Weak Q3

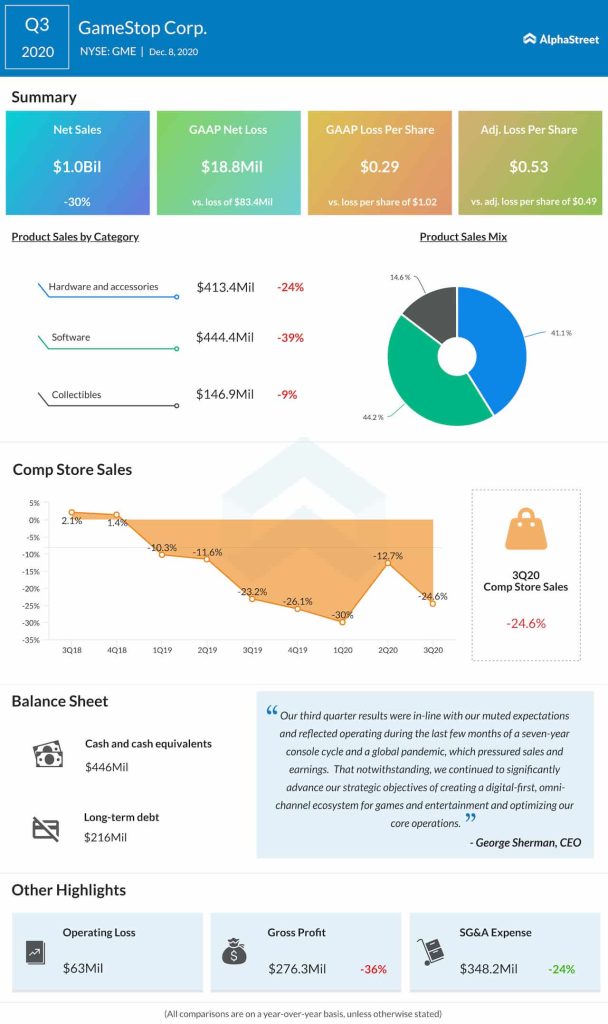

The company once again disappointed the stakeholders this week by reporting a loss for the most recent quarter. Loss widened to $0.53 per share in the third quarter, hurt by a 30% fall in sales to about $1 billion. While the bottom-line beat the Street view, sales fell short of expectations. Reflecting the underlying weakness, all the three business segments registered negative growth even as comparable sales deteriorated after last quarter’s improvement.

The highlight of the third quarter was a two-fold growth in e-commerce sales, which is in line with the performance of the broad retail sector. In a sign sales are picking up during the holiday season, comparable sales bounced back in the early fourth quarter, coinciding with the recent console launches.

The recovery is important for the company because it comes at a time when the demand for discretionary items hit a low. Investors will be watching the performance closely as the season progresses. Sales of consoles and other gaming products usually spike during the period.

Revival Strategy

After closing more than 1,000 stores since last year, with more in the firing line, GameStop executives have laid down a strategy to stabilize and optimize core operations to combat the challenges posed by the pandemic-induced supply-chain disruption and the transition from generation 8 to generation 9 console gaming products. On the positive side, the cost-cutting initiatives have started yielding results, enhancing the cash flow.

We are positioning GameStop to be the leading global omnichannel retailer for all things gaming and entertainment. We are encouraged by our successful efforts in 2020 to begin category and product extensions that increased our addressable market as well as by our customers’ early response to expanded products and services offering. At the forefront of this strategy is a digital-first approach focused on delivering a best-in-class e-commerce experience along with an optimized retail footprint.

George Sherman, chief executive officer of GameStop

A Rough Patch

Since customers are unlikely to go back to conventional discs for consuming gaming content and GameStop lacks a clear strategy to stay relevant in the digital era, it looks like the company’s struggles are far from over.

Read management/analysts’ comments on GameStop’s Q3 results

After recovering from the recent lows, GameStop’s stock dropped this week following the third-quarter earnings release and traded lower during Wednesday’s regular session. It is yet to fully recover from the losing spree that started a few years ago, though the value more than doubled in the past twelve months.