The Stock

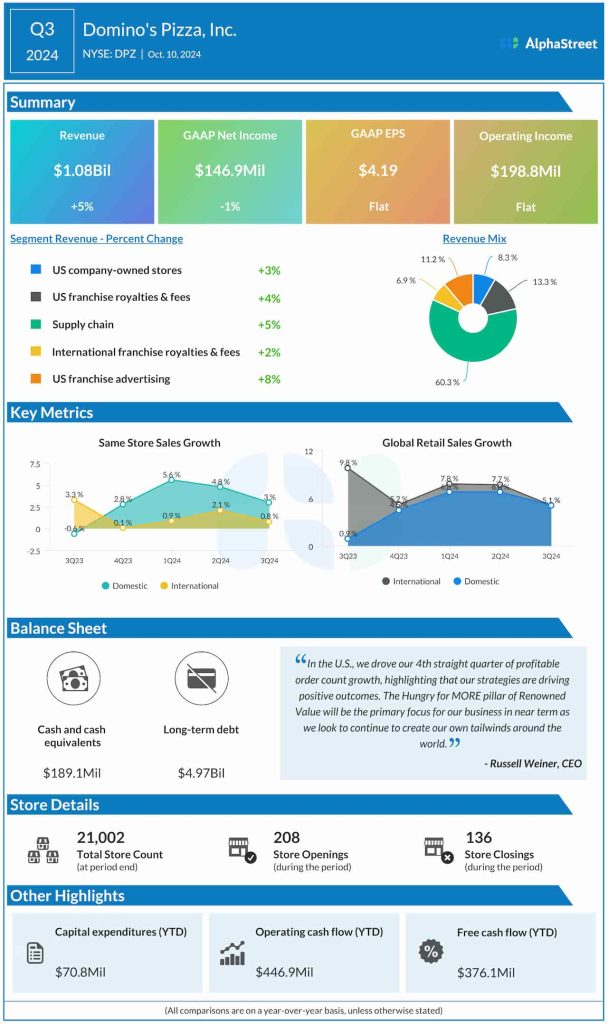

Net income was $146.9 million or $4.19 per share in the third quarter, compared to $147.7 million or $4.18 per share in the prior-year period. Earnings came in above estimates. Net revenues increased 5% to $1.08 billion in the August quarter. Domestic comparable-store sales grew 3% annually. The company opened 208 new stores during the three months and closed 136 units, ending the quarter with a total of 21,002 locations.

Mixed Show

The Pizza Chain delivered better-than-expected earnings consistently in the past eight quarters, while the top line mostly missed estimates during that period. Though sales have benefited from the company’s Hungry for More strategy — a five-year plan initiated in December last year focused on growth, technological innovation, and empowering franchisees — weakness in consumer spending weighs on the top-line performance.

Global retail sales, excluding foreign currency impact, rose 5.1% in Q3 when international same-store sales edged up 0.8% year-over-year. US same-store sales were up 3%. Transaction growth and marketing initiatives are the main drivers of same-store sales growth in the US market. Interestingly, sales from the Uber Eats partnership reached around 2.7% of the total in Q3, which is in line with the management’s target.

Guidance

Of late, Domino’s Pizza’s international business was affected by geopolitical issues and macroeconomic uncertainties. The company sees 1-2% same-store sales growth for its international segment this year and the next, and expects sales to return to more normalized levels by fiscal 2026. For both fiscal 2024 and 2025, the leadership expects around 6% annual growth in global retail sales and 8% increase in operating income. It also sees an 800-850 global net store growth for FY24. Beyond that, from 2026 through 2028, global retail sales are expected to rise more than 7% annually, while income from operations is estimated to grow around 8%.

From Domino’s Pizza’s Q3 2024 earnings call:

“Looking to Q4, Domino’s will give customers what they are demanding from their QSR brands — more. We opened the quarter with our MOREflation deal at a time where consumers are feeling that they’re getting less and paying more, MOREflation showed them that Domino’s was in their corner, giving them more for less. We follow this up with a 50% off boost week, and next week one of our biggest renowned value promotions ever will go back on air — Emergency Pizza. While providing value through our own channels is one part of our renowned value barbell strategy, tapping into the aggregator marketplace is the other.”

After recovering from their initial slump, Domino’s shares traded higher in the early hours of Thursday’s session. They have lost around 16% in the past six months.