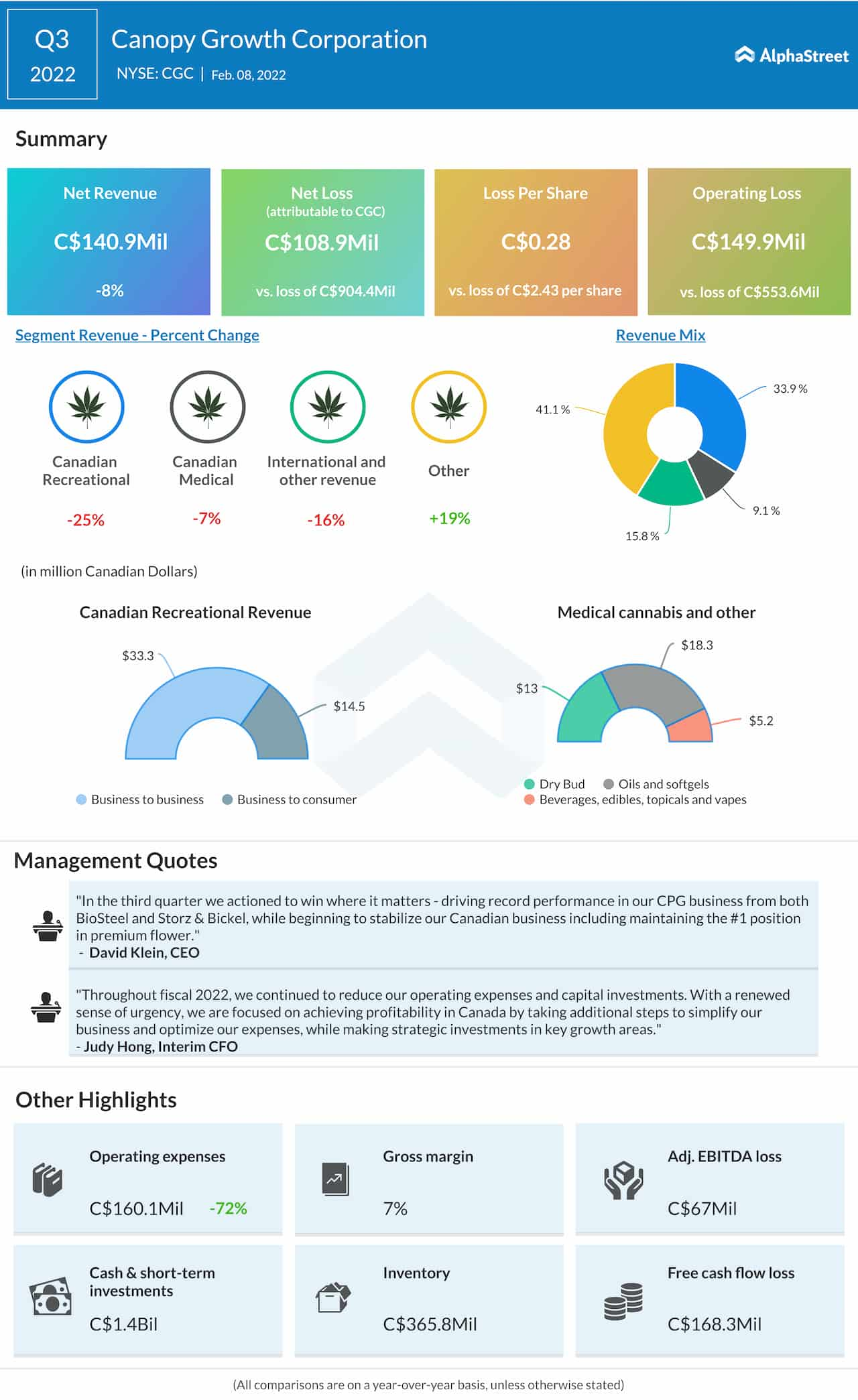

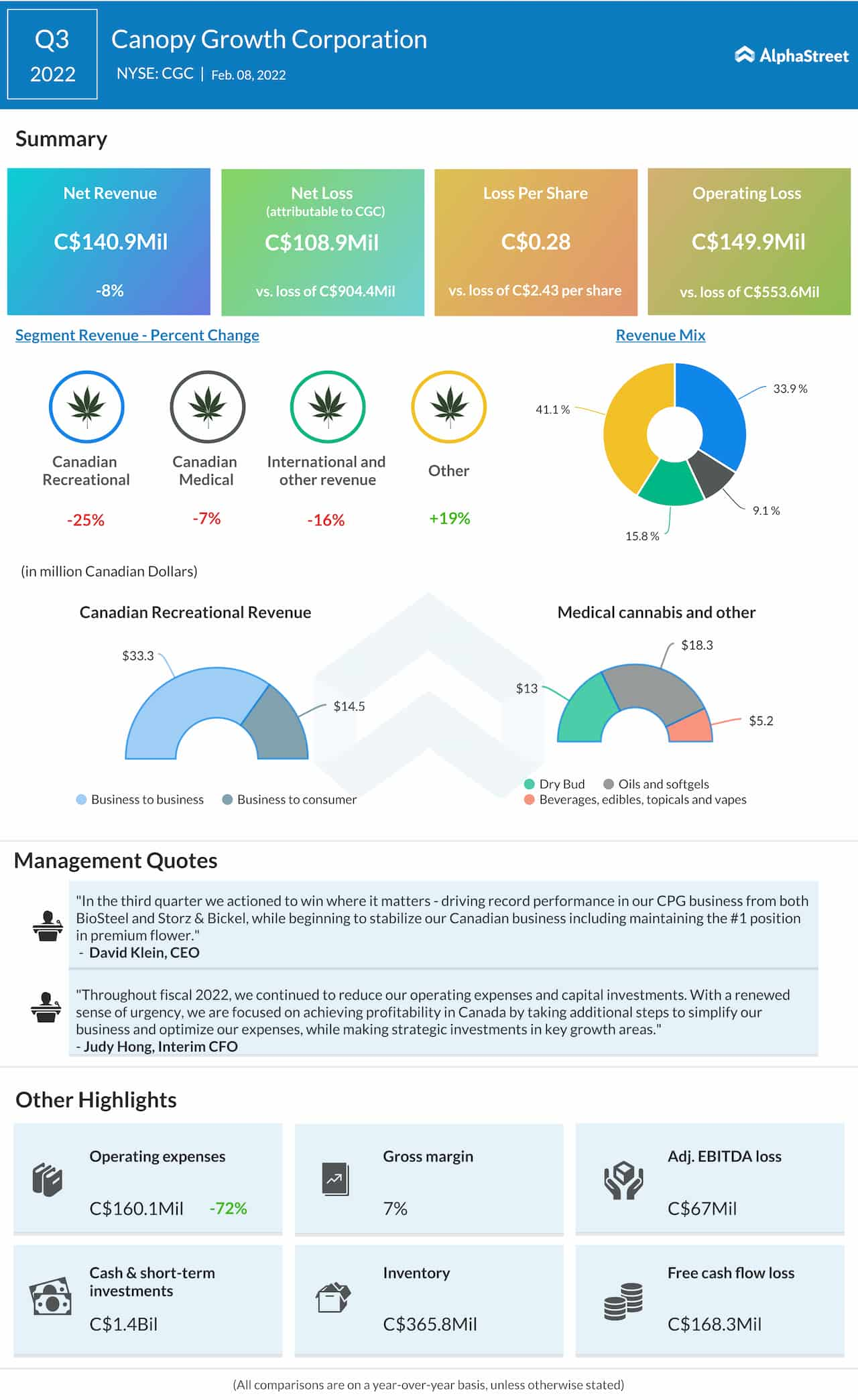

Cannabis producer Canopy Growth Corporation (NASDAQ: CGC) reported a narrower net loss for the third quarter of 2022, despite an 8% decrease in revenues.

In the three months ended December 2021, net loss narrowed to C$108.9 million or C$0.28 per share from C$904.4 million or C$2.43 per share in the same period of the previous year. In the prior-year quarter, the bottom line was impacted by material non-cash asset impairment and restructuring charges.

Third-quarter revenues decreased 8% annually to C$140.9 million as strong growth in the consumer products segment was offset by a decline in Canadian cannabis sales.

“In the third quarter, we actioned to win where it matters – driving record performance in our CPG business from both BioSteel and Storz & Bickel while beginning to stabilize our Canadian business including maintaining the #1 position in premium flower. Our continued discipline and focus are expected to fortify Canopy’s competitive positioning in Canada as we ambitiously build our U.S. CPG, CBD, and THC strategies,” said David Klein, chief executive officer of Canopy Growth.

Read management/analysts’ comments on quarterly results

Canopy growth’s stock has been on a downward spiral for more than a year, losing about 81% during that period. CGC made modest gains at the Nasdaq stock exchange early Wednesday, after closing the previous session lower.