Shares of Netflix Inc. (NASDAQ: NFLX) were down 3% on Wednesday, a day after the streaming giant delivered mixed results for the first quarter of 2023 and provided second quarter guidance that was below expectations. Despite these minor setbacks, the company appears to be making meaningful progress on two of its important initiatives – paid sharing and its ad-supported plan.

Ad-supported plan

Netflix’s ad-supported plan is progressing well. In its Q1 2023 letter to shareholders, the company said the engagement on its ads tier has been better than expected and it has seen very little switching from its standard and premium plans.

The current performance and trajectory of its per-member advertising economics also remains encouraging. In the US, the average revenue per membership from the ad-supported plan is greater than the standard plan.

The company plans to upgrade the features for its ad-supported plan to include 1080p versus 720p video quality and two concurrent streams in all its 12 ads markets. This is expected to boost the engagement for existing users as well as bring new users to the ad-supported tier.

Paid sharing

The other important initiative is paid sharing and while Netflix’s postponement of the widespread roll-out of this measure in Q1 was disappointing, the company remains optimistic on the long-term benefits of this plan.

Netflix was pleased with the progress it saw in markets like Canada, New Zealand, Spain and Portugal where it launched paid sharing during the first quarter. Despite initial cancellations, the company saw an increase in acquisition and revenue as borrowers began activating their own accounts and members started adding extra accounts. Its paid membership base in Canada is now larger than it was before the launch of paid sharing and its revenue in the region is growing faster than the US.

Netflix now plans to launch paid sharing more broadly in the second quarter as it found opportunities to further improve features within this initiative. This will shift some of the membership growth and revenue benefit from Q2 to Q3 but the company believes this will provide a better result for its business. Netflix remains optimistic that paid sharing will drive higher revenue and engagement growth over the long term.

Mixed results and outlook below expectations

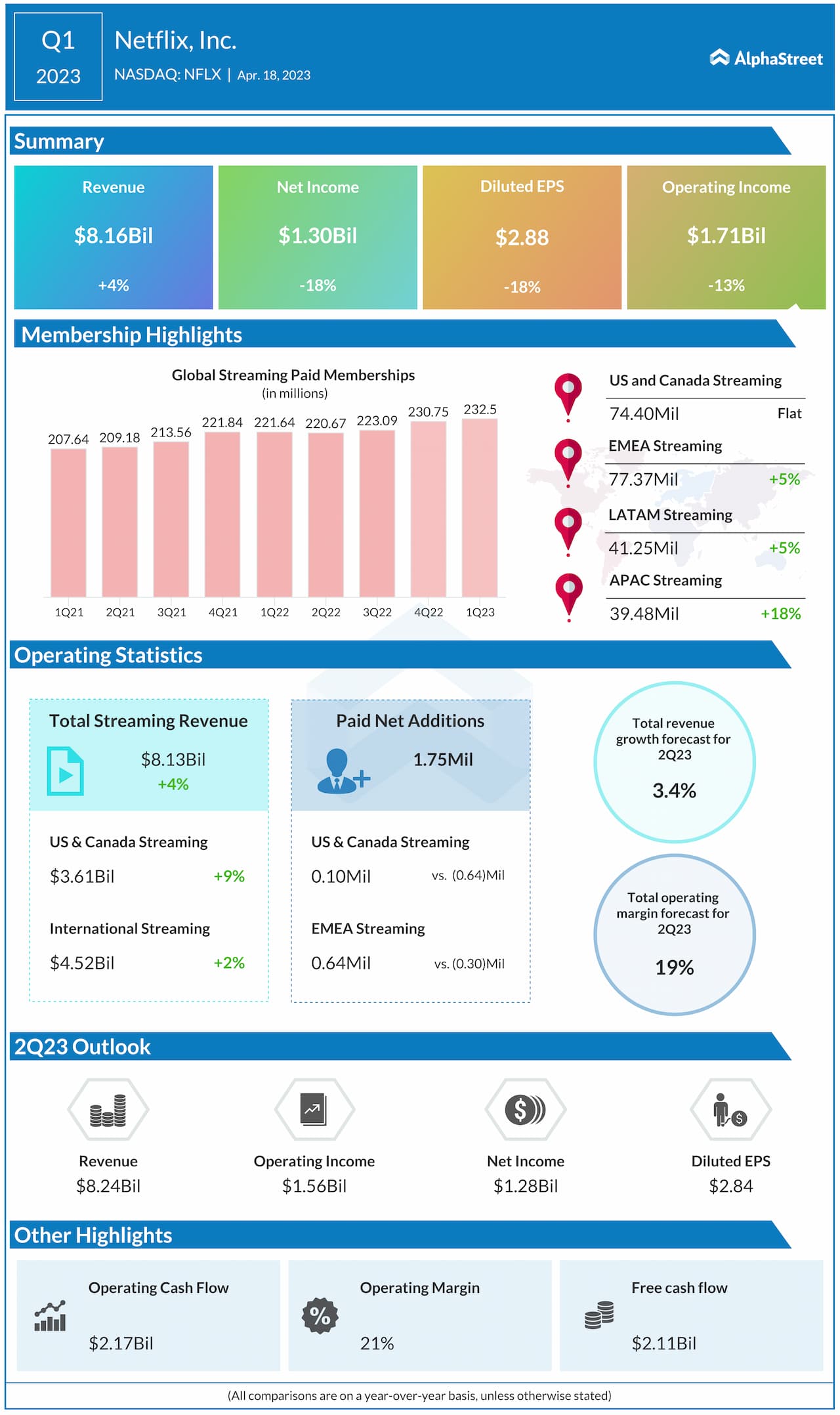

Netflix’s Q1 revenue grew 4% year-over-year to $8.16 billion, but fell below estimates of $8.17 billion. EPS was $2.88, down 18% YoY but ahead of expectations of $2.86.

For the second quarter of 2023, Netflix has guided for revenue of $8.24 billion and EPS of $2.84. This is below the consensus targets of $8.48 billion in revenue and EPS of $3.05.