Facebook has been diversifying its services and has been

investing in areas like video streaming. Investors will be interested in the

company’s updates in this area as well as on topics such as its cryptocurrency

Libra and political advertising.

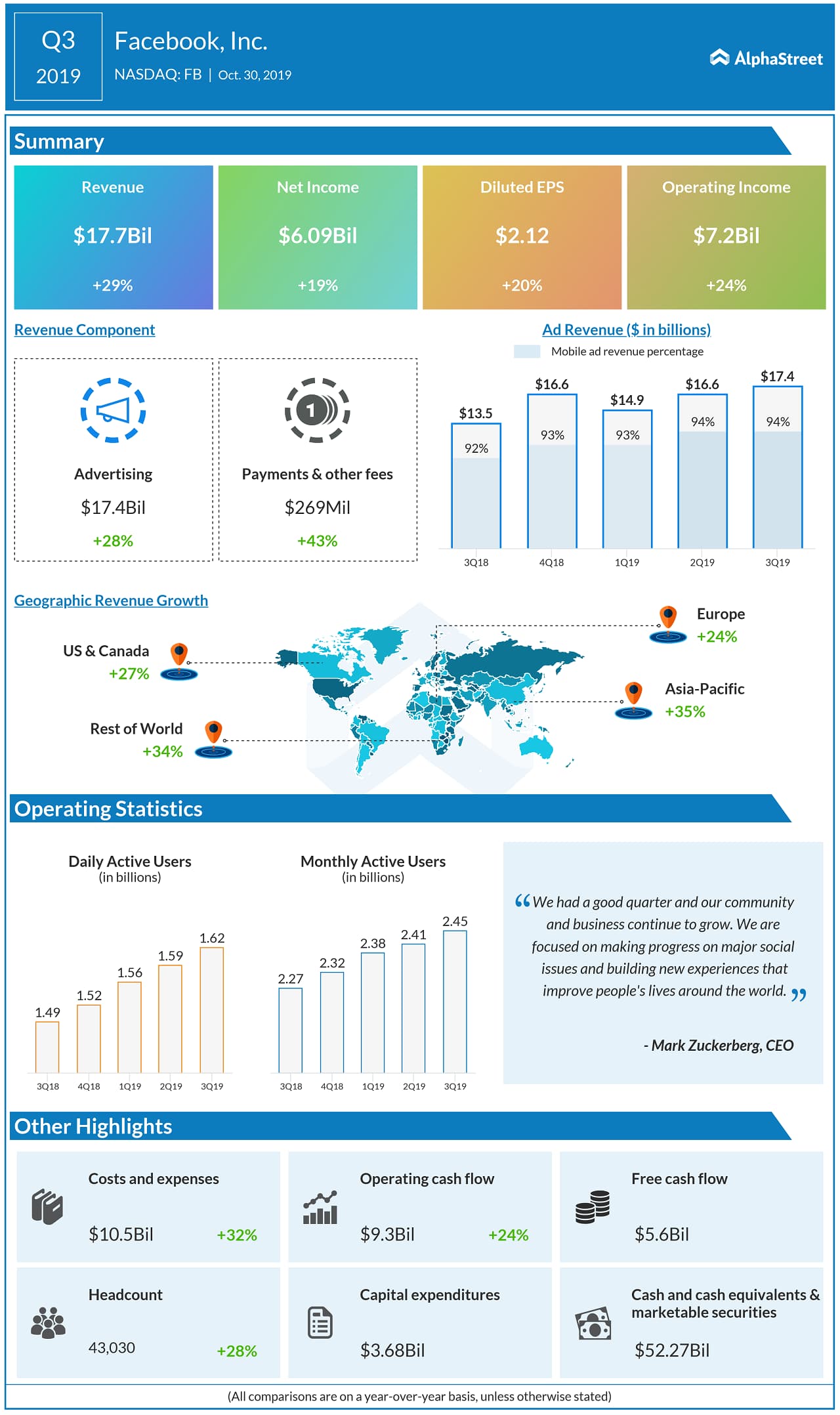

As we have witnessed over the past quarters, Facebook

continues to see growth in users despite the privacy concerns and negativity it

has faced. User growth has been stronger in regions outside the US and Europe. Last

quarter, daily active users increased 9% while monthly active users rose 8%.

The social media giant still faces scrutiny on the way it

handles its user data and the company continues to invest in improving its

privacy features. This has, however, not affected the popularity of the

platform significantly.

In the third quarter of 2019, Facebook beat revenue and earnings estimates. Revenues increased 29% year-over-year to $17.65 billion and EPS rose 20% to $2.12.

Shares of Facebook have gained 45% over the past one year and 15% over the past three months. The stock has a majority rating of Buy and the average price target is $245.74.