General Motors Co. (NYSE: GM) reported a 0.3% rise in earnings for the second quarter as strong all-new light-duty truck performance and its cost actions partially offset planned heavy-duty truck downtime and expected lower China equity income. The results exceeded analysts’ expectations. Further, the company reaffirmed the adjusted earnings outlook for 2019.

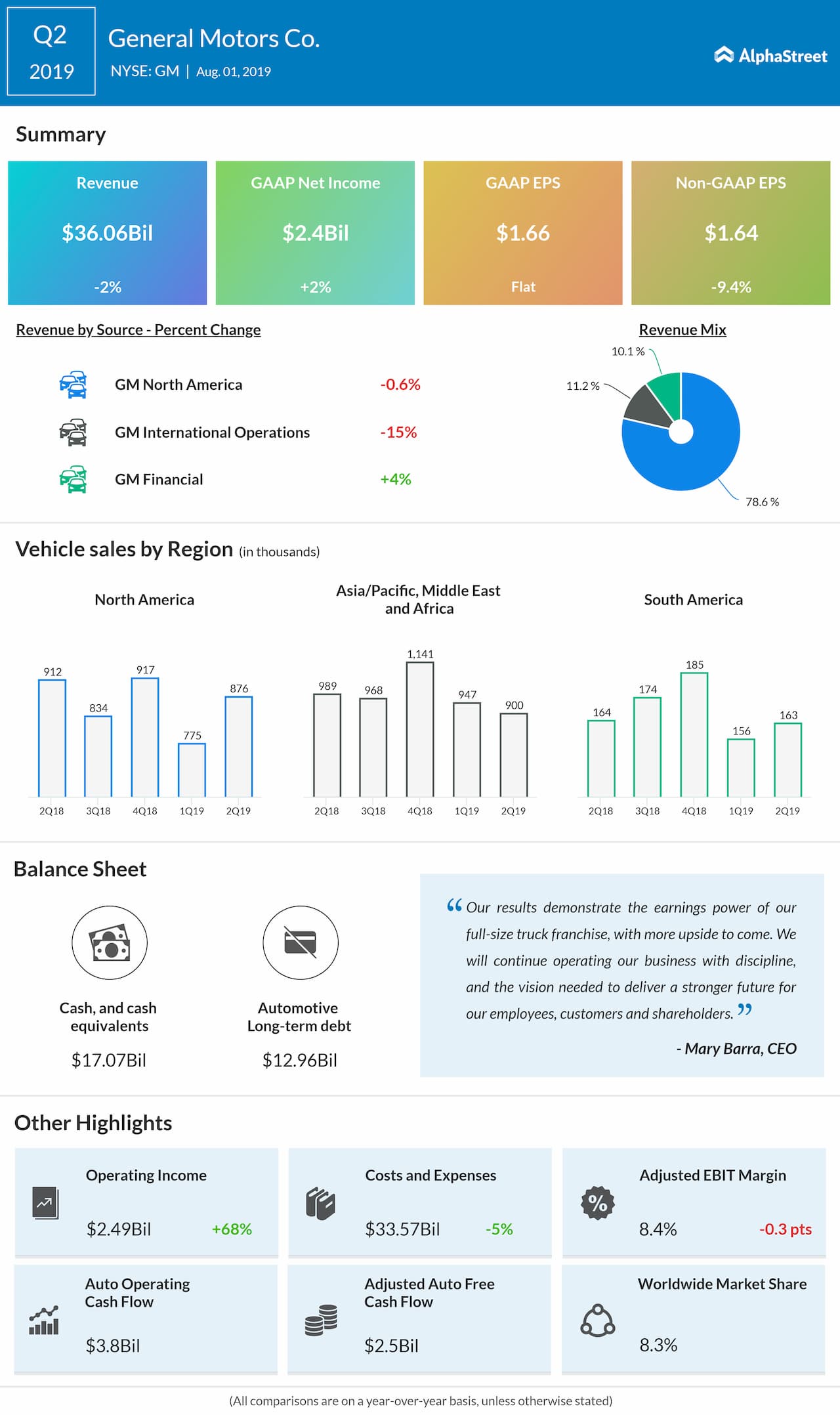

Net income rose by 0.3% to $2.38 billion, while earnings remained unchanged from the previous year quarter at $1.66 per share. Adjusted earnings decreased by 9% to $1.64 per share.

Net revenue declined by 2% to $36.1 billion. The results were hurt by lower passenger car sales and planned heavy-duty truck downtime at GMNA.

Looking ahead into the full year 2019, the company continues to expect adjusted earnings in the range of $6.50 to $7.00 per share and adjusted automotive free cash flow in the range of $4.5 billion to $6 billion.

The company remains on track for the execution of transformation cost savings of $2 billion to $2.5 billion through 2019. Earnings guidance is narrowed to the range of $5.91 to $6.75 per share from the previous range of $5.76 to $6.79 per share for the full year.

For the second quarter, total vehicle sales in North America decreased by 4% year-over-year to 876,000 and vehicle sales in the Asia/Pacific, Middle East, and Africa fell by 9% to 900,000. Total vehicle sales in South America declined by 0.6% to 163,000.

Also read: Ford Q2 financials

Due to China’s economic slowdown, China industry unit sales are expected to remain weak through the second half of the year, with industry deliveries projected to be down for the full year. GM China expects to benefit from about 20 new vehicle launches, the majority of which will go on sale later in the year.

Nearly two-thirds of the launches in the second half are SUVs. However, GM expects equity income in the second half of the year to be generally in line with the first half, due to ongoing headwinds.

Shares of General Motors ended Wednesday’s regular session down 0.17% at $40.34 on the NYSE. Following the earnings release, the stock rose 3% in the premarket session.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.