Shares of Kellogg Company (NYSE: K) were up 1% on Monday. The stock has gained 9% year-to-date and 13% over the past 12 months. Last week, the company delivered better-than-expected results for its third quarter of 2022 and raised its guidance for the full year. Here are three factors that work in favor of the cereal company:

Sales growth

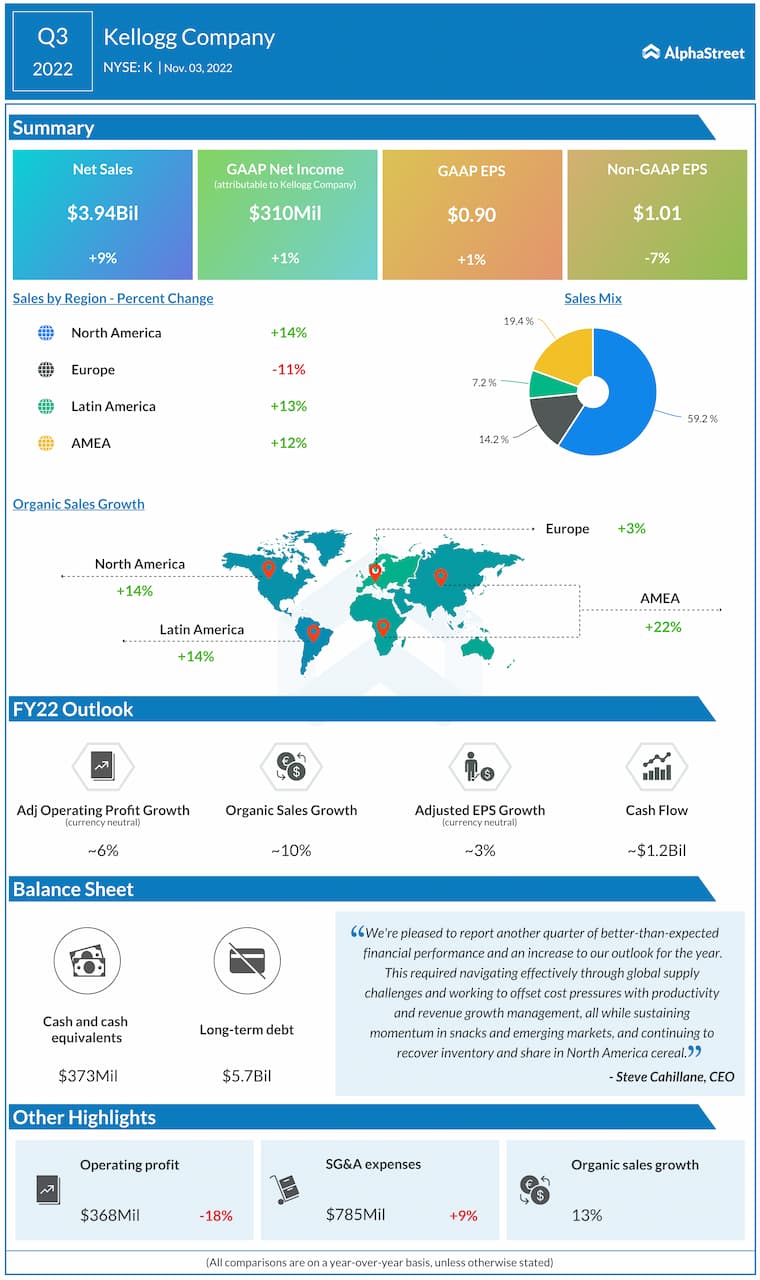

Kellogg saw strong sales growth for its overall business and across most of its segments during the third quarter. In Q3, Kellogg’s net sales increased 9% to $3.94 billion compared to the year-ago period, driven by strength in snacks and noodles as well as a rebound in the North America cereal business. The top line growth was also helped by positive price/mix. On an organic basis, net sales grew 13.4%.

Net sales in the Kellogg North America segment increased 14% both on a reported and organic basis. The growth was driven by price/mix and volume growth as well as momentum in snacks and a pickup in the cereal business.

The Kellogg Latin America segment reported sales growth of 13% on a reported basis and 10% on an organic basis. In the Kellogg AMEA segment, net sales grew 12% on a reported basis and 22% on an organic basis. In the Kellogg Europe division, net sales dropped 11% on a reported basis due to FX impacts as well as the impact from suspending shipments into Russia. On an organic basis, Europe sales increased 3%.

Category performance

Kellogg’s strong sales growth was driven by solid performance from its snacks business during the third quarter. The Pringles brand, which yields $2.5 billion in net sales annually worldwide, recorded double-digit consumption growth across all major markets in Q3. Cheez-It, which generates over $1 billion in annual net sales, recorded double-digit growth in the US and Canada. The company is also seeing strong performances from its Pop-Tarts and Rice Krispies Treats brands.

Kellogg saw good consumption growth continue through the quarter within its international cereal businesses. The company grew consumption across key European markets with the Special K brand and the launch of the low-sugar Special K Granola offering. Kellogg saw consumption grow in Australia, along with improvements in markets like Japan and Korea with the expansion of its granola offerings.

Within the frozen breakfast category, Kellogg saw steady consumption growth in the US for its Eggo brand, which generates about $750 million in annual net sales worldwide. The company is also seeing strong growth in its North America cereal business, which accelerated to double-digits in Q3 on the back of price hikes and below-average elasticity.

Outlook

Based on its strong year-to-date performance, Kellogg raised its revenue and profit guidance for the full year of 2022. The company now expects net sales to grow approx. 10% on an organic basis compared to its prior guidance of 7-8%. The updated guidance reflects better-than-expected growth as well as momentum in snacks and strength across emerging markets.

Adjusted operating profit is now expected to grow approx. 6% on a currency-neutral basis, versus the prior outlook of 4-5%. Adjusted EPS is now expected to grow approx. 3% on a currency-neutral basis versus the prior outlook of 2%, reflecting the improved operating profit guidance.

Click here to read the full transcript of Kellogg’s Q3 2022 earnings conference call