Stock Dips

Kroger’s stock suffered a surprise loss early Thursday despite the retailer reporting positive results for the first quarter and raising full-year guidance. Interestingly, KR had stayed broadly unaffected by the multiple challenges facing the business world. Though the stock had pulled back after peaking in early April, it returned to the growth path in the following weeks. The company has hiked dividends regularly for over a decade. The healthy cash flow allows it to return great value to shareholders.

Read management/analysts’ comments on quarterly reports

The Cincinnati-headquartered grocery retailer emerged as the star performer among retailers, thanks to the positive growth trend and strong profitability despite rising cost pressures. There is enough reason to believe it would maintain the uptrend in the near future. Also, the company has progressively reduced its market-share gap with retail titan Walmart Inc. (NYSE: WMT) by constantly revising its business strategy.

More Pros

Overall, 2021 was a fruitful year for the company, with the produce & prepared foods segment performing exceptionally well and often matching its bigger rivals in the retail space. Kroger’s high-quality private-label products are very popular among American households. Having its own supply chain comes in handy for the company when it comes to dealing with logistic issues and offering competitive prices.

“Our team is doing an outstanding job managing costs in an inflationary environment, which is allowing us to continue to invest in our associates while providing our customers the freshest food at affordable prices when and where they need it. We are delivering everyday value through personalized experiences, trusted Our Brands products, data-driven promotions, and seamless e-commerce solutions,” said Kroger’s CEO Rodney McMullen in a statement this week.

