GIS shares fell over 3% during pre-market trading on the topline miss. General Mills shares have maintained an upward trajectory since December last year – when it plunged to the lowest level in six years – gaining about 45% during this period.

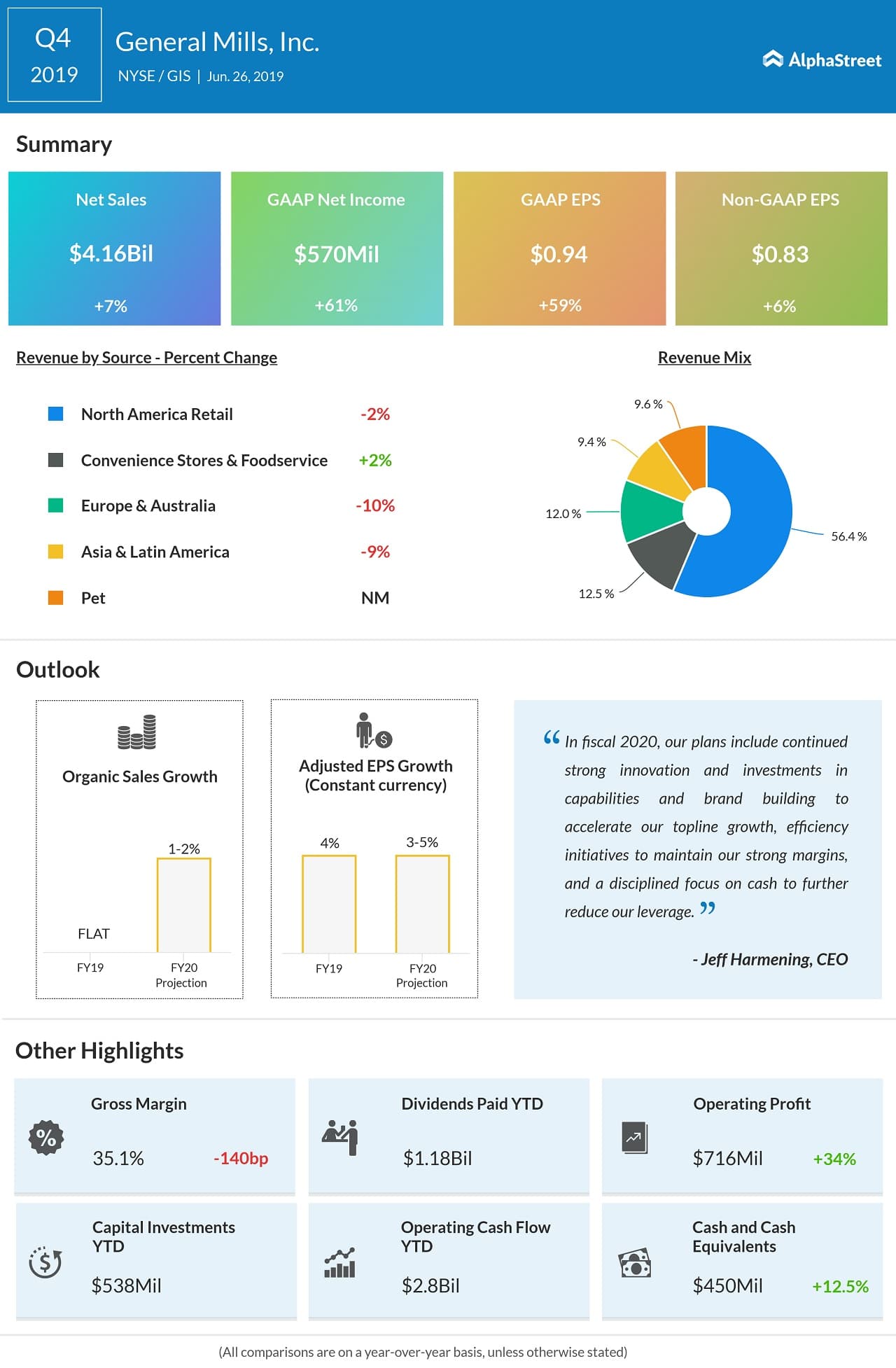

Adjusted gross margin declined 50 basis points to 35.3%, driven by higher input costs.

Cost escalation continues to be a concern as far as margins

are concerned and the trend is expected to continue throughout this year, with

the main contributors being the high costs of packaging, shipment, and raw

materials.

Outlook

For fiscal 2020, General Mills expects a 1-2% increase in organic net sales, while constant-currency adjusted EPS is expected to grow 3-5% from the base of $3.22 earned in fiscal 2019.

Among the other food companies, Kraft Heinz (KHC) has delayed the release of its first-quarter results pursuant to an investigation into its procurement practices. Based on an SEC notification, the company recently restated the financial reports for a period of more than two years to rectify certain errors.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.