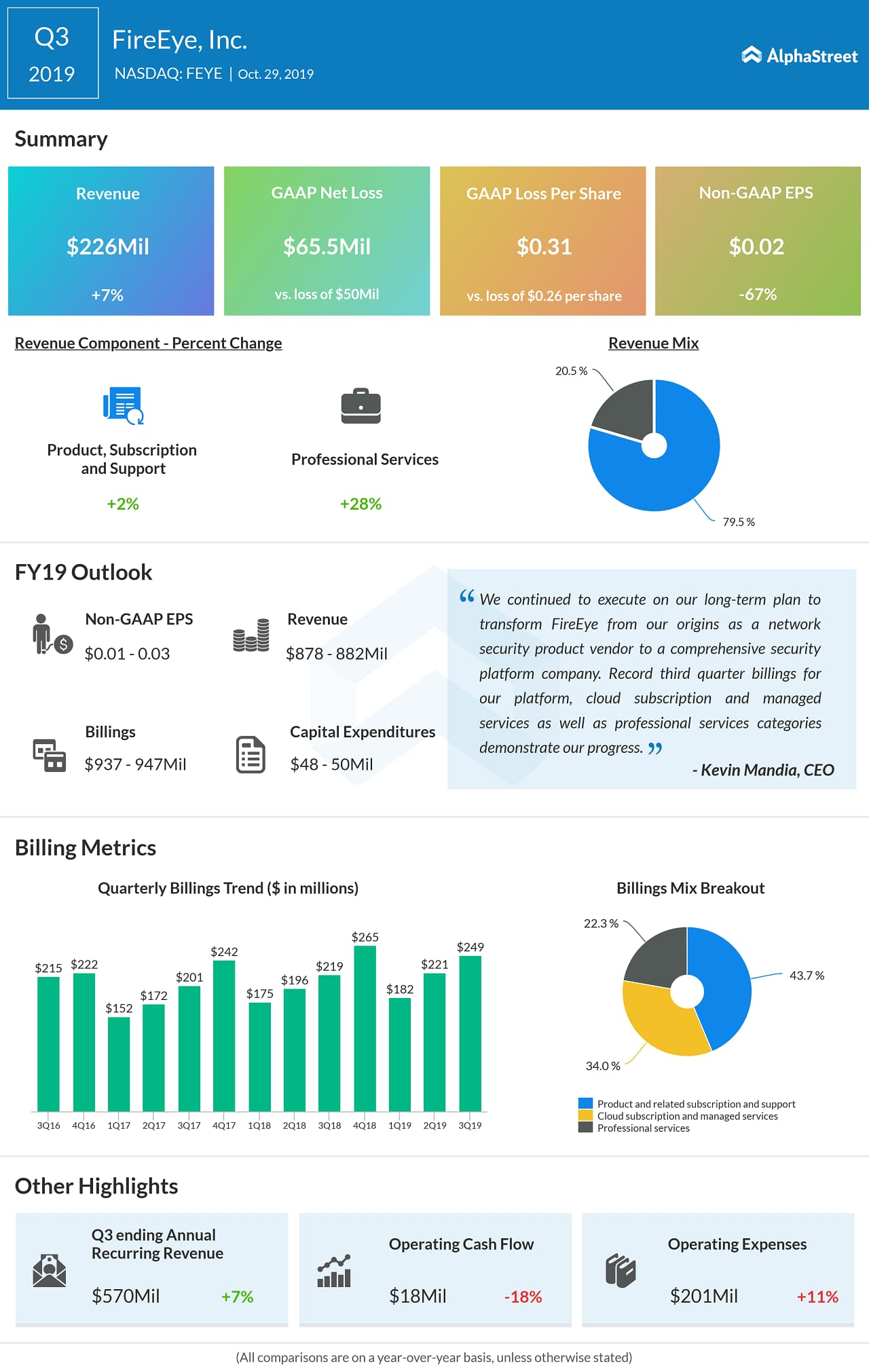

Total revenues grew by 7% to $226 million. This was above the guidance range of $217 million to $221 million. The acceleration of growth in its platform, cloud subscription, and managed services category drove billings higher by 13% to $249 million.

Looking ahead into the fourth quarter, the company expects revenue to be in the range of $224 million to $228 million and adjusted earnings of $0.03 to $0.05 per share. Billings are anticipated to be within the $285 million to $295 million range.

For the full year 2019, the company lifted its revenue outlook to the range of $878 million to $882 million from the prior range of $865 million to $875 million. Adjusted earnings guidance is narrowed to the range of $0.01 to $0.03 per share from the previous range of $0.00 to $0.04 per share. Billings forecast is tightened to the range of $937 million to $947 million from the prior range of $935 million to $955 million.

As the competition has been mounting in the cybersecurity space, FireEye is likely to leverage new partnerships and acquisitions for expanding its cloud portfolio and on-demand expertise. The company has been looking forward to business transformation as this could change its model towards a more subscription-oriented one.

The company has been keen on maintaining its cash position in par with its debt. The company has a total debt of $1.08 billion while its cash stood at $987 million. The company has enough liquidity to meet its debt obligations.