Revenues

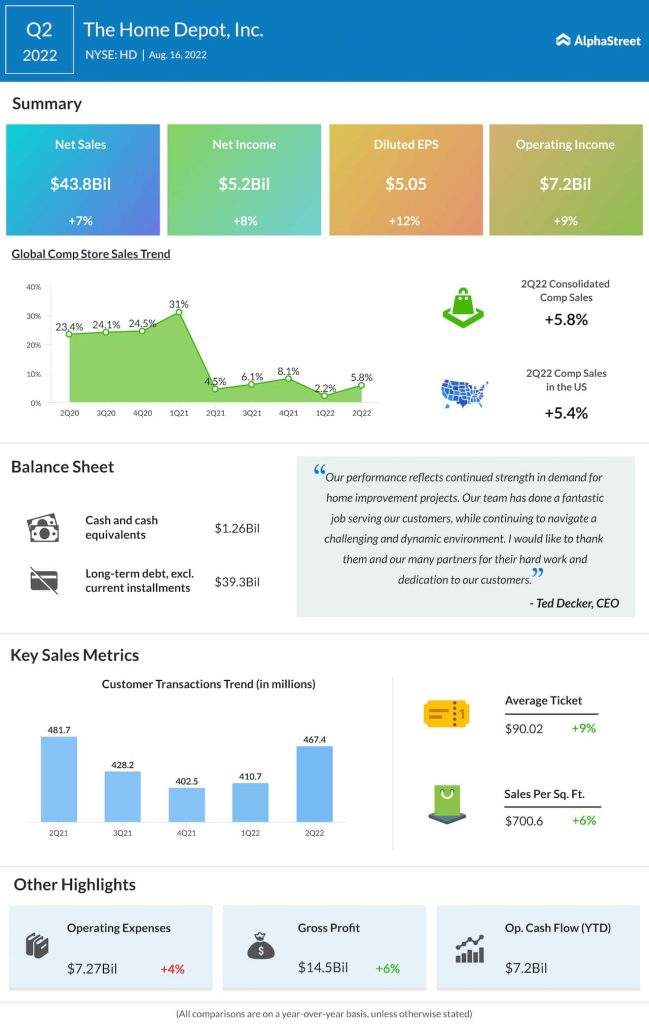

Comparable sales rose 5.8% with US comp sales up 5.4%. During the quarter, Home Depot saw sales growth in both the Pro and DIY categories. Pro outperformed DIY with strong project demand and healthy backlogs as evidenced by double-digit comp performance in categories like building materials, plumbing and fencing.

Lowe’s total sales for Q2 2022 dipped slightly to $27.5 billion from $27.6 billion last year. Comparable sales were down 0.3% while US home improvement comp sales were up 0.2%. Lowe’s derives 75% of its sales from the DIY category with the remainder coming from Pro. DIY sales saw a drop during the quarter due to a short spring season and lower demand in some discretionary categories. This was offset by a 13% growth in Pro sales.

Profits

Home Depot delivered EPS of $5.05 in Q2, which was up 11.5% year-over-year. Its gross margin declined approx. 15 basis points to 33.1% mainly due to supply chain investments while operating margin rose to 16.5% from 16.1% last year.

Lowe’s EPS increased 10% YoY to $4.67. Gross margin dropped 54 basis points to 33.24% while operating margin improved by 12 basis points to 15.39%.

Outlook

Home Depot expects sales growth and comp sales growth to be approx. 3% for FY2022. Operating margin is expected to be around 15.4% for the year. The company expects mid single-digit percent growth in EPS.

Lowe’s expects its sales for FY2022 to be near the bottom of its range of approx. $97-99 billion, and comparable sales to be towards the bottom end of the range of down 1% to up 1%. The company expects its Pro category to outperform the DIY category for the rest of this year and gross margins to be up slightly compared to last year. Operating margin is expected to be at the top end of its range of 12.8-13% for the year and EPS is expected to be at the top end of the range of $13.10-13.60.

Shares of Home Depot have dropped 34% year-to-date while Lowe’s stock has dropped 26% for the same period.

Click here to read the full transcripts of Home Depot and Lowe’s Q2 2022 earnings conference calls