Key Numbers

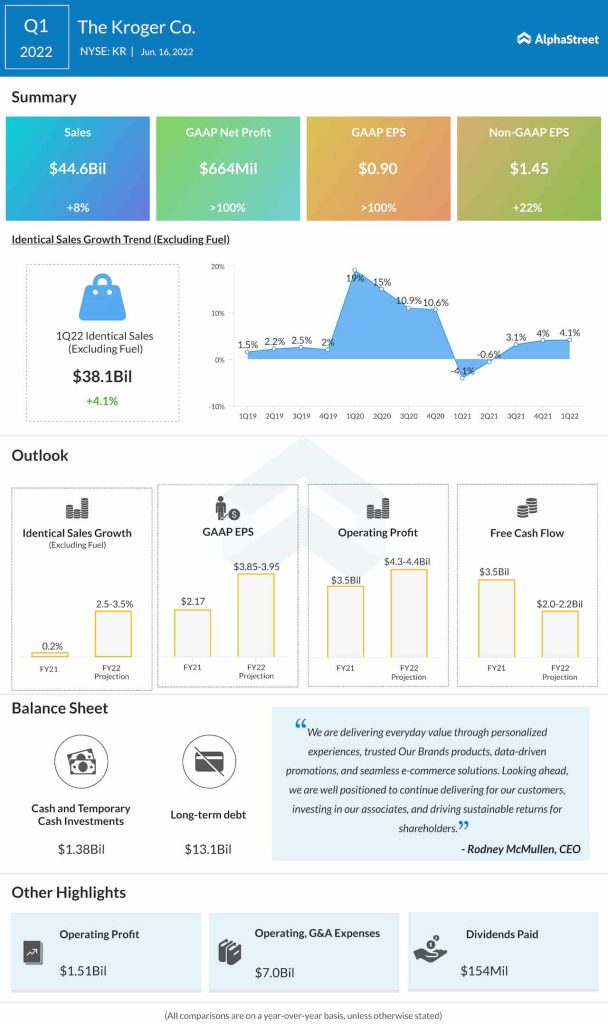

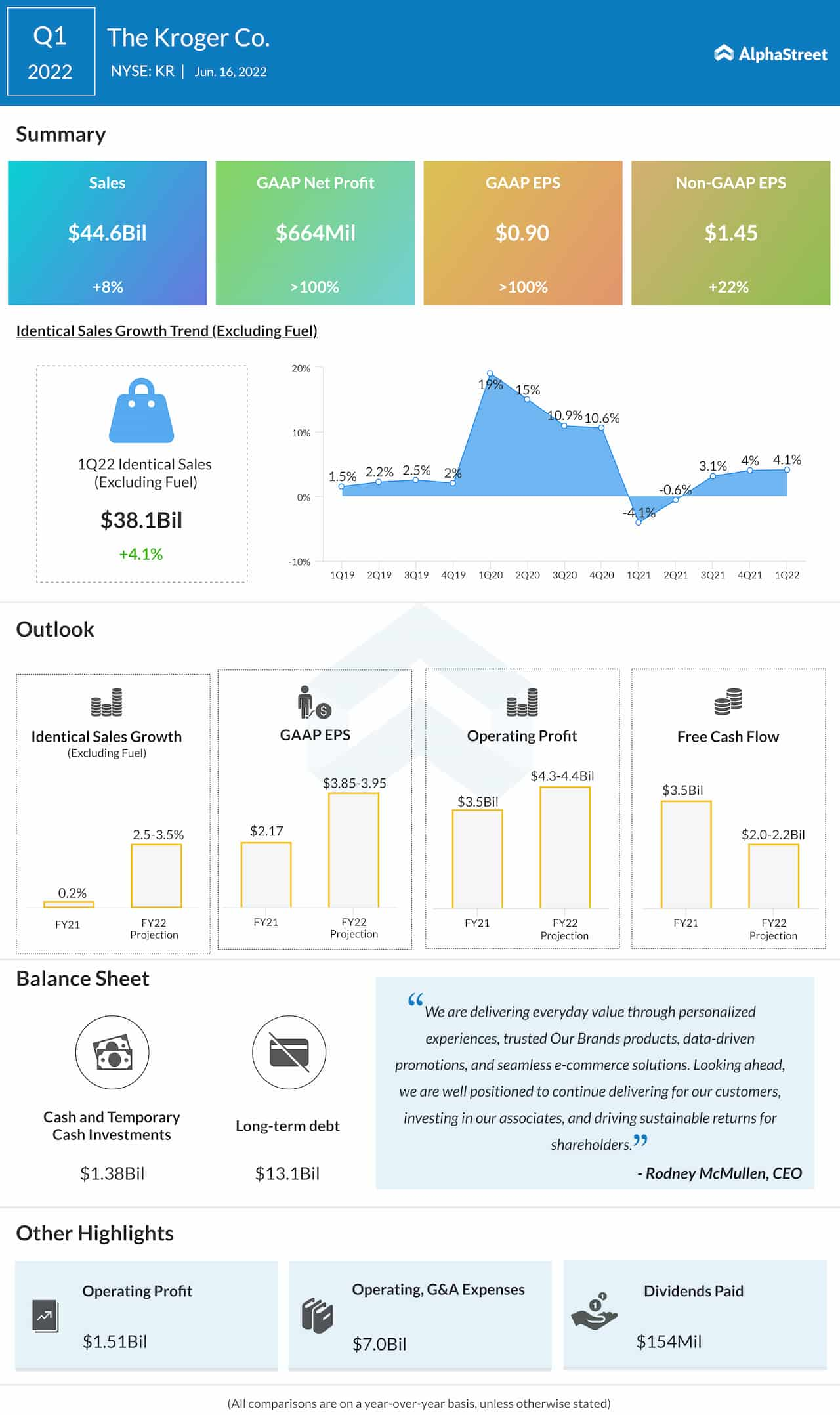

Kroger has an impressive history of beating analysts’ estimates on quarterly earnings. In the first quarter of 2022, identical sales, a key metric to gauge sales performance, grew 4.1%, accelerating for the fourth time in a row. That translated into an 8% increase in net sales to about $45 billion and a double-digit growth in adjusted earnings to $1.45 per share. Buoyed by the strong outcome, the management raised its full-year guidance.

The latest data show that Kroger’s business has not been materially affected by inflation, but any unfavorable shift in customers’ shopping habits can impact sales in the future. Also, the company would need to constantly innovate in order to tackle the growing competition.

Walmart cuts profit outlook as inflationary pressures are expected to persist

On Thursday, shares of Kroger traded down 19% from their April peak and hovered around the $50-mark. Over the past twelve months, however, they gained about 30%.