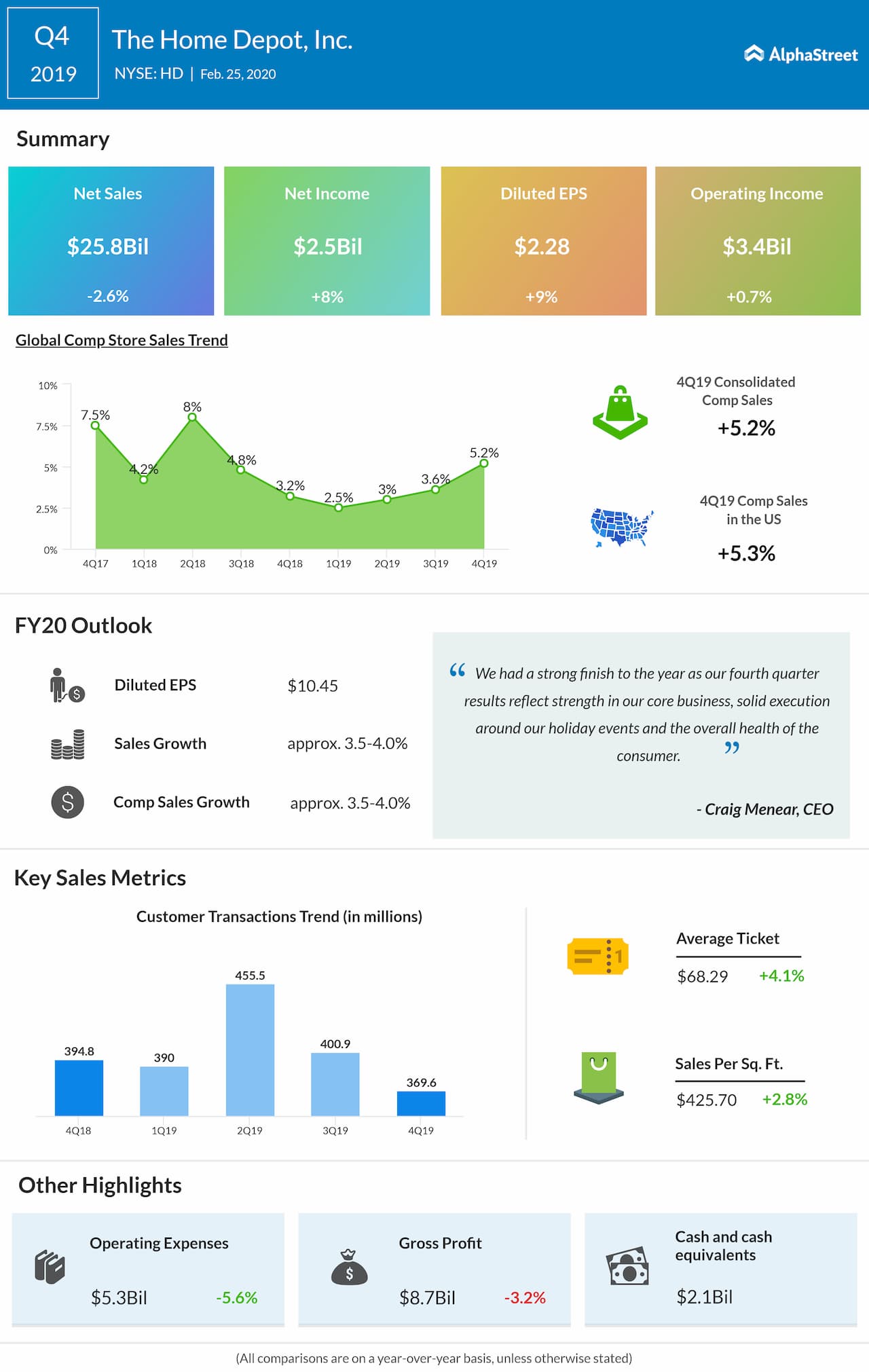

Net earnings were $2.5 billion, or $2.28 per share, compared to $2.3 billion, or $2.09 per share, in the prior-year quarter.

Comparable sales increased 5.2% and comp sales in the US

increased 5.3%. Customer transactions declined 6.4% during the quarter while

average ticket and sales per retail square foot increased 4.1% and 2.8%

respectively.

The company stated that its strategic initiatives are yielding value and that sales have grown by over $9 billion through the second year of the One Home Depot investment program.

Earlier this month, the retailer said it is planning to hire

80,000 associates for spring, which is its busiest season of the year. Most of

the part-time workers will be staffed in the garden center, with the aim of

helping customers with their spring projects.

In December, Home Depot had provided preliminary 2020

guidance which was below analysts’ expectations and this caused the stock to

drop at the time.

For fiscal year 2020, the company expects total sales growth of approx. 3.5-4%. Comparable sales is

expected to grow approx. 3.5-4%. Diluted EPS is expected to grow approx. 2% to $10.45.

Home Depot plans to open six new stores during the year.

The board of directors approved a 10% increase in the

quarterly dividend to $1.50 per share, which amounts to an annual dividend of

$6.00 per share. The dividend is payable on March 26, 2020 to shareholders of

record on March 12, 2020.

At the end of the fourth

quarter, Home Depot operated a total of 2,291 retail stores in all 50 states,

the District of Columbia, Puerto

Rico, the US Virgin Islands, Guam, 10

Canadian provinces and Mexico.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.