General Mills (NYSE: GIS) reported a decline in its third-quarter earnings even as revenues remained unchanged from last year. Earnings exceeded the market’s prediction, while sales missed. The company also revised up its earnings guidance for fiscal 2020.

Shares of General Mills have been resilient to the market turmoil triggered by the covid-19 crisis. Though the stock suffered a loss last month, it bounced back in the following weeks. It traded lower during Wednesday’s pre-market session as the market was not impressed by the top-line performance.

Earnings Beat

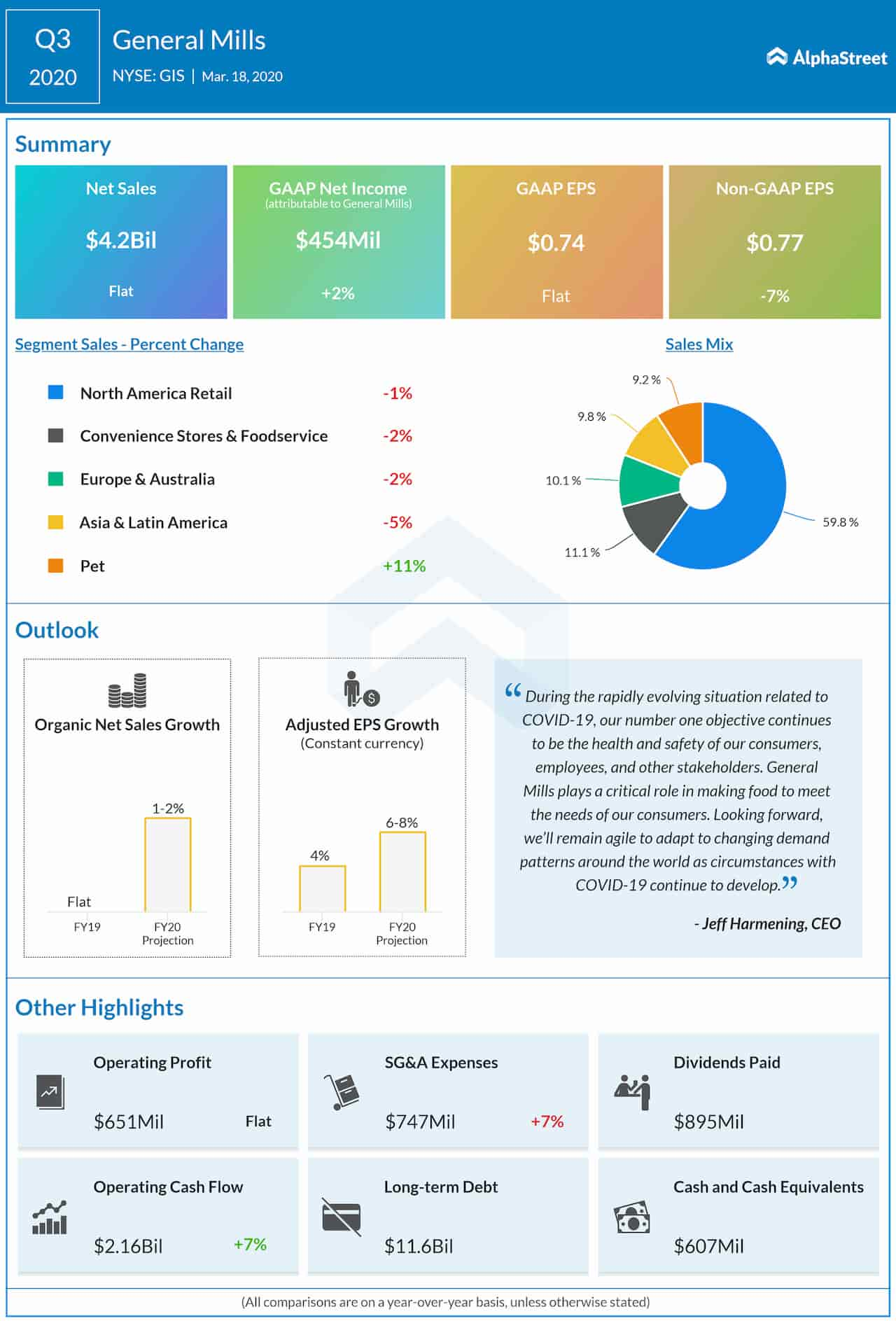

The food products manufacturer reported adjusted earnings of $0.77 per share for the third quarter of 2020, down from last year’s profit of $0.83 per share. Analysts were looking for a smaller number for the latest quarter. Meanwhile, un-adjusted earnings remained unchanged year-over-year at $0.74 per share.

Flat Sales

Net sales were $4.2 billion during the three-month period, broadly flat year-over-year. The top-line came in slightly below analysts’ forecast.

“We began fiscal 2020 with three key priorities: accelerate our organic sales growth, maintain our strong margins, and reduce our leverage. Looking forward, we’ll remain agile to adapt to changing demand patterns around the world as circumstances with COVID-19 continue to develop,” said CEO Jeff Harmening.

Outlook

While the impact of the epidemic on the company’s finances in the remainder of fiscal 2020 is uncertain, the management is looking for a 1-2% rise in full-year organic net sales and a 1% increase in net sales. The top-line performance has been boosted by increased retail orders as customer rush to stock up on commodities in the wake of the coronavirus crisis.

It also revised up the guidance for operating profit growth to 4-6% from the earlier outlook of 2-4%. Full-year adjusted profit is currently expected to grow at a faster rate of 6-8% than the 3-5% growth predicted earlier. The bottom line is estimated to have benefited from a reduction in cost escalation and improved margin management.

General Mills’ shares dropped early Wednesday soon after the earnings announcement. The stock has gained about 15% since the beginning of the year.