Over the past two months, a few analysts and market observers have predicted an imminent stock slide, but Wayfair has strode past these projections.

The windfall

A few e-commerce focused investors identified early on in the lockdown phase that customers would soon start depending on online retailers for home accessories just like any other commodity, as brick-and-mortar shops remained shut. Wayfair is also likely to have benefited from many people setting up office spaces at their homes.

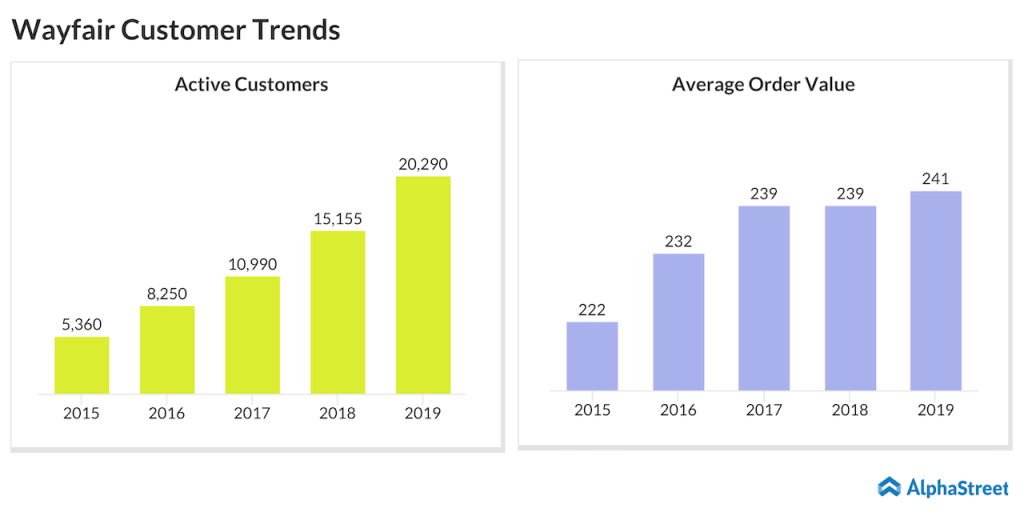

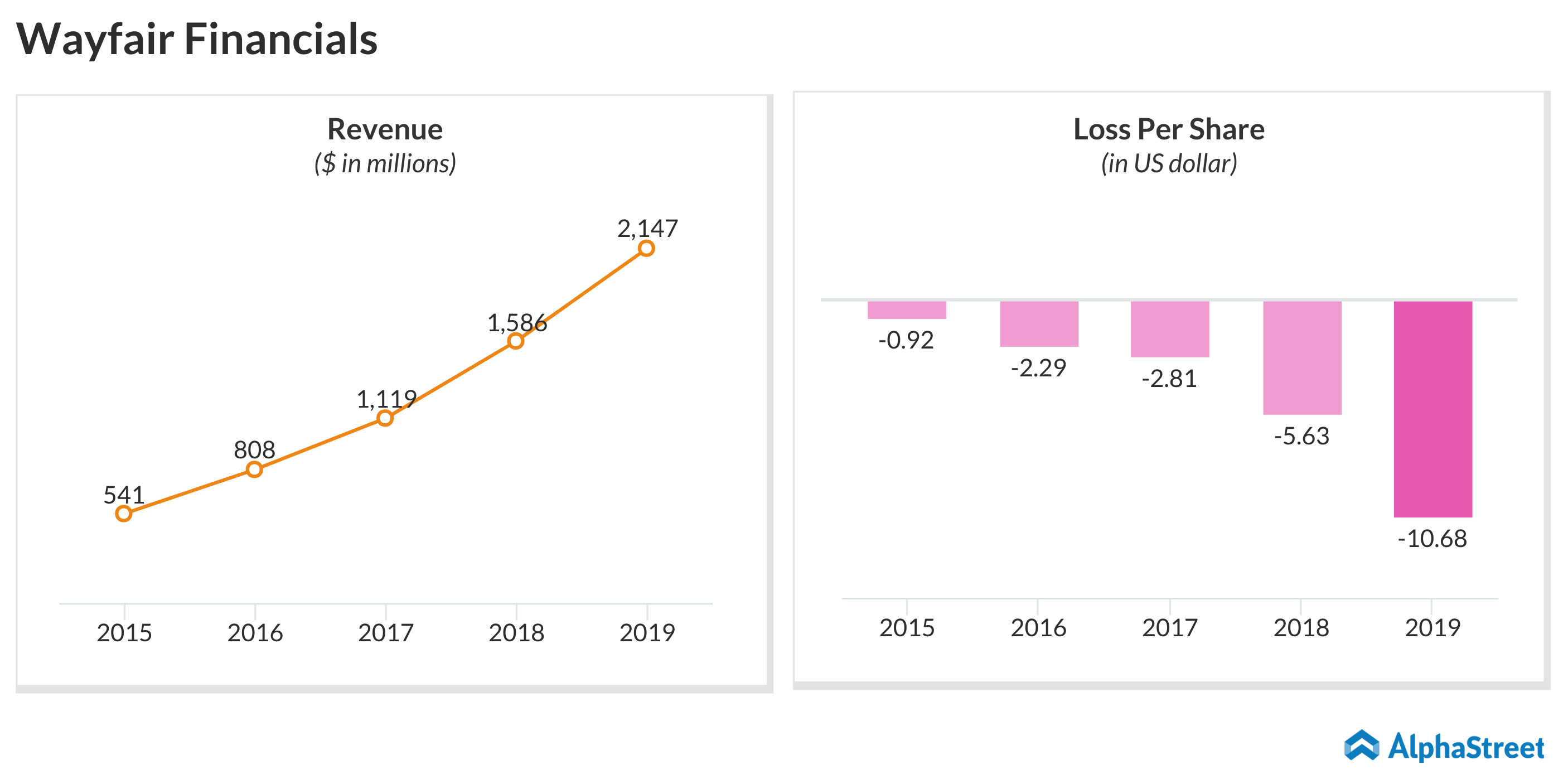

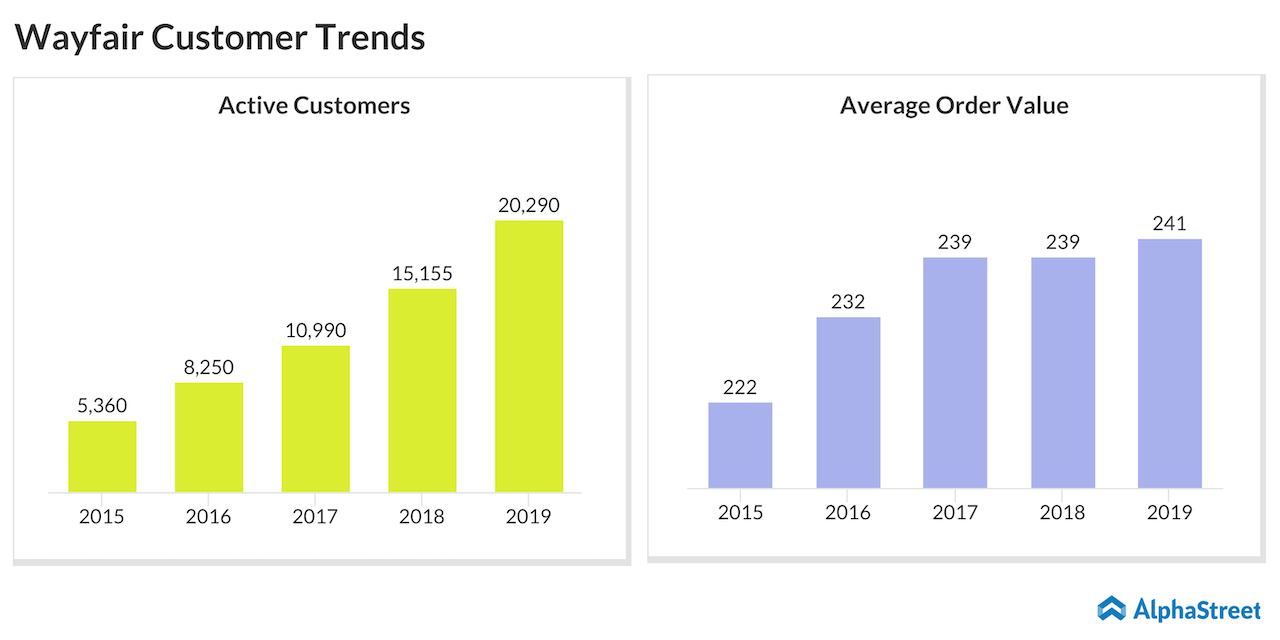

The thesis proved right when the Boston, Massachusetts-based firm reported first-quarter earnings results in early May. Total net revenue had jumped 20% as active customers jumped 29% year-over-year. During the earnings conference call, CEO Niraj Shah said:

“The competitive landscape shifted as many physical retail stores closed temporarily, leading customers to move increasingly toward shopping online across all categories, including home. This pickup in demand has continued to gain momentum. And in the US, the rollout of stimulus monies in mid-April served as an added accelerant of new and repeat customers coming to Wayfair.”

The Q1 results acted as a stimulus for

further growth in the stock.

Bottomline strength

Wayfair is undeniably a strong firm, and the shelter-at-home norms have definitely benefited it. Also, the company’s target audience is the tech-savvy millennials. In the annual 10-K filing the company notes:

“We believe there are approximately 80 million millennials in the US, many of whom are accustomed to purchasing goods online. As millennials age, start new families and move into new homes, we expect online sales of home goods to increase.”

