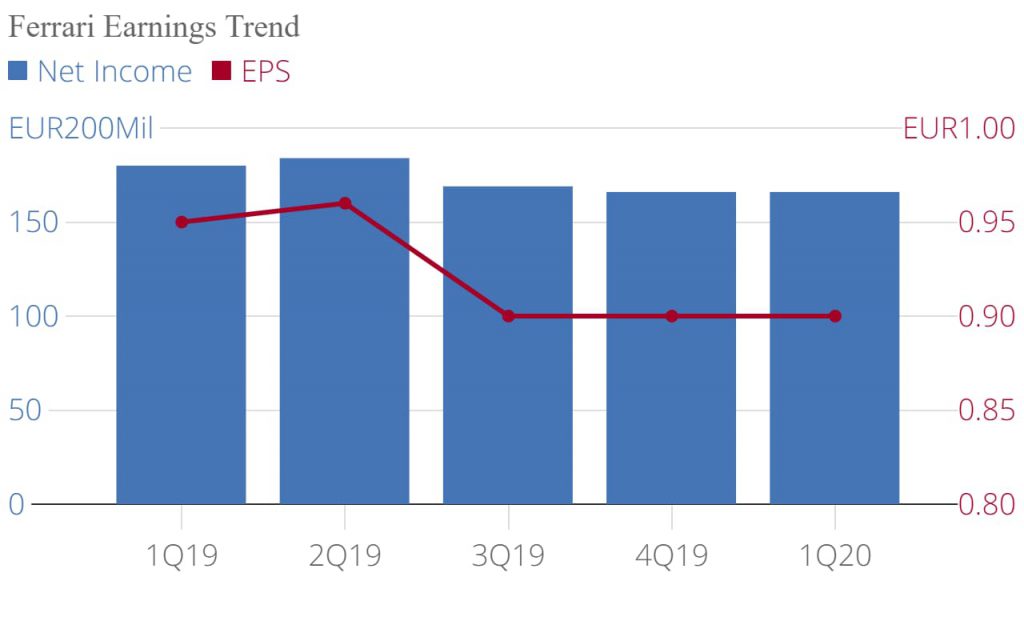

Sports car maker Ferrari N.V (NYSE: RACE) reported its financial results for the quarter ended March 31, 2020, on Monday. The company posted an 8% dip in earnings due to higher costs and expenses as well as a 1% decline in net revenues.

The sales of the 488 Pista and 488 Pista Spider along with the ramp-up of the F8 Tributo drove the revenues in cars and spare parts higher. For the first quarter, engine revenue continued to decline on lower shipments to Maserati. Sponsorship, commercial and brand revenues were impacted by the COVID-19.

For the first quarter of 2020, shipments rose by 4.9% backed by higher sales of 8 cylinder models (V8) and of 12 cylinder models (V12), despite deliveries being suspended earlier than expected due to the COVID-19 pandemic.

The company revised its guidance for the full year 2020 that reflects the projected impact of the COVID-19 pandemic. This will primarily impact second-quarter results and provides for a harsh reduction in Formula 1 brand and Maserati engines’ revenue and earnings.

For 2020, Ferrari lowered its net revenue outlook to the range of EUR3.4-3.6 billion from the prior estimate of more than EUR4.1 billion, and adjusted EPS guidance to the range of EUR2.4-3.1 from the previous range of EUR3.90-3.95.