Strong Q3 performance

Strong value proposition

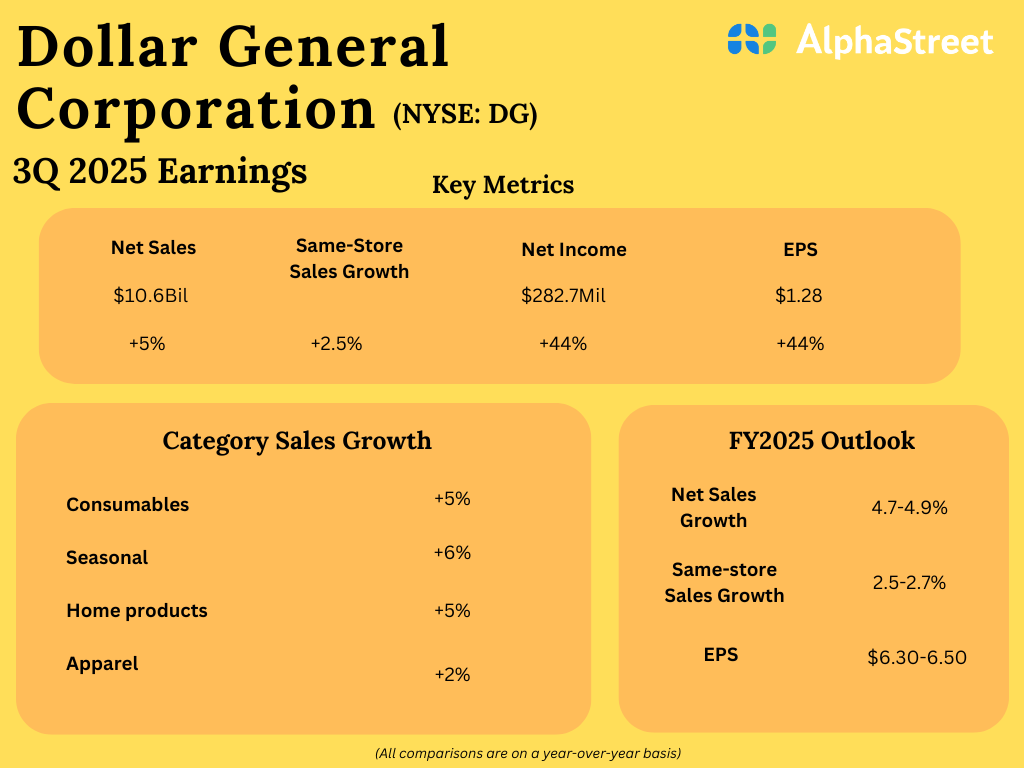

Dollar General continues to benefit from its wide range of offerings that provide value to customers. In Q3, the company saw a 2.5% growth in customer traffic while the average transaction amount remained flat. As mentioned on its quarterly call, the dollar store continues to gain more customers, especially from higher-income households. Through its varied assortment and low price points, DG believes it can gain market share with customers across all income groups.

During the third quarter, Dollar General saw sales and comps growth across all its categories – consumables, seasonal, home, and apparel. It gained market share in both the consumables and non-consumables categories.

Growth initiatives

Dollar General is focusing on a number of initiatives to drive growth, which include its real estate projects and digital capabilities. The company continues to revamp its store fleet through new store openings and remodels. Its remodel programs Project Renovate and Project Elevate are seeing substantial progress.

In the third quarter, DG opened 196 new stores, and remodeled 651 stores through Project Elevate and 524 stores through Project Renovate. The company believes it is well-positioned to serve customers in rural areas of the US, with 80% of its current store base serving small towns. Looking ahead, DG plans to open larger-footprint stores mainly in rural communities, with an expanded range of offerings that will offer value and convenience to customers.

Dollar General’s digital initiatives complement its vast store footprint, and its mobile app and website are popular with customers. Its DG Delivery service and its partnerships with DoorDash and Uber Eats are helping improve its delivery capabilities. The company is seeing larger basket sizes and strong repeat visit rates from customers on its delivery platform, with ample opportunity for sales growth.

Upbeat outlook

Dollar General raised its guidance for fiscal year 2025, based on its strong Q3 performance and an improved outlook for the remainder of the year, while also keeping in mind the uncertain consumer environment. The company now expects net sales growth of 4.7-4.9%, same-store sales growth of 2.5-2.7%, and EPS of $6.30-6.50 for the year.