Establishing its foray into robotic health products, pharmaceutical giant Johnson & Johnson (JNJ) on Wednesday announced it was acquiring California-based Auris Health in a cash deal valued at approximately $3.4 billion.

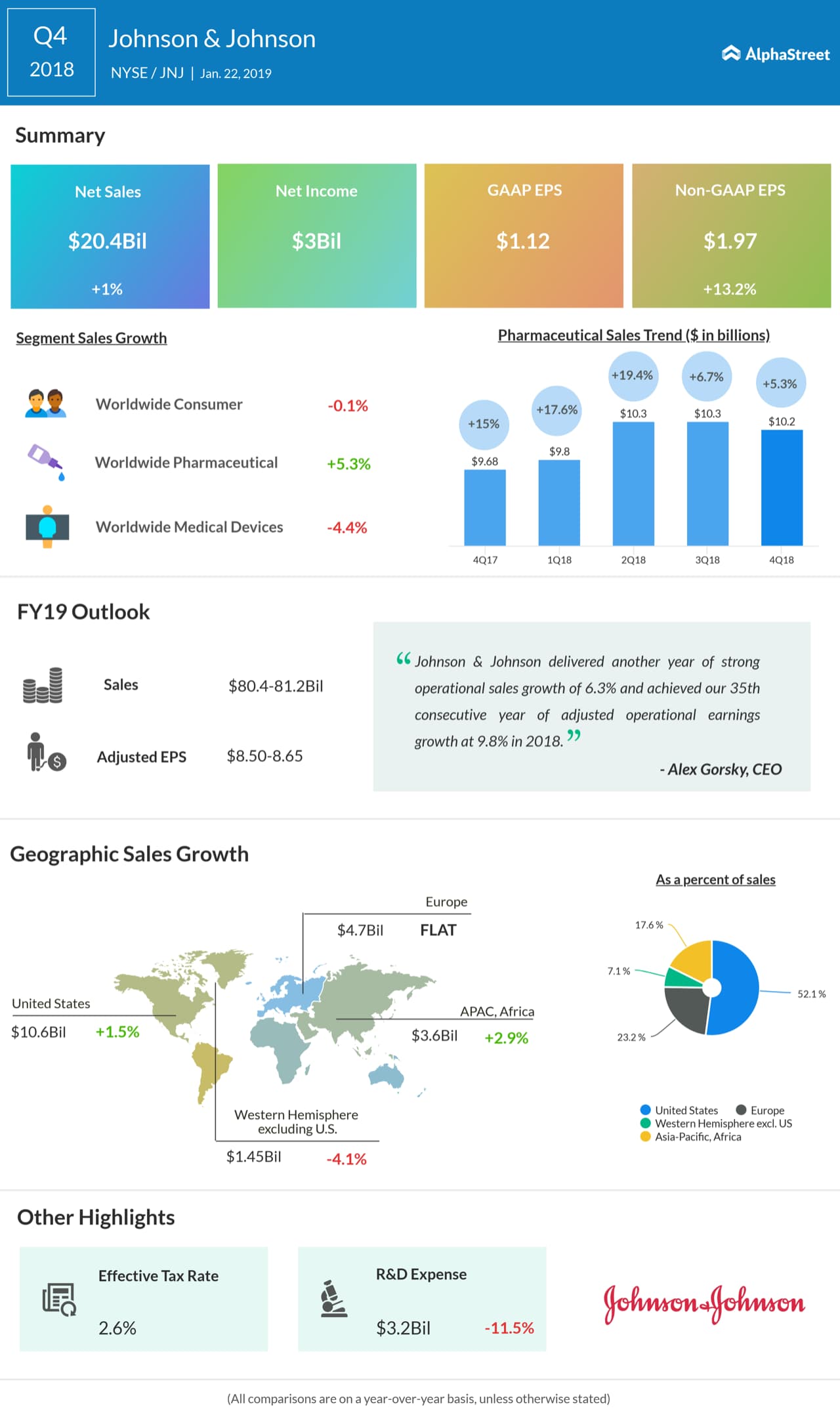

Auris Health specializes in robotic technologies and has an FDA-approved platform used in bronchoscopic procedures. The addition of Auris Health is expected to boost Johnson & Johnson’s ailing medical devices unit, where sales declined 4% in the last reported quarter.

The latest acquisition will be complemented by the pharmaceutical giant’s partnership with Alphabet’s (GOOGL) Verily, which was inked in 2015 with an aim to develop surgical robots.

JNJ shares were slightly up during the morning trading hours. The stock has gained 3.4% during the prior 12-month period.

Worldwide Chairman, Medical Devices at Johnson & Johnson, Ashley McEvoy, said, “We believe the combination of best-in-class robotics, advanced instrumentation, and unparalleled end-to-end connectivity will make a meaningful difference in patient outcomes.”

Founder and CEO of Auris Health Frederic Moll will join Johnson & Johnson upon the completion of this transaction.

“This combination is a testament to the incredible work of the Auris Health team and the innovation engine behind the Monarch Platform, which represents a huge step forward in endoluminal technology,” Dr Moll said.

The transaction is expected to close by the end of the second quarter of 2019.