The strength in the commercial aerospace market might benefit

the company in the third quarter. The building solutions and process solutions

businesses are also expected to remain healthy in the period. However, weakness

in the safety and productivity solutions is likely to dampen results. Economic

volatility and currency headwinds are also likely to take a toll on the quarterly

numbers.

During the quarter, Honeywell acquired privately-held TruTrak Flight Systems for an undisclosed amount. The acquisition is expected to expand the company’s capabilities in the aviation market.

Also read: JPMorgan Q3 2019 Earnings Preview

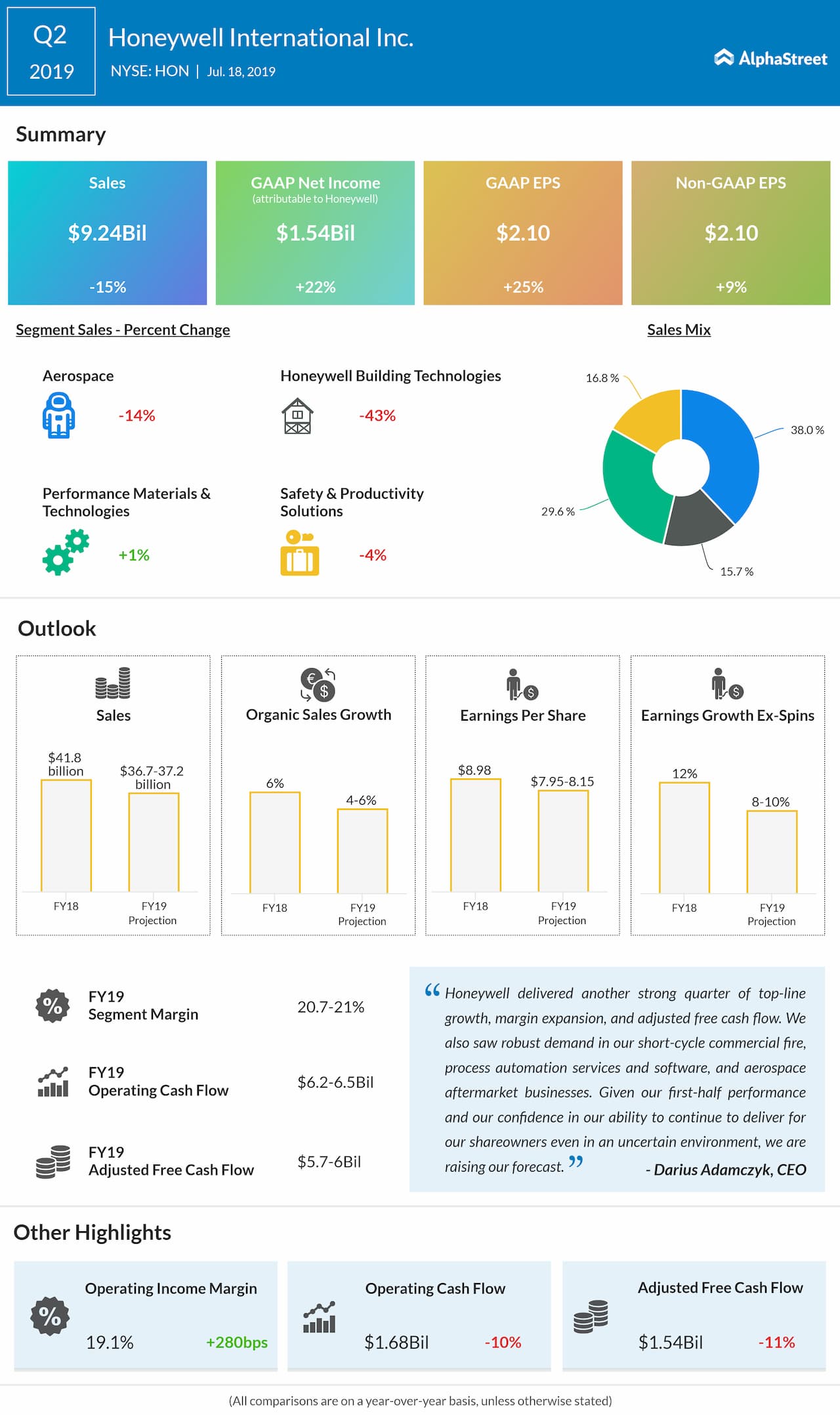

In the second quarter of 2019, Honeywell beat earnings estimates while revenues fell short of expectations. Sales dropped 15% year-over-year to $9.24 billion while adjusted EPS rose 9% to $2.10.

For the third quarter of 2019, Honeywell has guided for sales

of $9 billion to $9.2 billion, representing an organic growth of 2-4%. EPS is

expected to grow 4-6% to $1.97-2.02, excluding spins. For the full year of

2019, the company expects sales to grow 4-6% organically to $36.7 billion to

$37.2 billion. EPS is expected to grow 8-10% to $7.95-8.15, excluding spins.

Honeywell’s shares have gained 24% thus far this year. The majority of analysts have rated the stock as Buy and it has an average price target of $186.86.