Shares of Walmart Inc. (NYSE: WMT) plunged 11% on Tuesday after the company delivered mixed results for its first quarter of 2023. While revenues beat expectations, earnings missed. The company raised its sales outlook for the year but cut its profits forecast, which was another disappointment. The stock has dropped 9% year-to-date.

Quarterly numbers

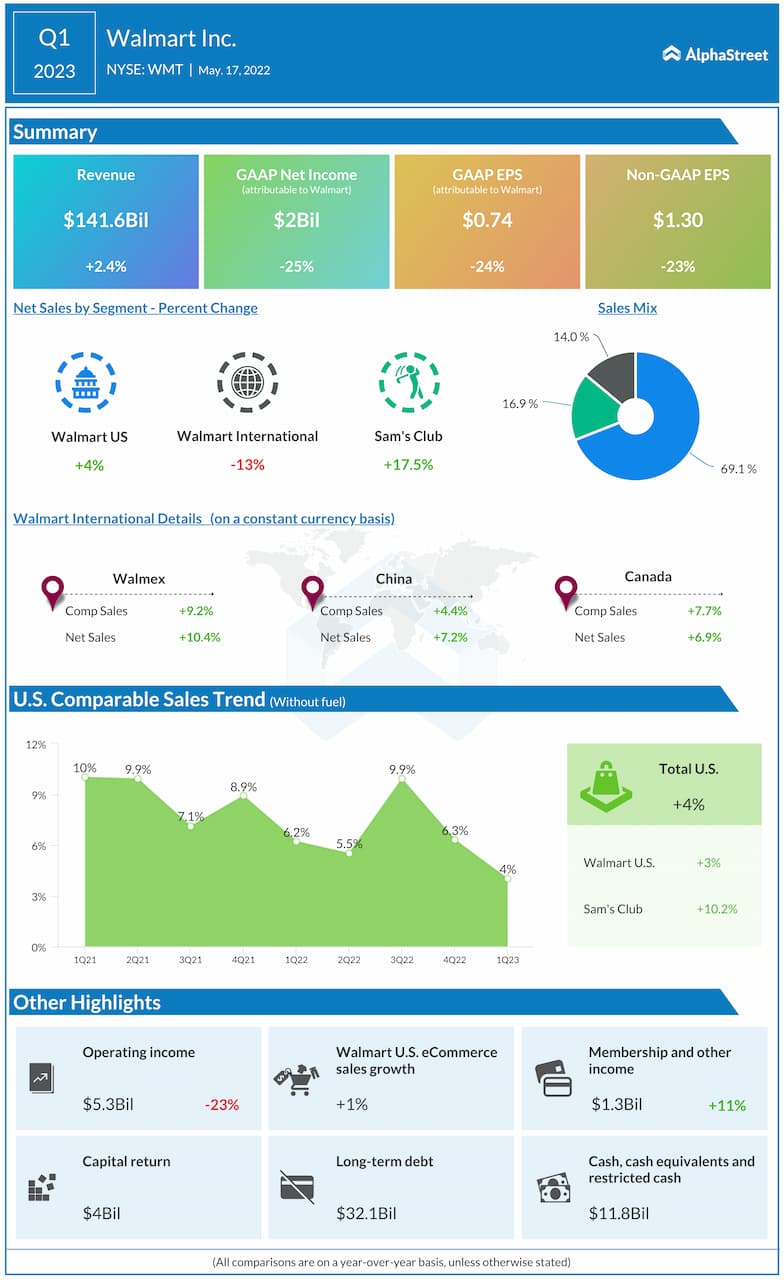

In Q1 2023, Walmart’s revenue increased 2.4% year-over-year to $141.6 billion, surpassing projections. On a constant currency basis, revenue grew 2.6%. GAAP earnings fell nearly 25% to $2.05 billion, or $0.74 per share, from the previous year. Adjusted EPS declined 23% YoY to $1.30, missing estimates. Total US comparable sales, excluding fuel, were up 4%.

Performance

Inflation was a huge issue during the quarter weighing on profitability and margins. The company stated that US inflation levels, particularly in food and fuel, created more pressure on margin mix and operating costs than expected. Gross profit rate in Q1 dropped 87 basis points to 23.8%.

Net sales for Walmart US increased 4% to $96.9 billion. Comparable sales grew 3% led by strength in food categories. The company witnessed continued grocery market share gains during the quarter. Food categories increased by mid-20% on a three-year stack. General merchandise witnessed a decline in the low double digits due to softness in discretionary categories and unseasonably cool weather which pressured sales in apparel, patio furniture and landscaping supplies.

Walmart international net sales declined 13% YoY to $23.8 billion. While Mexico, Canada and Chile witnessed strong sales growth, in China, sales growth was slower than expected. Gross profit rate decreased by 108 basis points due to negative impacts from the divestitures.

Net sales for Sam’s Club rose over 17% to $19.6 billion while comp sales were up 17%. Comp sales growth was driven by low double digit increase in transactions as well as inflation. Comp sales, ex fuel was up 10.2%. Ecommerce net sales growth was 22%, helped by strong contributions from direct-to-home and curbside.

Outlook

Walmart expects consolidated net sales for the second quarter of 2023 to increase over 5% YoY, and comp sales growth for Walmart US to increase 4-5%, excluding fuel. Both EPS and operating income are now expected to be flat to up slightly in Q2 versus the prior outlook of a low to mid single digit increase for both metrics.

For the full year of 2023, Walmart expects net sales to increase about 4% in constant currency versus the previous outlook of 3%. Comp sales growth for Walmart US is expected to be about 3.5%, ex fuel, versus the prior expectation of 3%. Consolidated operating income is now expected to decrease about 1% in constant currency versus the previous expectation for an increase of 3%. EPS is now estimated to drop 1% versus the previous outlook of a mid-single digit increase. The company expects to see higher supply chain costs and continued pressure from inflation through the year.

Click here to access the full transcript of Walmart’s Q1 2023 earnings conference call