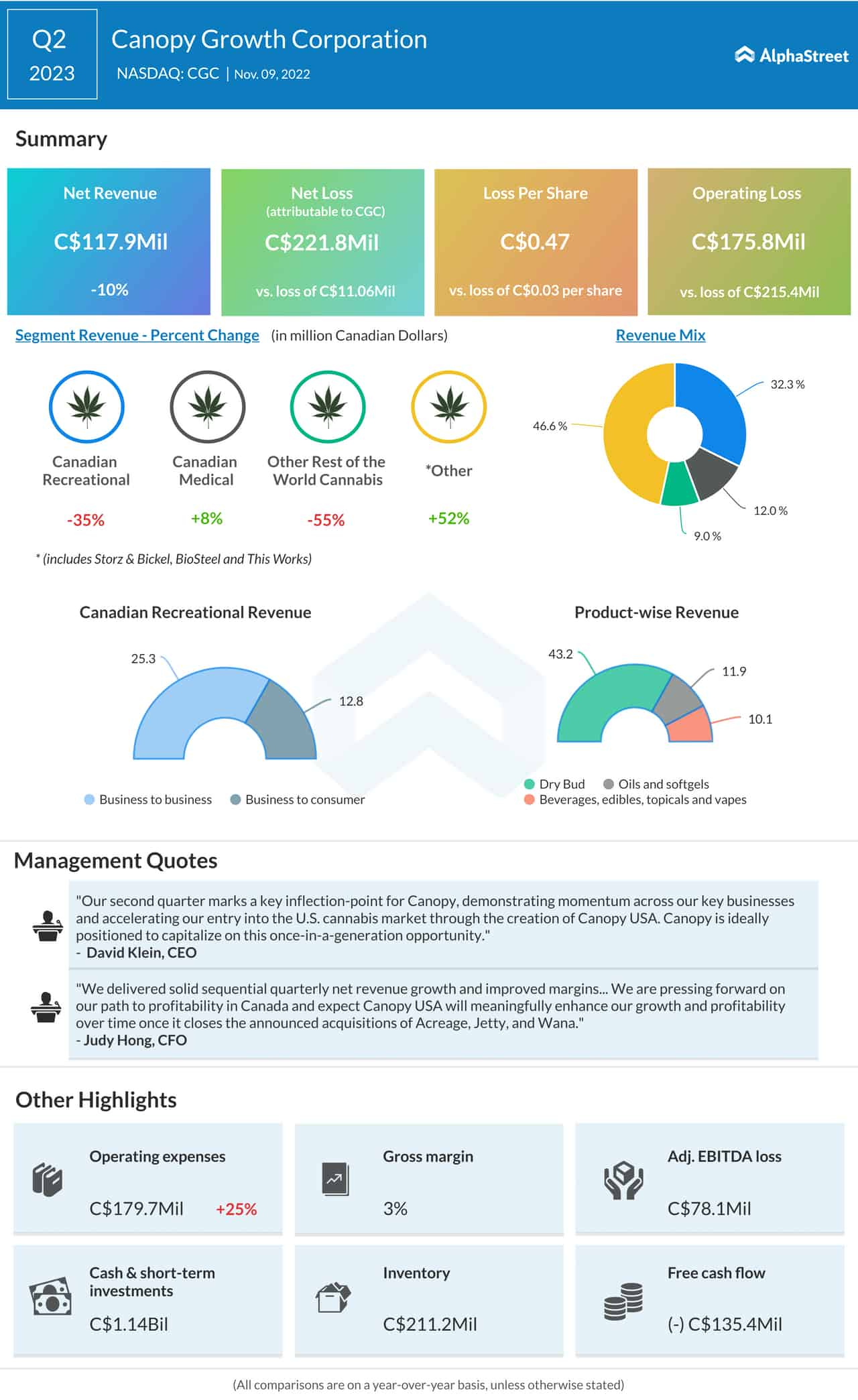

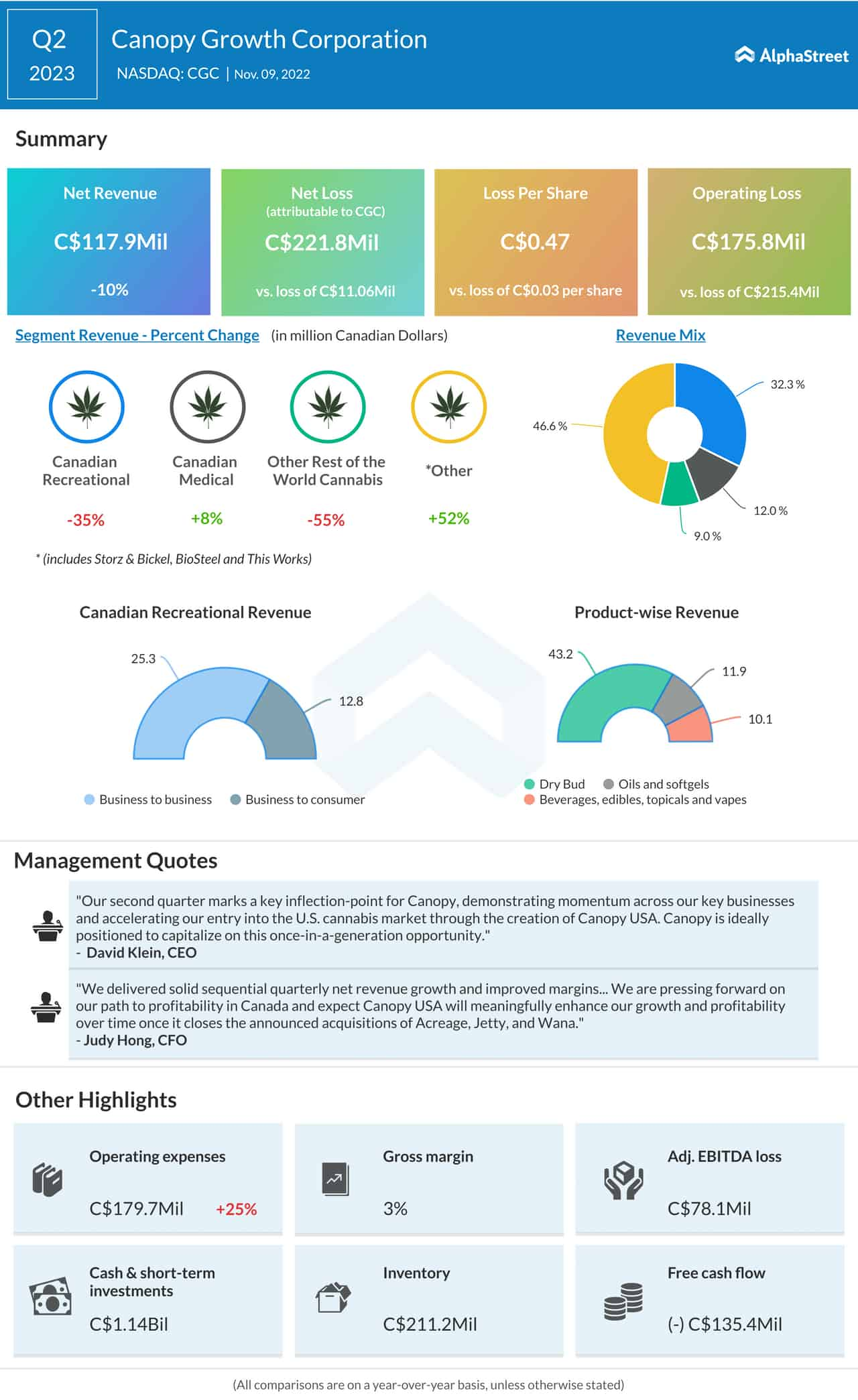

Cannabis producer Canopy Growth Corporation (NASDAQ: CGC) reported a wider net loss for the second quarter of 2023, hurt by a 10% fall in revenues.

In the three months that ended September 2022, the net loss widened to C$221.8 million or C$0.47 per share from C$11.06 million or C$0.03 per share in the same period of the previous year. The bottom line was negatively impacted by non-cash fair value changes and an increase in asset impairment and restructuring costs, which were partially offset by improved margins.

Second-quarter revenues decreased 10% annually to C$117.9 million, mainly reflecting weakness in the recreational cannabis segments and lower sales in the international market.

Check this space to read management/analysts’ comments on quarterly results

“Our second quarter marks a key inflection point for Canopy, demonstrating momentum across our key businesses and accelerating our entry into the U.S. cannabis market through the creation of Canopy USA. Canopy is ideally positioned to capitalize on this once-ina-generation opportunity and accelerate our path to North American cannabis market leadership,” said David Klein, chief executive officer of Canopy Growth.