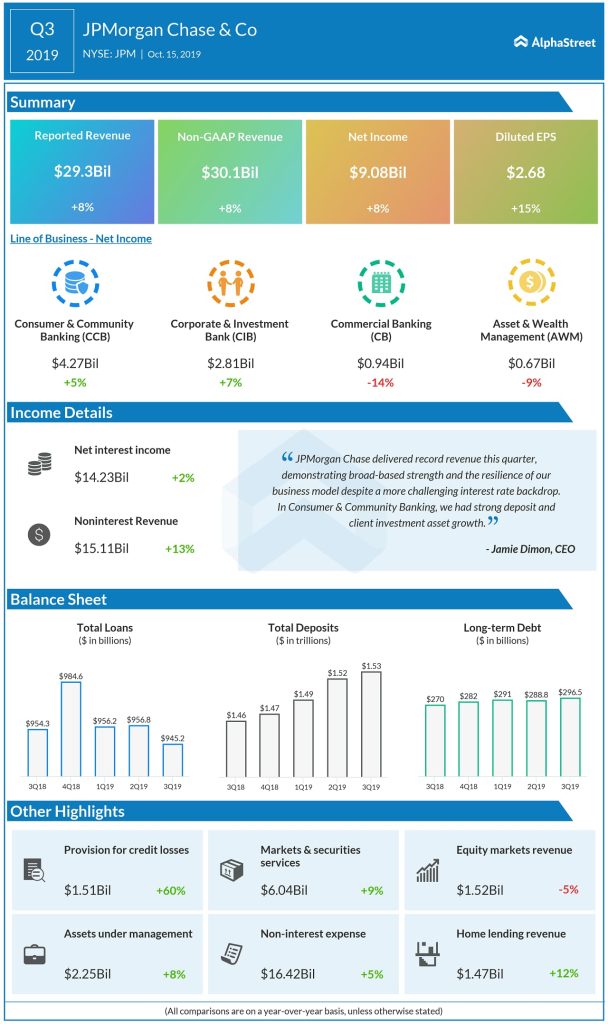

JPMorgan’s revenue on an adjusted basis, increased 8% year-over-year in 3Q to $30.06 billion. Net interest income grew 2% to $14.4 billion in the recently ended quarter, driven by continued balance sheet growth and mix, offset by the impact of rates.

Consumer & Community Banking segment had strong deposit and client investment asset growth. Consumer lending businesses benefited from the company’s continued investments and a favorable environment for borrowers, which helped drive healthy volumes in Home Lending and Auto and strong loan growth in Card.

In the Corporate and Investment Banking segment, Markets revenue surged 14% to $5.1 billion. Fixed Income Markets revenue was $3.6 billion, up 25% compared to the prior year which reflected less favorable market conditions. Third quarter 2019 results were driven by strong client activity across products. Equity Markets revenue was $1.5 billion, down 5% compared to a strong prior year, reflecting lower revenues in derivatives.

“In the U.S. economy, GDP growth has slowed slightly. The consumer remains healthy with growth in wages and spending, combined with strong balance sheets and low unemployment levels. This is being offset by weakening business sentiment and capital expenditures mostly driven by increasingly complex geopolitical risks, including tensions in global trade,” said CEO Jamie Dimon.

Read: Charles Schwab (SCHW) outclasses Q3 2019 earnings and revenue targets on strong client demand

JPMorgan’s peers Citigroup (NYSE: C) and Wells Fargo (NYSE: WFC) also reported their quarterly results today. While Citigroup’s Q3 profit surpassed market’s views, Wells Fargo failed to meet Q3 earnings targets. However, Wells Fargo beat revenue estimates.

JPMorgan stock, which hit a fresh 52-week high ($120.40) last month, had advanced 19% since the beginning of this year and 9% in the past 12 months.