Revenue

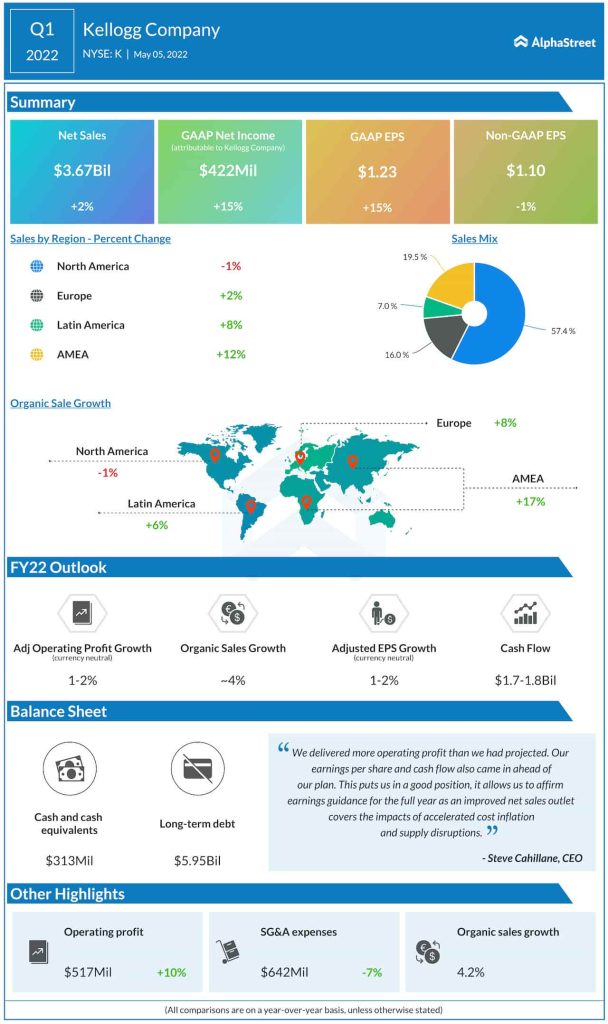

Organic sales growth in Q1 was 4%. The top line growth was driven by positive price/mix and the strong performance of the company’s snacks brands across all regions. On its first quarter conference call, Kellogg said it expects to see momentum in its top line continue through the year on the back of a strong snacking portfolio.

Profits

The consensus estimate for adjusted EPS in Q2 2022 is $1.05. In Q2 2021, adjusted EPS was $1.14. Kellogg reported adjusted EPS of $1.10 in the first quarter of 2022, which was down 1% YoY. The bottom line was impacted by high cost inflation and economy-wide bottlenecks but the company managed to mitigate these impacts to an extent through productivity initiatives and price realization. On its Q1 call, Kellogg said it expects cost inflation to persist longer than it had previously expected. It also expects bottlenecks and shortages to continue through the first half.

Portfolio transformation

The biggest highlight of the report is likely to be the company’s decision to split its business into three independent companies. In June, Kellogg announced that it plans to spin off its US, Canadian, and Caribbean cereal and plant-based businesses into three independent companies. These businesses together made up around 20% of Kellogg’s net sales in 2021. The remaining business, which made up 80% of net sales in 2021, is focused on global snacking, international cereal and noodles, and North America frozen breakfast.

These companies will temporarily be known as the Global Snacking Co., the North America Cereal Co., and the Plant Co. The Global Snacking Co. will comprise the global snacking, international cereal and noodles, and North America frozen breakfast products. The North America Cereal Co. will comprise the company’s cereal brands in the US, Canada and Caribbean. The Plant Co. will be a pure-play plant-based foods company.

The spin-offs are expected to be completed by the end of 2023. There are likely to be several questions on the company’s proposed strategies for these businesses along with the associated costs and expected profits from these separations.

Click here to access the full transcripts of the latest earnings conference calls