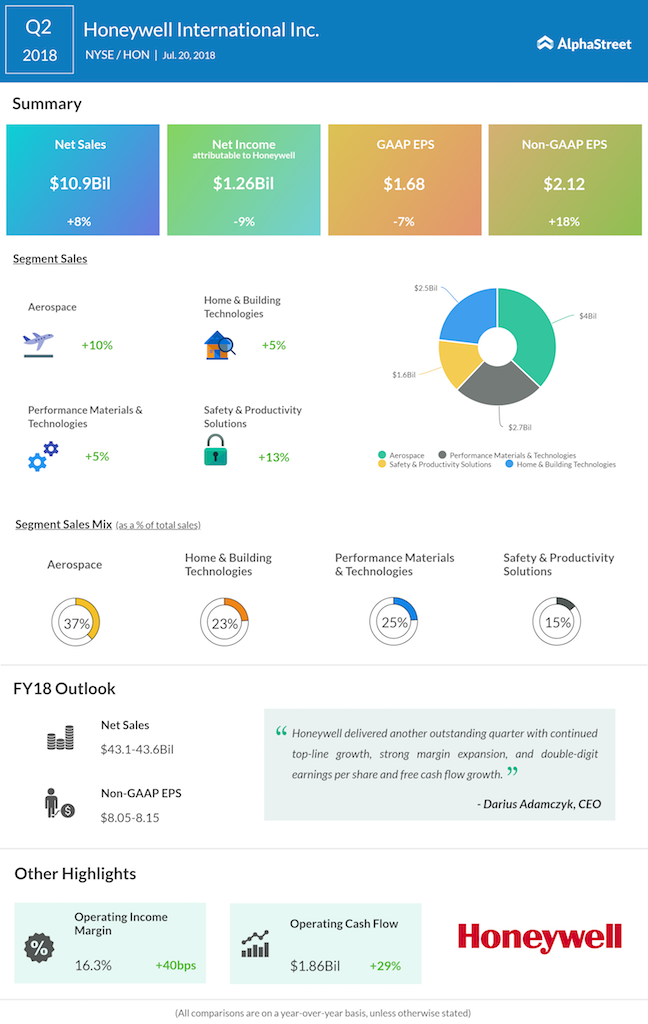

Honeywell International Inc. (HON) reported an 8% increase in sales to $10.9 billion during the second quarter of 2018. Sales grew 6% on an organic basis, driven by widespread growth across the business.

Net income attributable to Honeywell decreased to $1.26 billion or $1.68 per share from $1.39 billion or $1.80 per share last year. Reported EPS declined 7%. On an adjusted basis, EPS grew 18% to $2.12, exceeding the high end of the company’s guidance range. The firm’s revenue and adjusted EPS numbers beat analyst expectations.

Operating income margin improved 40 basis points to 16.3%. Segment margin improved 60 basis points to 19.6%, coming in above the high end of the outlook provided last quarter.

Aerospace sales grew 8% on an organic basis driven by growth in business aviation OE, demand in commercial aftermarket and Transportation Systems along with strength in defense. Home and Building Technologies sales rose 3% organically helped by strength in residential thermal products and growth in the ADI distribution business.

Honeywell expects to complete the spinoff of its Transportation Systems operations by the end of the third quarter, at which time the business will be rebranded as Garrett. The Homes business spinoff is on track to be completed by the end of 2018. The company’s long-cycle orders and backlog grew 11% and 14% respectively.

Honeywell raised its guidance for full-year 2018. The company expects sales of $43.1 billion to $43.6 billion and organic growth of 5% to 6%. EPS is expected to grow 13% to 15% to a range between $8.05 and $8.15.

Related: Earnings preview: Honeywell might prevail despite the tariff war

Related: Honeywell International Inc. Q2 2018 Earnings Call Transcript

Related: Honeywell Q1 2018 Earnings Infographic