Buying vehicles online might seem like a bad idea, but some dealers like CarMax Inc. (NYSE: KMX) are using their e-commerce platforms effectively to generate sales. For the company, the diversified business model came in handy during the virus crisis when the demand for second-hand cars spiked as customers turned cautious in their spending. Meanwhile, there are concerns of sales softening amid the continuing market volatility.

Mixed Sentiment

After hitting a new high a few months ago, CarMax’s shares remained steady as the market responded positively to the high demand. However, the stock slipped this week following the company’s mixed earnings report. If the bullish outlook on the stock is any indication, with experts predicting a 30% growth in the next twelve months, investors can expect decent returns in the near term. In short, KMX is favorably priced and is an investment option worth considering.

Wholesale Leads

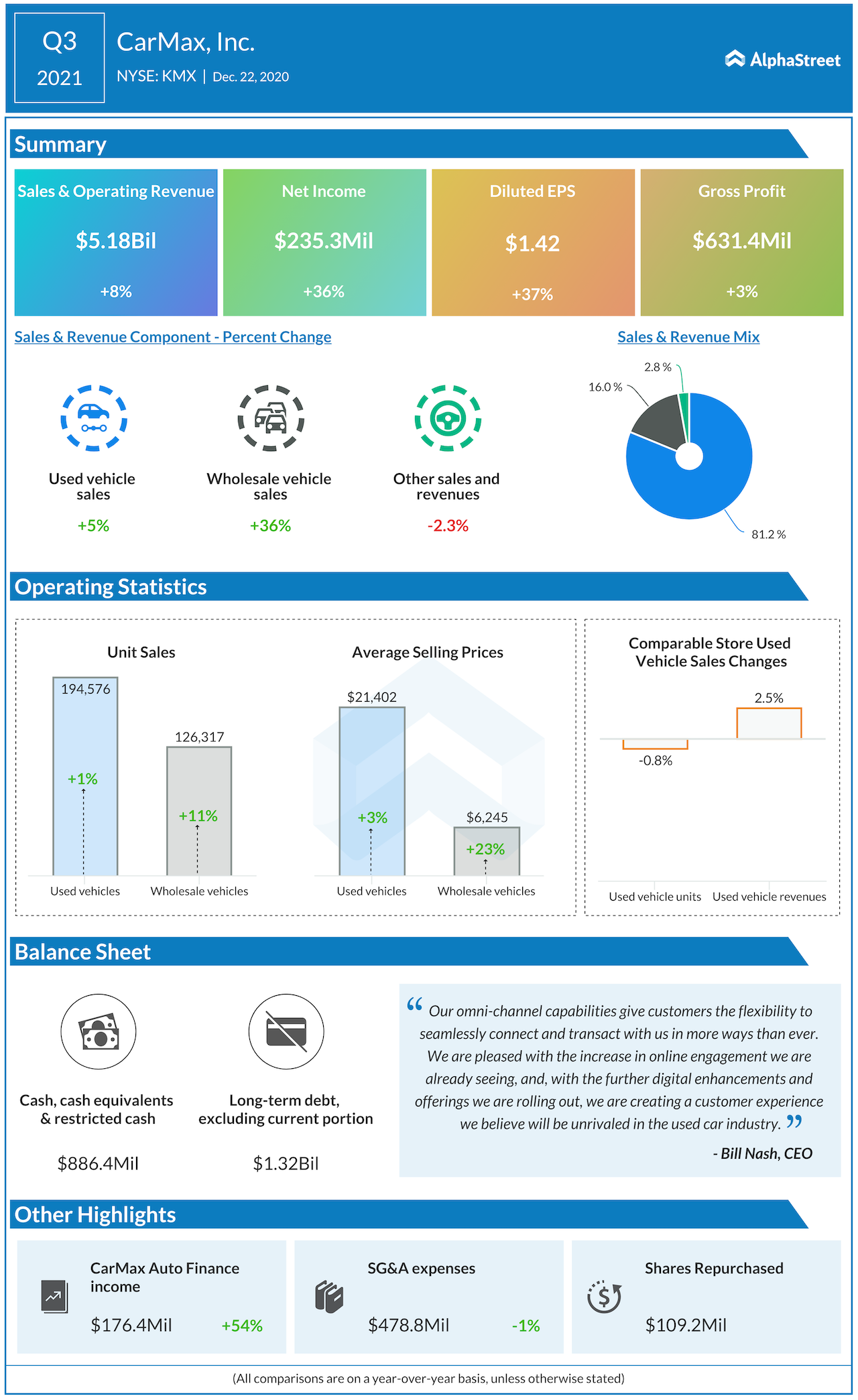

Despite a decline in the number of units sold, revenues from used vehicle sales increased 5% in the third quarter, reflecting a hike in average selling price. While the wholesale division performed well, the retail segment witnessed weakness. Net profit climbed 37% annually to $1.42 per share and came in above analysts’ forecast, as it did in the previous quarter. Recent efforts to boost omnichannel capabilities, to allow customers to buy cars online, contributed to the sales growth.

“Looking ahead, we’re confident the sales trends we experienced in the latter part of the third quarter and into December are shorter-term in nature. Today, approximately half of our stores have occupancy restrictions in place due to state and local government mandates. Of these, more than 40 stores have mandates limiting capacity to 25% or less. Even with these restrictions, our omnichannel experience is allowing customers to connect and transact with us in more ways than ever,” said Bill Nash, chief executive officer of CarMax, during the post-earnings conference call.

Meanwhile, the aggressive omnichannel push could be a drag on the bottom-line, mainly due to costs associated with the promotional activities aimed at attracting customers to the e-commerce platform. When it comes to capital allocation, the other key priorities would be vehicle/customer acquisition and expansion of the store footprint. The management banks on the relatively strong cash flow to meet the investment goals.

Looming Uncertainty

But the factors that support the demand growth might not stay in the coming months, since the launch of coronavirus vaccines shows that normalcy would return to the market sooner than initially estimated. At the same time, the resurgence of COVID cases and fresh restrictions have weighed on sales. In view of the prevailing uncertainty, the management withheld its guidance for the remainder of the year. That did not go well with investors and the negative sentiment was evident in the stock’s performance.

Read management/analysts’ comments on CarMax’s Q3 earnings

Recovering from the pullback in the early days of the pandemic, CarMax’s stock crossed the $100-mark once again in mid-August, before slipping to the double-digit territory in the following weeks. The stock closed the last trading session lower but traded slightly higher during Wednesday’s session.