Better-than-expected results

COVID-19 vaccine outlook

In Q3 2022, Pfizer’s COVID-19 vaccine Comirnaty yielded $4.4 billion in revenues, down 66% from the year-ago period. Sales for Comirnaty in the US were up 83% YoY, driven by deliveries of the Omicron bivalent booster as well as the granting of an emergency use authorization (EUA) for a primary vaccination series for children aged 6 months to less than 5 years.

International sales for Comirnaty were down 87% on a reported basis due to deliveries being shifted to the fourth quarter of 2022 as well as slower demand in emerging markets. Pfizer’s oral treatment for COVID-19, Paxlovid, generated $7.5 billion in sales in Q3.

Pfizer raised its guidance for Comirnaty revenues for the full year of 2022 to approx. $34 billion, up by $2 billion compared to the previous outlook. It reaffirmed its sales guidance for Paxlovid at approx. $22 billion.

Pipeline progression

Pfizer reported positive data from a Phase 3 study of its maternal respiratory syncytial virus (RSV) vaccine candidate, RSVpreF, which is intended to protect infants from the RSV disease after birth. The maternal RSV vaccine, along with an RSV vaccine for older adults aged 60 years and above, represent a potential multi-billion dollar peak revenue opportunity, if approved.

Pfizer’s acquisition of Biohaven Pharmaceutical has given it the opportunity to build a global migraine franchise. Its portfolio, which includes Nurtec ODT and zavegepant, could meet a range of needs in migraine treatment and prevention, with the potential to reach over $6 billion in peak revenues.

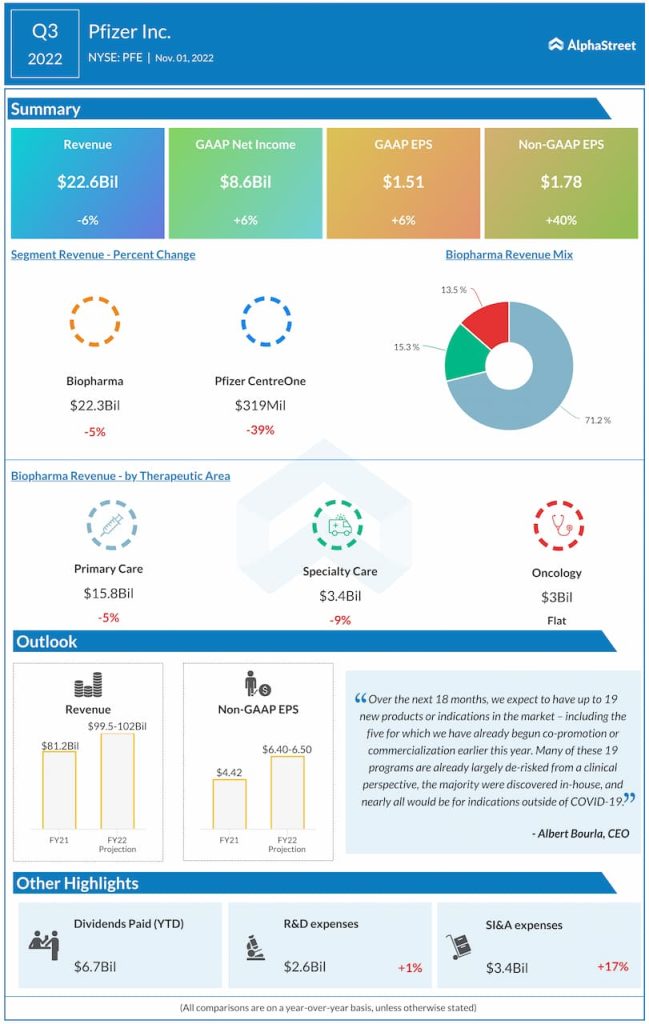

Raised full-year outlook

Pfizer raised its sales and adjusted earnings guidance for the full year of 2022. It now expects revenues to range between $99.5-102 billion, reflecting a YoY growth of 22-25%. This compares to the previous outlook of $98-102 billion. The company also lifted its adjusted EPS guidance to $6.40-6.50 from the prior range of $6.30-6.45.