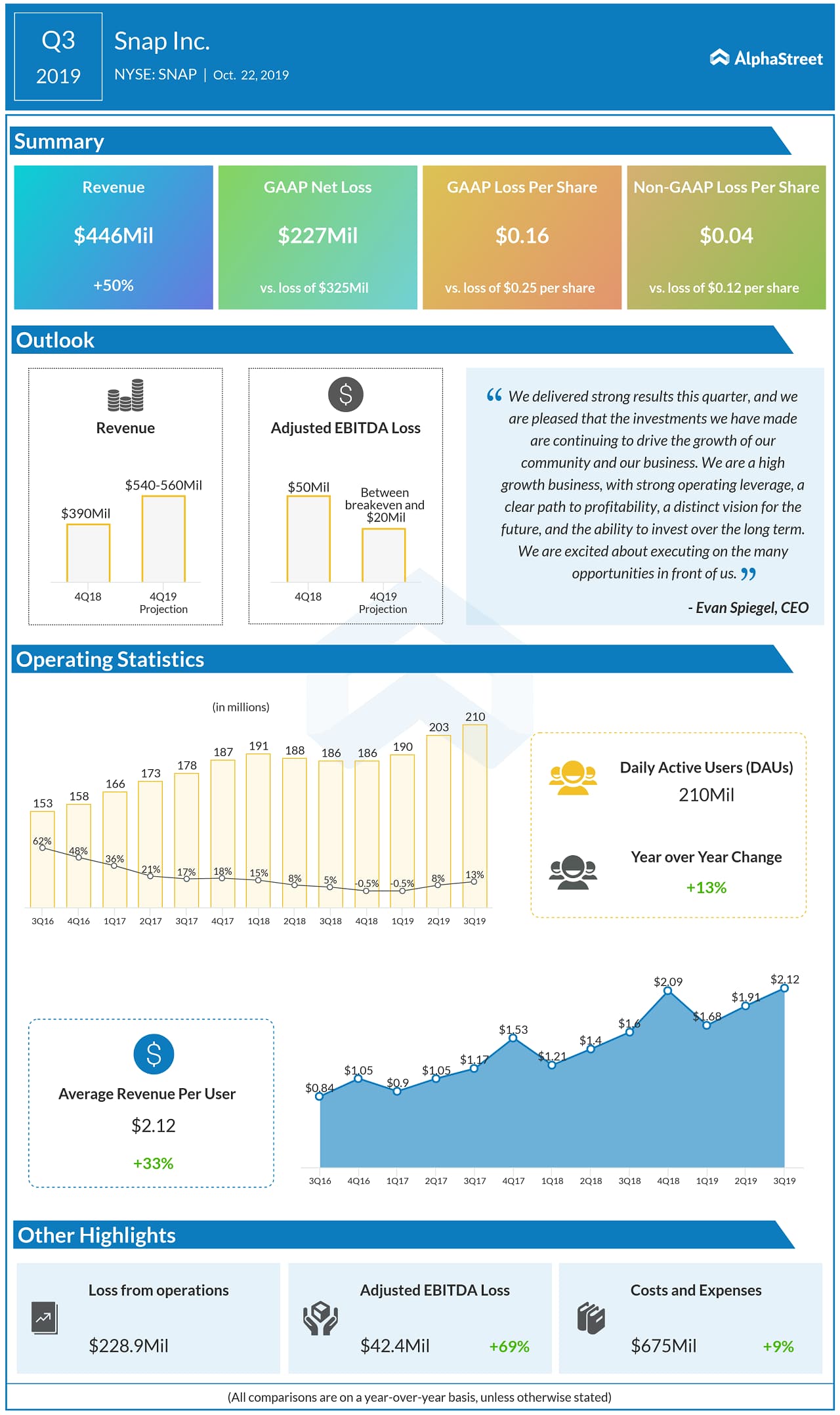

The main number to watch will be the user metrics. Snap has recorded a steady sequential growth in daily active users (DAUs) over the past four quarters. Last quarter, DAUs increased 13% year-over-year. Average revenue per user also increased 33% year-over-year to $2.12.

Snap has been investing in developing several new features

and capabilities in order to drive user growth and engagement. The Discover

platform, Snap Games and augmented reality platform have all helped in

improving user engagement.

Last quarter, Snap partnered with SYBO Games and launched a new multiplayer game called Subway Surfers Airtime, which was an exclusive release on Snapchat. The Lens Studio is another feature that is bringing users to the platform. It bodes well that Snap is able to grow its user base amid the tough competition it faces from Facebook’s (NYSE: FB) Instagram.

In the fourth quarter, Snap released Spectacles 3, which comes with dual HD cameras to capture 3D photos and videos, allowing the transformation of Snaps with 3D effects. The company also debuted an experimental short film Duck Duck by Harmony Korine which was shot using Spectacles 3 to explore storytelling in 3D.

Also read: Honeywell Q4 2019 Earnings Report

In the third quarter of 2019, Snap beat revenue and earnings

estimates. Revenue rose 50% to $446 million while adjusted loss amounted to

$0.04 per share, which was narrower than the year-ago number.

For the fourth quarter,

Snap estimates revenues to come in the range of $540 million to $560 million

with adjusted EBITDA expected to be between breakeven and $20 million.

Shares of Snap have gained 166% over the past one year and 21% over the past three months. The stock has a majority rating of Buy and the average price target is $20.67.