Gap Inc. (NYSE: GPS) reported its third quarter results, in which earnings slightly exceeded consensus views. Q3 revenue also surpassed estimates, while fiscal 2019 outlook was in line with expectations. The stock ended the day at $24.66, down 3.07% before hitting a new 52-week low of $24.25 during the regular trading session.

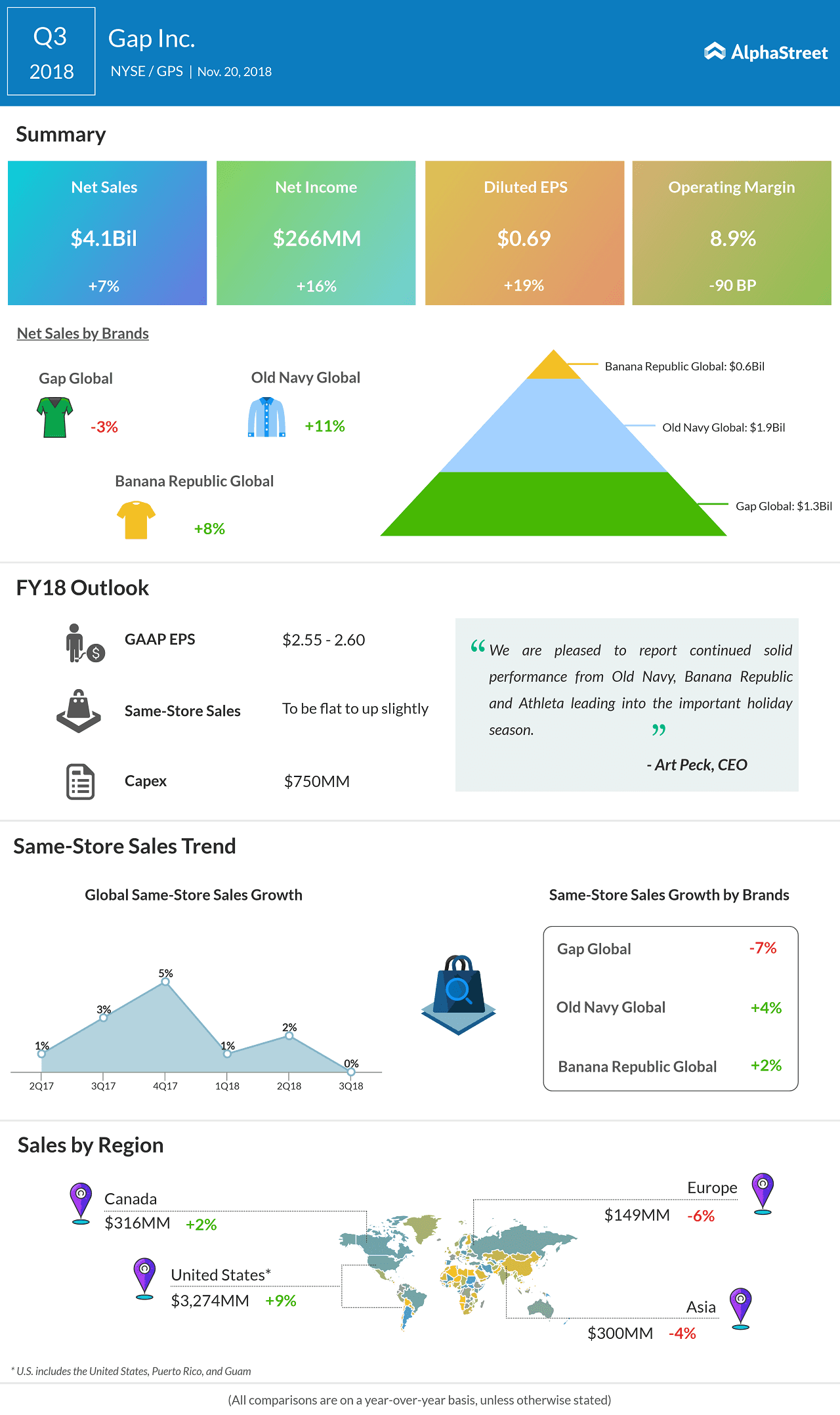

EPS of $0.69 exceeded the estimate of $0.68 and revenue of $4.09 billion, up 6.5%, beat the estimated figure of $4.01 billion.

Comp sales were flat compared to the 3% increase in last year, mainly due to a 7% decline in Gap brand comp sales versus positive 1% last year. Also, like the second quarter, Old Navy didn’t help the company to post strong sales.

“We are pleased to report continued solid performance from Old Navy, Banana Republic and Athleta leading into the important holiday season,” said Art Peck, CEO. He also added that the company is not satisfied with the performance of Gap brand.

Gap lowered the upper end of its 2018 EPS outlook. The company now expects earnings to be in the range of $2.55 to $2.60. Comparable sales are expected to be flat to up slightly.

Gap targets to open about 25 company-operated stores, net of closures and repositions in the fiscal year 2018. In line with its strategy, the company expects store openings to be focused on Athleta and Old Navy locations, with closures weighted toward Gap brand and Banana Republic.

Gap’s peer Foot Locker (FL), which also reported its quarterly results after the bell, exceeded the estimates and the stock surged more than 10% in the after-hours trading.

Shares of Gap have lost 28% of its value in the year-to-date period and 18% in the past 52-weeks.

Follow our Google News edition to get the latest stock market, earnings, and financial news at your fingertips