Strong performance

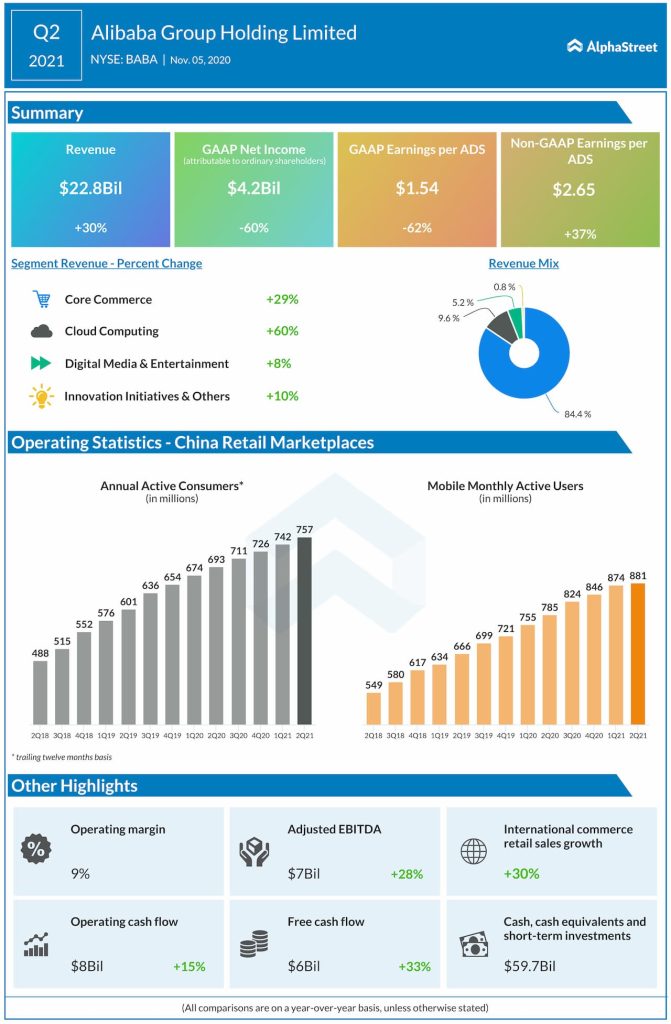

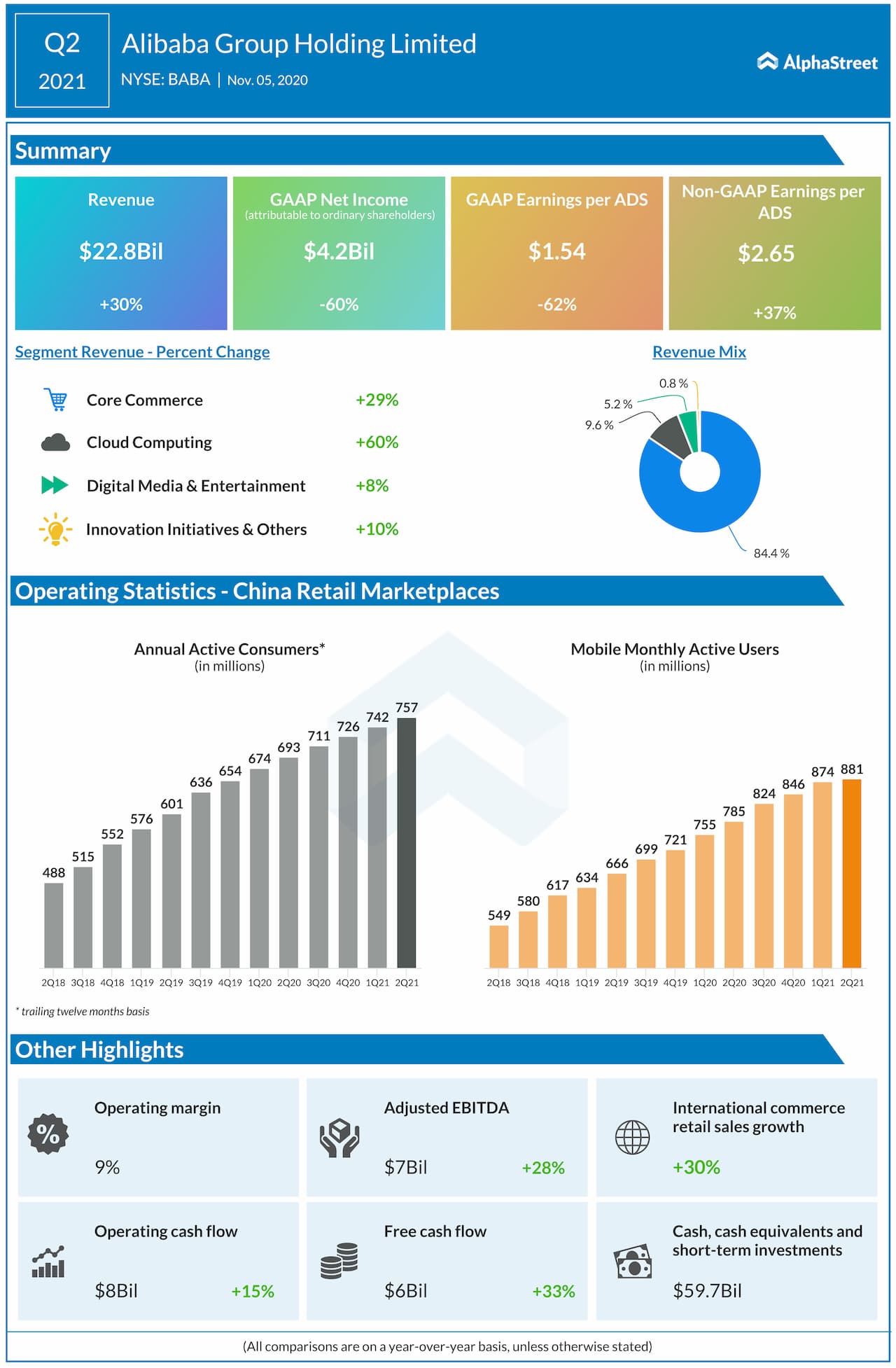

With a market cap of $642 billion, Alibaba is one of the 10 largest companies worldwide. For the first two quarters of FY2021, Alibaba posted revenue growth of 34% and 30% respectively. At the end of September 2020, annual active customers on its China retail marketplaces stood at 757 million, which was up by 15 million from the 12-month period ended June, 2020.

Mobile monthly active users reached 881 million in September 2020, up by 7 million over June 2020. The company has managed to increase its penetration in less developed areas by broadening its product offerings as well as through Taobao Deals, its marketplace for value-conscious customers.

Alibaba has created a community within itself that spans across various services such as ecommerce, grocery retail, restaurant services and digital entertainment. Tmall Global, its cross-border ecommerce platform, witnessed a 37% growth in GMV during Q2 2021. Its live-streaming portal Taobao Live generated GMV in excess of RMB350 billion for the 12 months ended September 30, 2020.

For the 12 months ended September 30, 2020, annual active customers for Alibaba’s grocery retail chain Freshippo reached over 26 million. Its food delivery app Ele.me saw a 45% year-over-year growth in average daily number of paying members during Q2.

Alibaba generated RMB498.2 billion, or $74.1 billion, in GMV at its 2020 11.11 Global Shopping Festival, with over 470 brands achieving more than RMB100 million in GMV.

Luxury market

Alibaba has partnered with Farfetch (NYSE: FTCH) and Richemont to bring luxury brands to China and to accelerate the digitization of the global luxury industry. Farfetch will launch luxury shopping channels on Tmall Luxury Pavilion, Luxury Soho and Tmall Global. Alibaba and Richemont will together invest $500 million in Farfetch China.

Last month, Alibaba released findings from a research report by Bain & Company and Tmall Luxury Division that showed luxury spending in China rebounded strongly as consumers made more domestic purchases during the COVID-19 lockdowns. The mainland China luxury market was estimated to grow by 48% to reach RMB346 billion by the end of 2020.

The global luxury market fell 23% in 2020 but mainland China’s market share nearly doubled from about 11% last year to 20% in 2020. This growth is expected to continue through 2025.

In short, despite the current challenges faced by Alibaba, the company is expected to hold its ground firmly and emerge strong from this setback.