Signs of Hope

While it is certain that the industry will continue to evolve, there is no reason to believe that Baidu would be left out. The average buy rating analysts have assigned to the stock implies that the company might get back on track in the near future. Their twelve-month price target of around $140 represents a 43% upside from the current levels, which will attract new investors and give some hope to the frustrated shareholders.

Meanwhile, a section of market watchers is not so optimistic about the prospects of the company, which disappointed the stakeholders with back-to-back losses in the recent quarters. An almost equal number of analysts recommend hold.

One factor that needs to be considered is that the way internet search is done in China is slightly different from that in the western world, where the search engine plays a bigger role in guiding users to what they are looking for.

Time to Act

It is high time Baidu addressed users’ concerns regarding the quality of its services. There have been complaints that the site’s search and advertising policies lacked transparency. Also, there is a looming threat of Google launching its search service customized for the China market, though the company is yet to make an official statement.

Slowdown

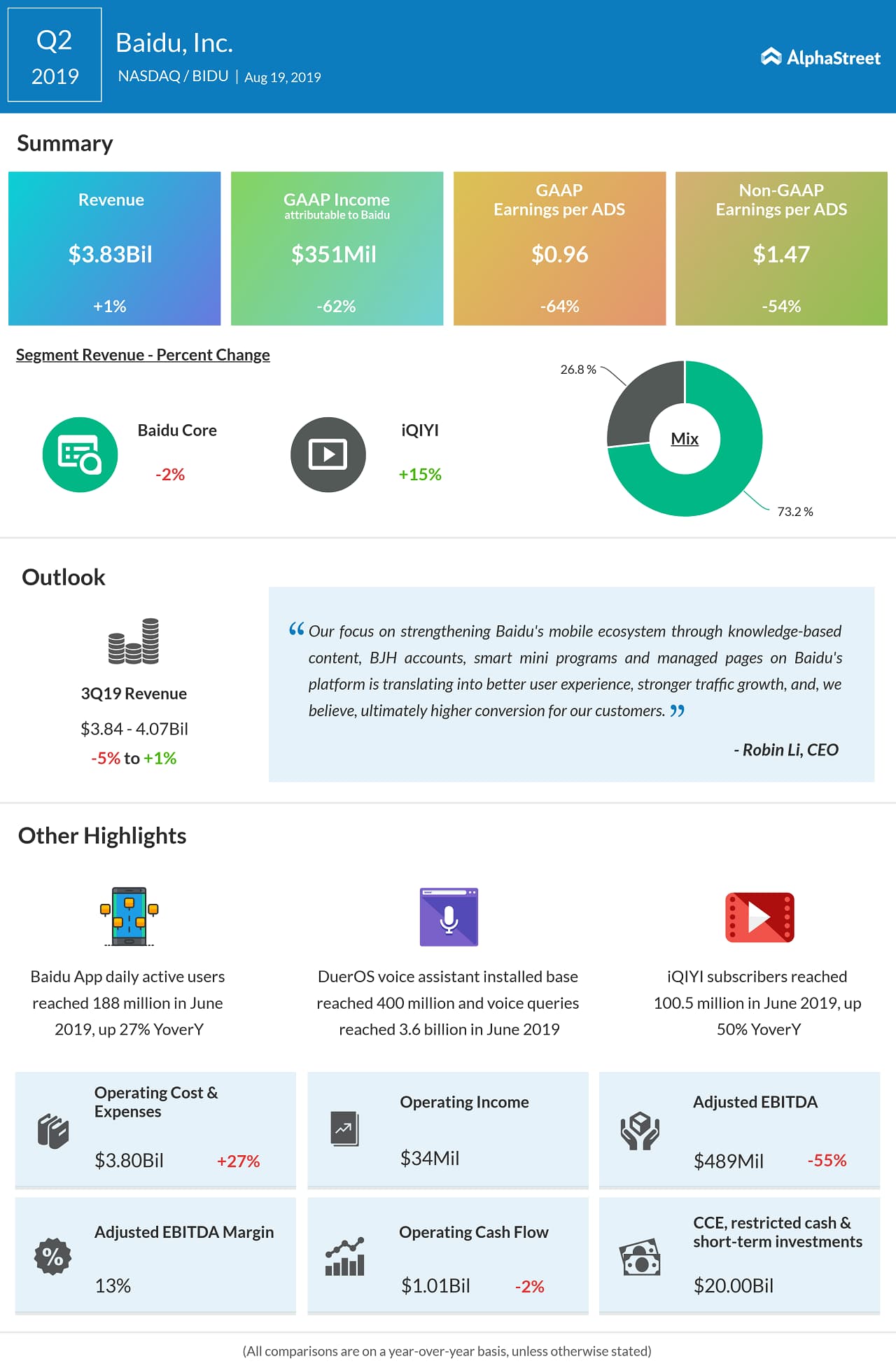

Baidu had a dismal start to 2019 as its earnings for the first three months of the year fell sharply and missed the estimates. Though the performance improved slightly in the second quarter, the overall outcome was reflective of the underlying weakness. Earnings and revenues declined in double digits to $1.47 per share and $3.83 billion respectively, hut mainly by muted performance by the Baidu Core segment.

The stock slipped to a six-year low this week, extending the downfall that started nearly a year ago. Though the stock bounced back briefly soon after the company’s second-quarter results in August, it failed to sustain the momentum. In contrast, Alibaba’s shares moved up about 4% in the past twelve months.