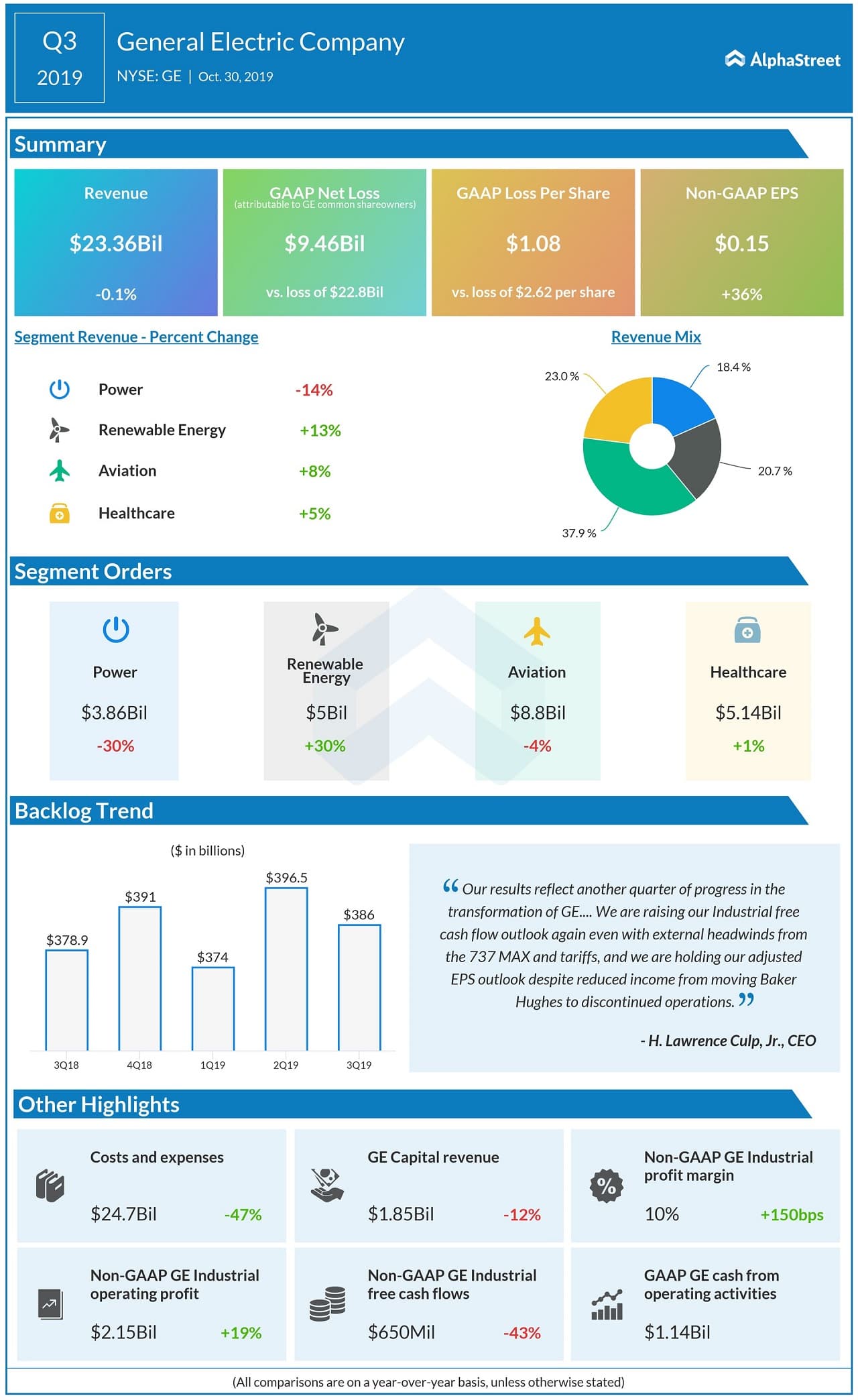

On a GAAP basis, net loss narrowed to $1.08 per share from net loss of $2.62 per share in the prior-year quarter. GAAP loss per share from continuing operations improved 94% year-over-year to $0.15.

For fiscal 2019, GE expects adjusted EPS to be between $0.55 and $0.65. The company increased the industrail free cash flow forecast to a range of $0-2 billion from the prior estimated range of $(1)-1 billion.

“We are encouraged by our strong backlog, organic growth, margin expansion, and positive cash trajectory amidst global macro uncertainty. We are raising our Industrial free cash flow outlook again even with external headwinds from the 737 MAX and tariffs, and we are holding our adjusted EPS outlook despite reduced income from moving Baker Hughes to discontinued operations,” said CEO Lawrence Culp, Jr.

Upon ceding majority ownership of Baker Hughes, GE expected to record a significant loss upon deconsolidating the segment, and segment results were reclassified to discontinued operations.

Also read: Boeing (BA) Q3 earnings miss estimates despite revenue beat

For the three months ended September 30, 2019, Power segment’s revenues and orders decreased 14% and 30%, respectively, while Renewable Energy’s revenues and orders rose 13% and 30%, respectively.

Aviation segment revenues grew 8% in the third quarter, while orders declined 4%. CFM, the joint venture between GE Aviation and Safran Aircraft Engines, continues to work closely with Boeing to ensure the timely and safe return to service of the 737 MAX.

GE shares have advanced 25% since the beginning of 2019, while it slipped 15% from this time last year.