Sales and earnings growth

Ulta Beauty Unleashed

As mentioned on the earnings call, Ulta anticipates the beauty category to remain resilient on the back of healthy engagement from consumers who are prioritizing beauty and wellness alongside value. In the first quarter, the company saw double-digit growth in the fragrances category, along with high-single-digit growth in the skincare and wellness category, driven by growth in body care, sun care and wellness.

As part of its strategy, Ulta has been improving its marketing efforts to build awareness, deepen engagement, and attract and retain loyalty members. The company has seen an improvement in brand visibility and a rise in traffic as a result of its relevant campaigns. Its loyalty member base increased 3% YoY to reach 45 million and it has been seeing higher engagement.

As part of its brand-building efforts, Ulta launched 19 new brands, many of which have been performing well and driving engagement and growth. The company has more brand launches and activations planned for the second quarter and the remainder of the year. The beauty retailer is also working on building its digital capabilities by expanding automation and adding new features to deliver a more personalized shopping experience for customers. These efforts are helping in driving engagement and growth.

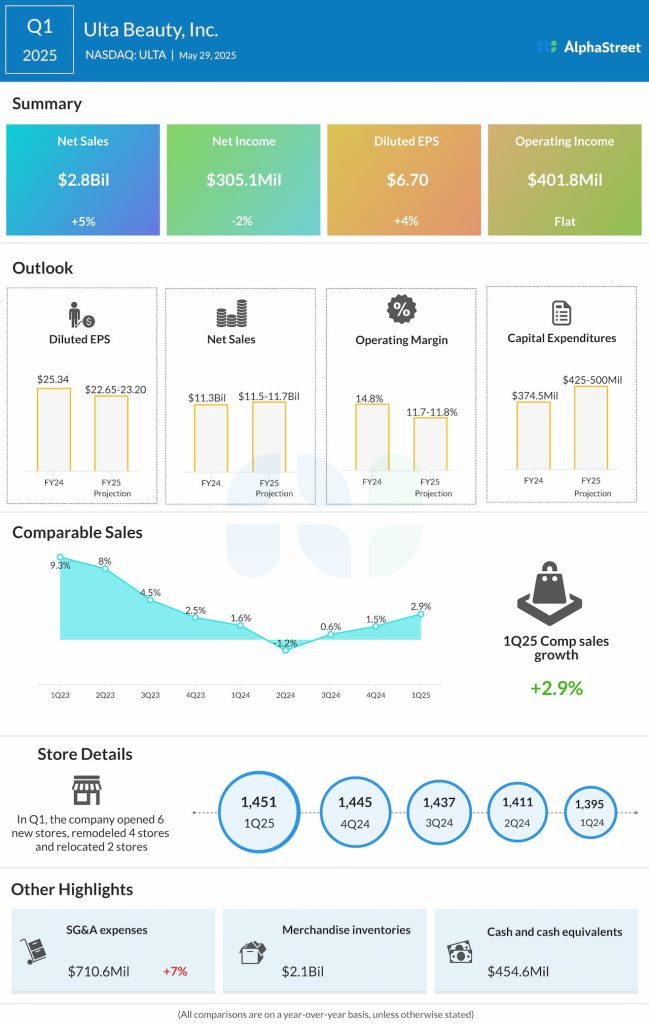

Guidance hike

Looking ahead to the remainder of fiscal year 2025, Ulta anticipates a dynamic operating environment and uncertainty regarding consumer demand. The company raised its outlook for the year based on its first quarter performance and now expects net sales to range between $11.5-11.7 billion and comparable sales growth to be 0-1.5%. EPS is now expected to be $22.65-23.20.