It’s hard to protest the idea. So it won’t be surprising to see more growth in the topline. However, investors will ultimately shift focus to profitability and that’s when the problems start arising. I don’t expect Wayfair to report profits in the upcoming quarters, or even this year. But the company needs to start working on a blueprint to show investors its earnings potential.

Between fiscal 2015 and 2019, loss per share has widened almost 10 times as a result of increased spending on advertising. With international expansion taking pace, it calls for increased expenses relating to setting up logistics and infrastructure. So when will the bottom-line start curving towards the positive side?

[irp posts=”64433″]

Note that the average order value has increased only slightly over the past five years even though active customers have seen a steady rise. This could lead to additional requirements to raise cash externally.

Impact of the economy

During the earnings conference call, the management

stressed that the firm is well set to go through economic downturns. The CEO pointed out:

“I will remind you that Wayfair’s revenue grew through the financial crisis in 2007, 2008 and 2009 even as the total addressable market declined some 30% and more than 10,000 brick-and-mortar stores went out of business.”

ADVERTISEMENT

However, consumer preferences need not

mirror historic trends. With unemployment set to peak at 25%, consumers might

as well delay purchases or opt for refurbished furniture. In such an instance,

mindless cash burn could backfire, making it necessary to have a clear plan to profitability

in place.

The company is next expected to report quarterly results in the first week of August and we expect to see some updates on margins and profitability then.

(DISCLAIMER: The article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone)

____

For more insights about Wayfair, read the latest earnings call transcript here.

[irp posts=”63849″]