Digital

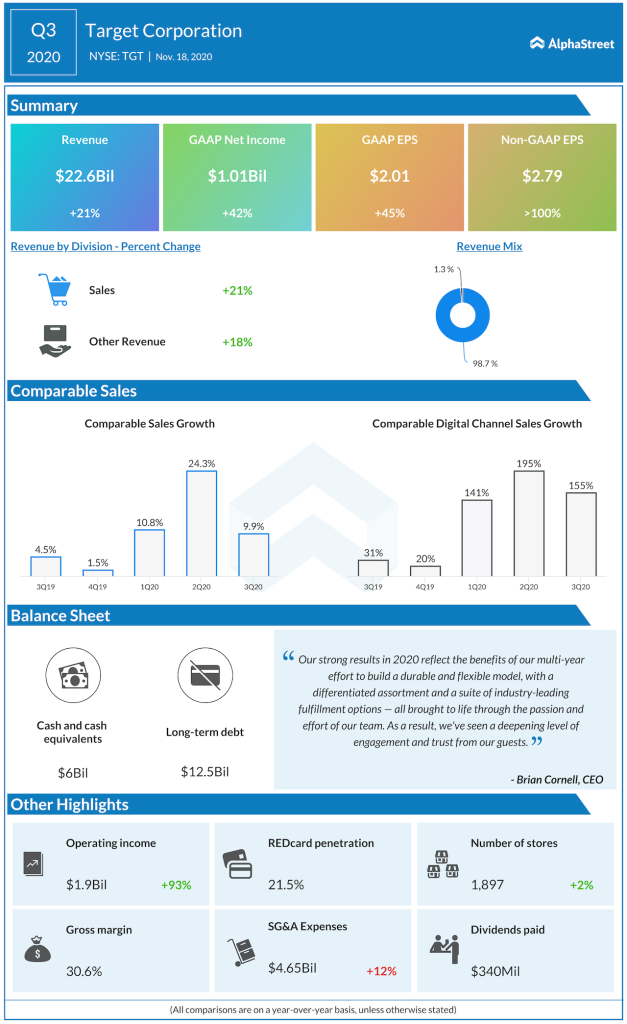

Digital comps grew 155% in the third quarter alongside a 10% growth in store comps. The company’s same-day delivery services – Pick Up, Drive Up and Shipt – grew over 200% on a combined basis. Drive Up sales increased 500% while Shipt saw growth of 280%. In-store pickup rose over 50% in the quarter.

For the holiday season, Target is doubling the number of Drive Up parking spaces compared to last year. The company has also added fresh, frozen and refrigerated items to its Pick Up and Drive Up assortment across 1,600 locations making it more convenient for customers to pick up their holiday groceries.

Stores

Target’s store fleet will play an important role in holiday shopping. In the third quarter, around 75% of digital sales were fulfilled by the store base. The company’s stores as hubs strategy has paid off resulting in significant growth in digital and store sales year-to-date.

Also read: US retailers and the holiday season – Kohl’s Corp. (KSS)

Categories

In terms of categories, Target saw strong growth in electronics and home. The comp growth of over 50% in electronics was driven by strong momentum in video games, computer software, electronic and office equipment. Within home, comp growth in the mid-20% range was driven by décor and kitchen. Comp sales in apparel grew 10% driven by intimates, sleepwear and men’s apparel.

For the holidays, Target is expanding Shipt services to include apparel. The company is also partnering with FAO Schwarz for toys and Ulta Beauty for personal care products. The beauty category has seen strong growth over the past couple of years and this alliance will further boost growth in this area. Target plans to open the first 100 Ulta Beauty shop-in-shop in 2021 with the potential to open another 100 in the coming years.

During the fourth quarter, Target expects to see a change in the category mix. The electronics and toy categories typically generate a vast portion of their sales in the fourth quarter but since these segments have seen strong sales thus far this year, it remains to be seen how they will perform in the fourth quarter. There is also uncertainty regarding the digital mix due to high levels of digital penetration seen this year.

Click here to read the next part of this story on TJX Companies