The Milpitas, California-based cybersecurity provider expect recurring contribution from billings in the long term and a lesser contribution from product/applications. The company believes that the industry has turned out to be less competitive than three years ago as the strategies have changed the competitive dynamics.

Analysts expect the company’s earnings to dip by 83.30% to $0.01 per share while revenue will increase by 4% to $219.8 million for the third quarter. The company has surprised investors by beating analysts’ expectations twice in the past four quarters. The majority of the analysts recommended a “hold” rating with an average price target of $18.18.

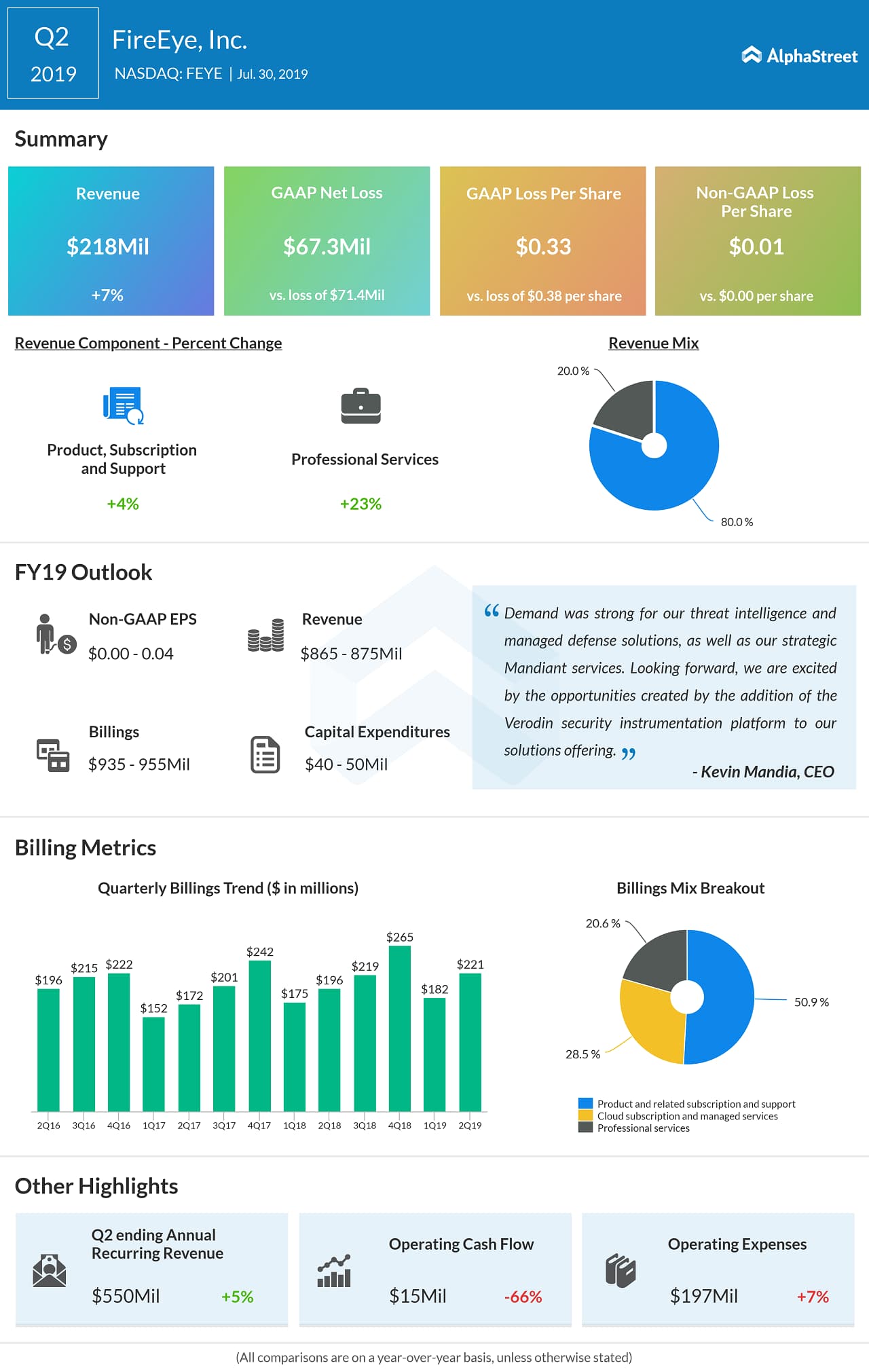

For the second quarter, FireEye posted a narrower loss helped by higher revenue, lower other expenses, and a decline in income tax provision. The billings increased by 13% led by the acceleration in growth in its platform, cloud subscription, and managed services category.

For the third quarter, the company expects revenue to be at or above the high end of the $217 million to $221 million range and adjusted earnings of $0.00 to $0.02 per share.

For the full year 2019, the company predicts revenues in the range of $865 million to $875 million and adjusted earnings of $0.00 to $0.04 per share. Billings are predicted to be within the $245 million to $255 million range for the third quarter and $935 million to $955 million for the full year.