The continuing stock market rally, at a time when the pandemic-hit economy is struggling to regain strength, has set off an IPO boom indicating that Wall Street is probably headed for a record year in terms of public listings. Tech firms have been dominating the IPO space for some time, thriving on the digitization wave, but the latest aspirants also include healthcare-related businesses like Sight Sciences, Inc.

Clear Vision

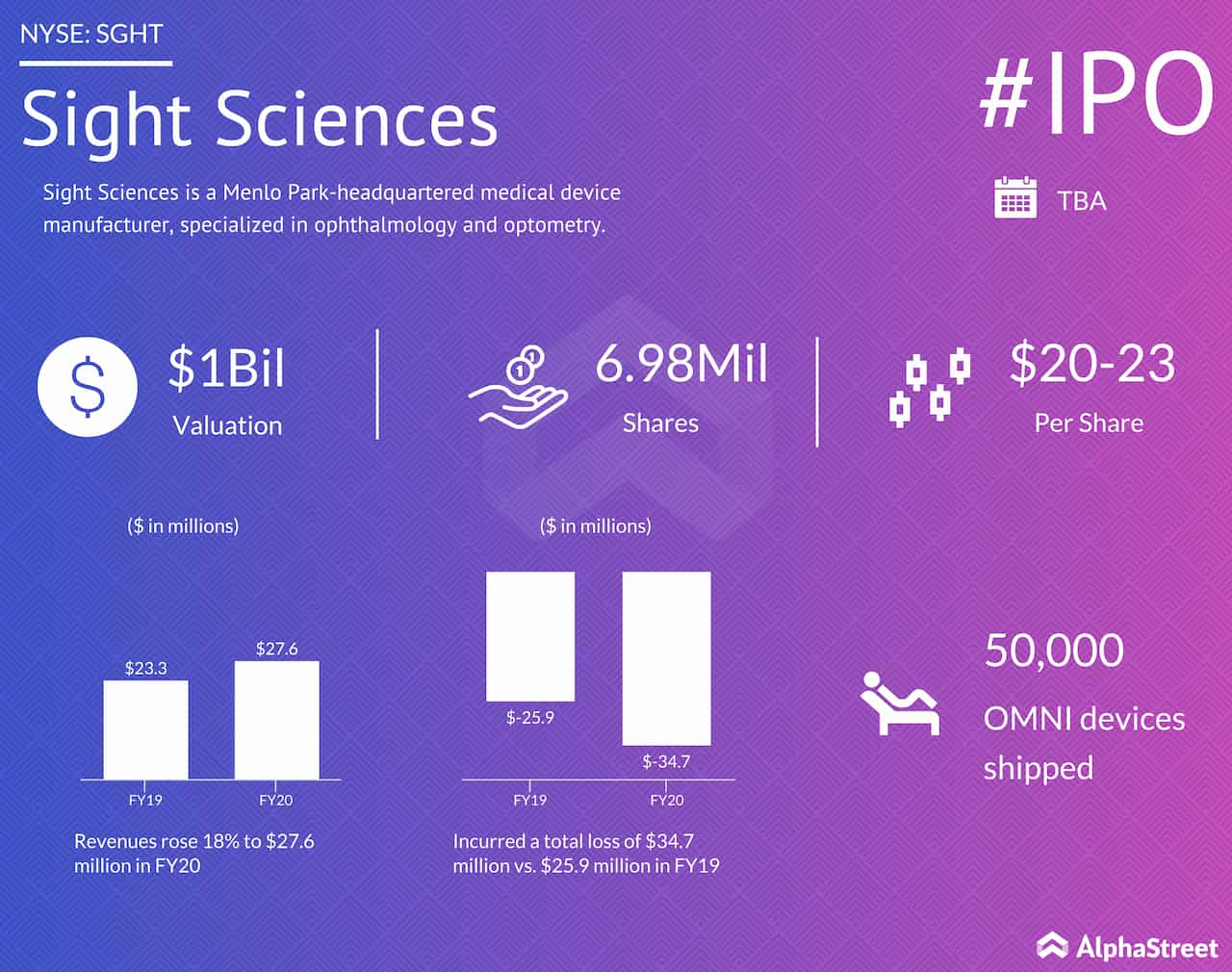

The Menlo Park-headquartered medical device manufacturer, specialized in ophthalmology and optometry, is advancing clinical trials on its blink-assisted eye-care device TearCare and implant-free OMNI surgical system. It is planning to raise about $150 million by offering around $7 million shares at an estimated price of $20-23 apiece. In a regulatory submission made to the Securities and Exchange Commission, the management revealed plans to list the stock on the Nasdaq stock market under the ticker symbol SGHT.

Read management/analysts’ comments on quarterly reports

Sight Sciences was founded by Paul Badawi and David Badawi in 2011, who together invented most of its successful products since then. The IPO is expected to elicit significant market interest, especially among life-science investors, given the company’s impressive performance during the crisis, marked by steady sales growth. Moreover, the eye care market is growing fast and the trend is expected to gain steam post-COVID.

Besides the trial program, the proceeds from the offering will be used for research activities and marketing. Three months ago, Sight Sciences had raised around $30 million in a financing round. Post-listing, it is expected to reach a market value of approximately $1 billion. The prevalence of glaucoma and dry-eye is increasing steadily due to the aging of the global population and lifestyle-related reasons.

Mixed Performance

The company generated sales worth $27.6 million in fiscal 2020, up 18% from the prior year. Benefits from the top-line growth were more than offset by a 24% increase in operating expenses to $50.6 million. As a result, net loss widened to $34.7 million or $3.71 per share from $25.9 million or $2.76 per share in fiscal 2019. Since the firm is deepening its research on glaucoma and dry-eye treatments — with around 11 studies either at various stages of completion or in the pipeline — costs would remain elevated and put pressure on margins.

All you need to know about Authentic Brands’ stock market debut

The company will have to compete with pharma giants like AbbVie, Novartis, and Johnson & Johnson (NYSE: JNJ) as well as eye care leaders like Bausch and Lomb to meet its growth targets, which would require the management to have a flawless strategy in place.

A Winning Model

The OMNI system has been successful in improving safety and efficiency in glaucoma surgery while nonsurgical device TearCare, which is worn over the eyelid to provide a warm compress when required, has set a new paradigm in the treatment of dry-eye. The products have witnessed strong growth and market adoption since they were commercially launched a few years ago. The continuing development of these primary offerings is important for the company, given the growing market for dry-eye and glaucoma care, which is estimated to reach $10 billion and $6 billion respectively.