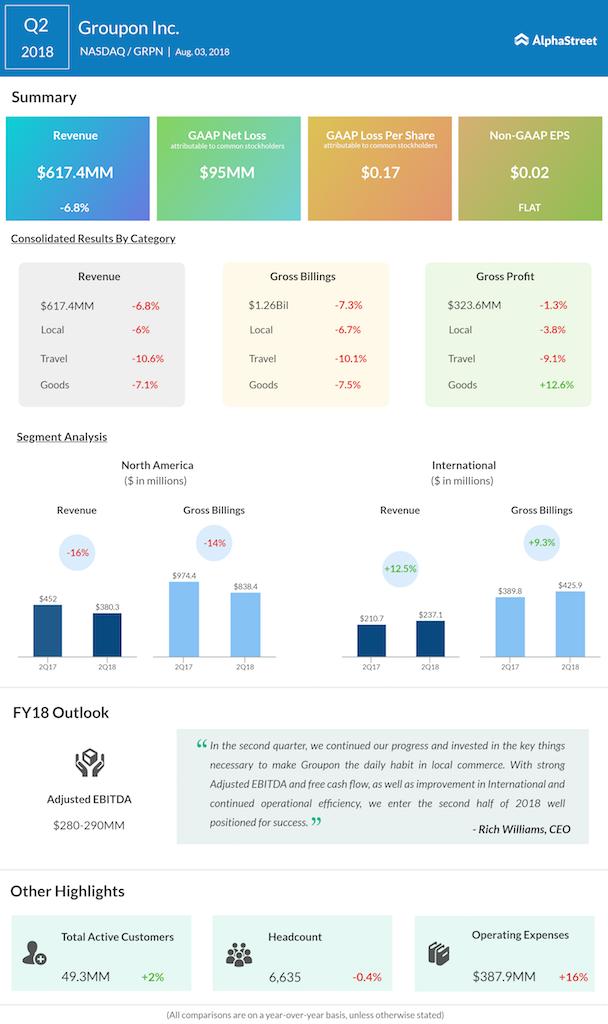

Gross billings, total income the company gets from the sale of goods and services, decreased 14% to $838.3 million. Active customers on the site grew to 49.3 million from 48.3 million during the prior year period. Active customers from North America reached 32.2 million as of June 30, 2018. International active customers increased to 17.1 million from 16.4 million in the prior year.

Global units sold declined 10% to 40 million. Units in North America were down 14% with a significant portion of that decline was due to the focus on long-term gross profit optimization in goods as well as continued scaling of Groupon Plus, a cash-back restaurant deal, and the sale of certain OrderUp assets that occurred in the second half of 2017.

RELATED: IBM seeks $167 million in settlement from Groupon

For the full year 2018, Groupon continues to expect adjusted EBITDA to be $280-290 million. Excluding amounts that might be paid related to the IBM litigation, the company anticipates generating free cash flow of approximately $200 million. On July 17, IBM won the internet patent battle against Groupon and the former was awarded $82.5 million by a federal jury.

RELATED: Groupon may soon find a deal for itself

Ever since the deals website went public in 2011, it has struggled to woo investors, especially in terms of revenue growth. Many blamed Groupon’s flawed business model. Recently, there were rumors that the company is looking for a prospective buyer and has held preliminary talks with more than one potential buyer so far. Industry watchers guess that the list includes major companies like Alibaba (BABA), which had picked 6% stake in the company in 2016, Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL) as well as IAC, who’s CEO Joey Levin sits on Groupon’s board.

Related Infographic