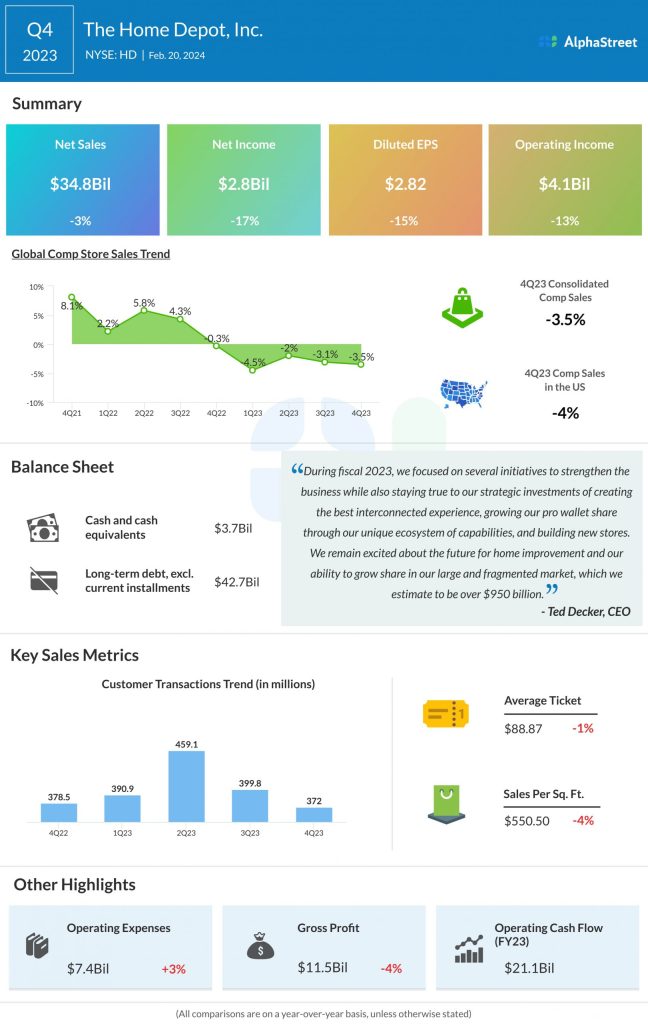

Net earnings were $2.8 billion, or $2.82 per share, compared to $3.4 billion, or $3.30 per share, last year.

Both revenue and earnings beat estimates.

For fiscal year 2024, the company expects total sales growth of approx. 1% including the 53rd week, comparable sales to decline approx. 1% for the 52-week period, and 53-week EPS percent growth of approx. 1%.

The company’s board of directors approved a 7.7% increase in its quarterly dividend to $2.25 per share, which equates to an annual dividend of $9.00 per share. The dividend is payable on March 21, 2024, to shareholders of record as of March 7, 2024.

The stock was down over 2% in premarket hours on Tuesday.

Prior performance