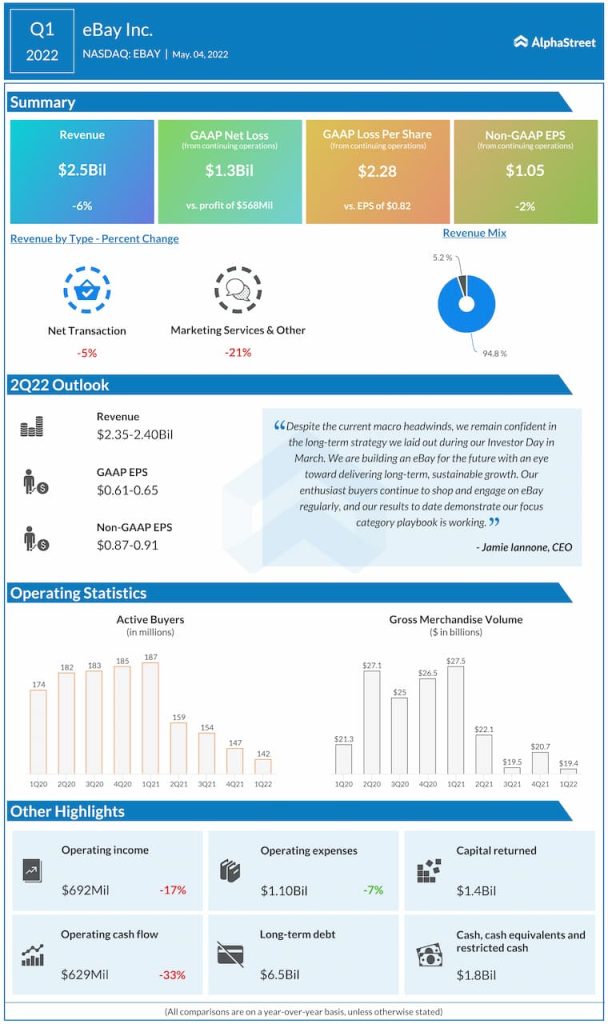

Revenue

Net transaction revenues were down 5% from last year to $2.3 billion while marketing services and other revenues dropped 21% YoY to $128 million. Looking ahead, for the remainder of 2022, the company expects to see near-term headwinds to ecommerce growth rates.

For the second quarter of 2022, eBay expects revenue to range between $2.35-2.40 billion, reflecting a YoY decline of 9-7% on an organic FX-neutral basis. For the full year of 2022, revenues are estimated to decrease 6-3% YoY on an FX-neutral basis to $9.6-9.9 billion.

Earnings

In Q1, eBay reported GAAP net loss from continuing operations of $1.3 billion, or $2.28 per share, compared to a net income of $568 million, or $0.82 per share, in the year-ago period. Adjusted EPS declined 2% YoY to $1.05 but came at the high end of the company’s guidance and also beat market expectations.

For Q2 2022, eBay expects GAAP EPS to range between $0.61-0.65 and adjusted EPS to range between $0.87-0.91. For FY2022, the company expects GAAP loss per share to range between $0.25-0.05 while adjusted EPS is estimated to range between $3.90-4.10.

Gross merchandise volume

Gross merchandise volume (GMV) in Q1 declined 20% YoY to $19.4 billion. GMV fell 17% on an FX-neutral basis. On its quarterly conference call, the company stated that the Russia-Ukraine war has impacted economic growth and consumer confidence throughout Europe and other parts of the world. This compounded the pressures caused by inflation and supply chain challenges.

In addition, rising interest rates are anticipated to impede near-term economic growth and sanctions could lead to a rise in fuel prices and more pressure on consumer spending. eBay revised its expectations to reflect the near-term uncertainty.

For Q2, the company expects to generate GMV of $18.02-$18.42 billion, reflecting a drop of 16-14%. For FY2022, GMV is estimated to range between $73.2-75.2 billion, representing a decline of between 12% and 10%.

Margins

In Q1, GAAP operating margin was 27.9% and adjusted operating margin was 32.4%. For Q2, adjusted operating margins are expected to range between 26.5% and 27.5%. In FY2022, operating margin is expected to range between 29-30%.

Click here to read the full transcript of eBay’s Q1 2022 earnings conference call