Better-than-expected results

Favorable trends

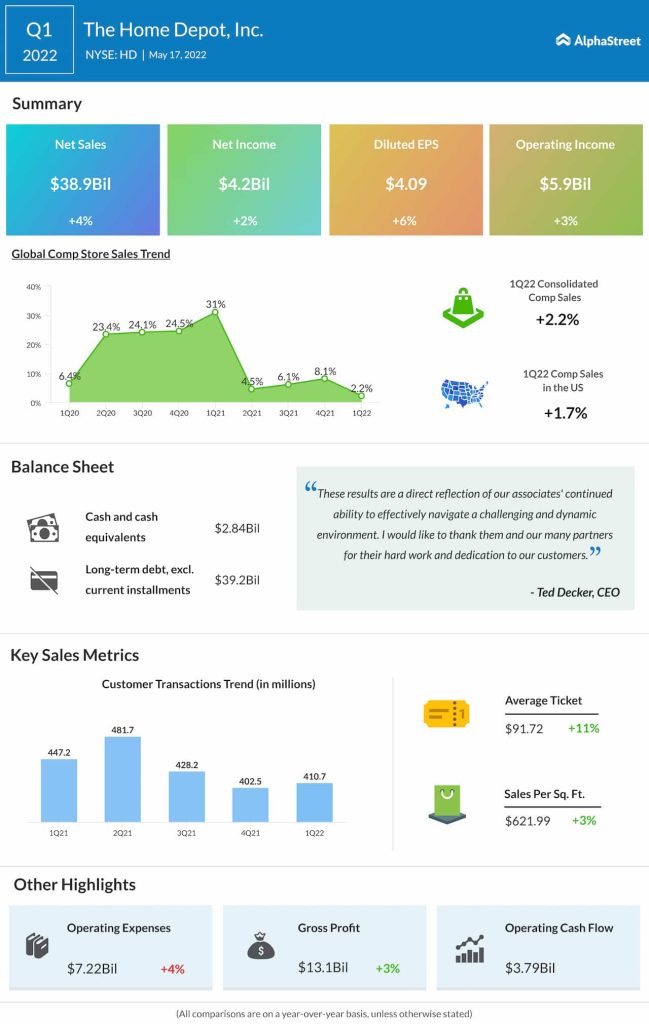

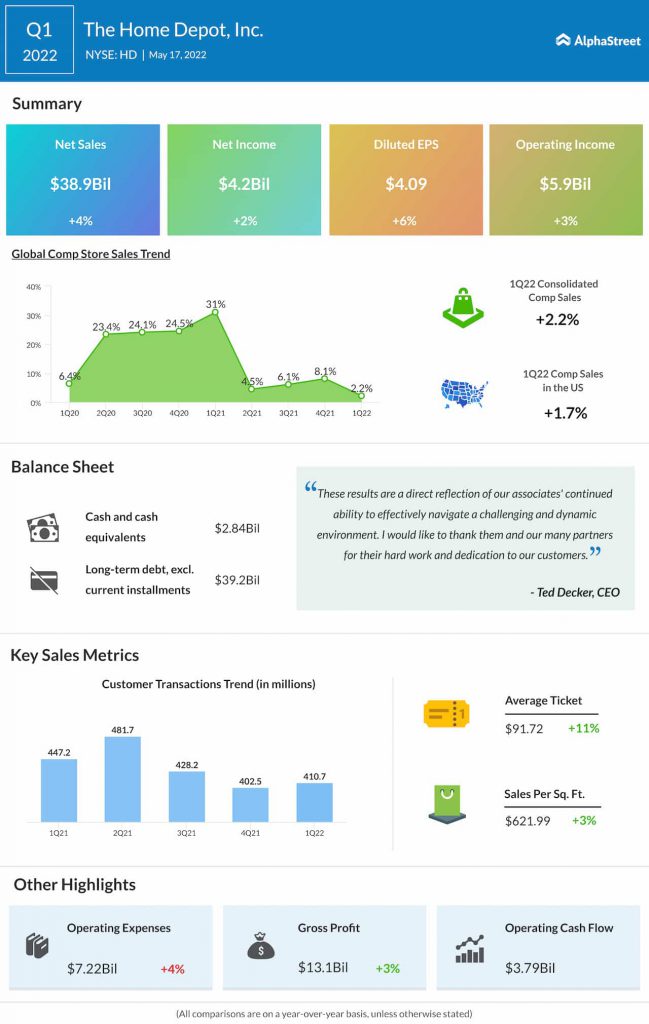

On its quarterly conference call, Home Depot said it continued to see strong demand for home improvement projects during the quarter. Most of the company’s merchandising departments like plumbing, building materials, and paint delivered positive comps. However, seasonal departments posted negative comps due to the late arrival of spring.

Comp average ticket increased 11.2% in Q1, fueled by inflation across many of the company’s product categories as well as demand for new products. Inflation in core commodity categories such as lumber and copper positively impacted average ticket growth by around 240 basis points during the quarter. On the other hand, the late start to spring led to an 8.4% drop in comp transactions.

During the quarter, Home Depot witnessed more strength in the Pro category versus the DIY category as many customers chose to take professional help for large renovation projects. As a result, the company posted double-digit comps in categories such as building materials, plumbing, and kitchen and bath.

Big-ticket comp transactions, meaning those over $1000, increased 12.4% year-over-year in Q1, helped by strength across many Pro-heavy categories such as pipe and fittings, gypsum, and fasteners. The company has several new product offerings across its seasonal categories for spring and it is encouraged by the momentum it has been seeing through the beginning of the second quarter.

Raised outlook

Home Depot raised its guidance for full-year 2022 and now expects total sales growth and comparable sales growth to be approx. 3%. The company had earlier guided for slightly positive sales and comp sales growth. Comps are expected to be stronger in the first half of the year than the second half.

EPS is now expected to grow in the mid-single digits versus the prior outlook of low single digit growth. Operating margin is now expected to be approx. 15.4% whereas previously it was expected to remain flat on a year-over-year basis.