Halliburton Company (NYSE: HAL) reported

better-than-expected revenue and earnings for the fourth quarter of 2019. Shares

were up 1.9% in premarket hours on Tuesday.

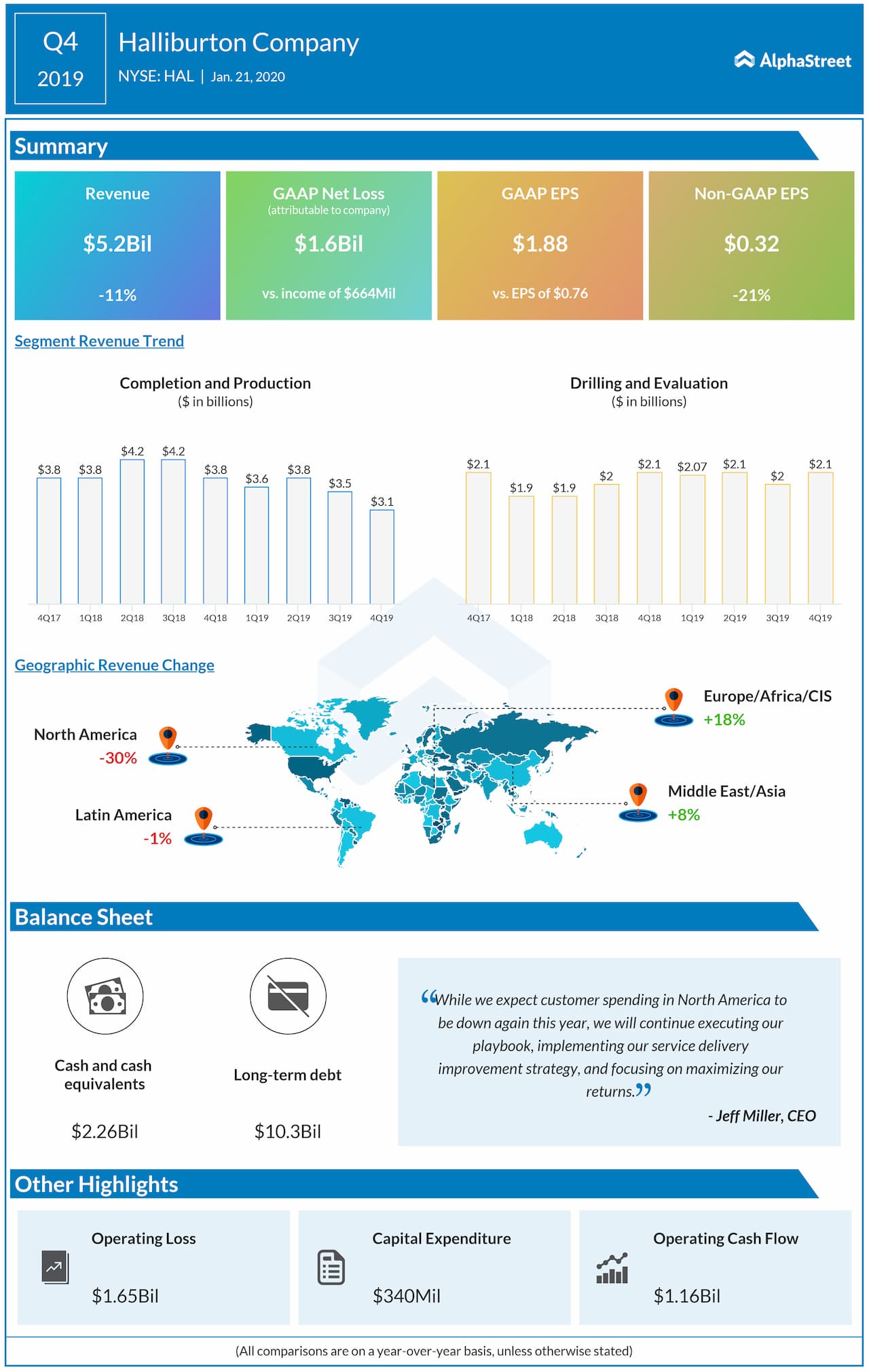

Total revenue of $5.2 billion was down 11% from the same period a year ago but came ahead of estimates of $5.11 billion.

The company reported a net loss of $1.6 billion, or $1.88 per

share in the quarter, compared to a net income of $664 million, or $0.76 per

share, last year, mainly due to a $2.2 billion impairment charge associated with

cost structure adjustments. Adjusted EPS totaled $0.32, beating forecasts of

$0.29.

CEO Jeff Miller stated, “In 2020, we expect our

international growth to continue. Increased activity, disciplined capital

allocation, pricing improvements, and our ability to compete for a larger share

of high-margin services should lead to improvement in our international margins

in 2020.”

Completion and Production revenue fell 13% sequentially to $3.1 billion due mainly to reduced activity and pricing in multiple product service lines in North America land and reduced stimulation services in Latin America.

Also read: Netflix Q4 2019 Earnings Preview

Drilling and Evaluation revenue increased 4% sequentially, driven

by increased activity in all product service lines in Middle East/Asia, along with

increased drilling activity in Europe/Africa/CIS and year-end software sales

globally.

Revenue in North America dropped 21% sequentially, mainly

due to reduced activity and pricing in North America land. International

revenue rose 10% sequentially, helped by increased activity in multiple product

service lines in Middle East/Asia and increased well construction activity in

the North Sea.

Revenue in Latin America fell 2% sequentially while revenue in the Europe/Africa/CIS and Middle East/Asia regions grew 6% and 19%, respectively.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.