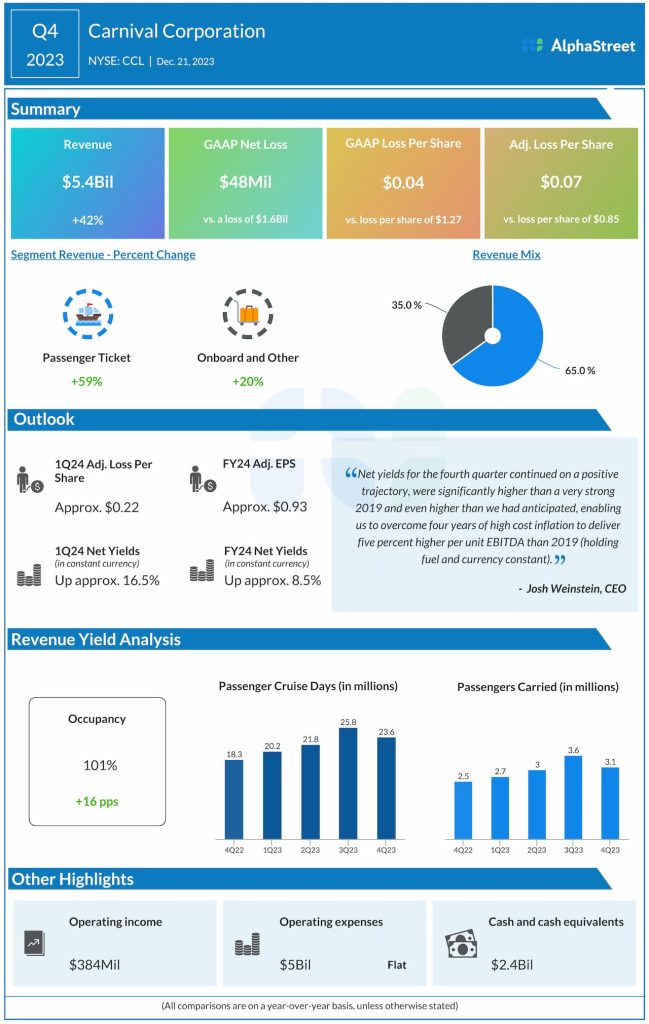

Quarterly numbers

Bookings

Carnival has been seeing demand strengthen across all its brands. Booking volumes in the fourth quarter were higher than the levels seen during the previous year and 2019. In addition, booking volumes for the two weeks around Black Friday and Cyber Monday reached an all-time high for that period.

“We entered the year with the best booked position we have ever seen, and now have nearly two-thirds of our occupancy already on the books for 2024, at considerably higher prices (in constant currency). We continue to experience strong bookings momentum across the board, with our European brands showing remarkable strength during the quarter with booking volumes running up well into the double digits at considerably higher prices (in constant currency).” – Josh Weinstein, CEO

Passenger cruise days increased to 23.6 million from 18.3 million in the prior-year quarter. Passengers carried totaled 3.1 million versus 2.5 million last year. Occupancy was over 101%. Total customer deposits reached $6.4 billion in Q4, up 25% from last year.

Outlook

For the first quarter of 2024, Carnival expects net yields, in constant currency, to be up approx. 16.5% from the same period last year with occupancy returning to historical levels as the cruise line operator closes the remaining occupancy gap in the first half of the year. Capacity is expected to be up 4.6% from the prior-year quarter. The company expects adjusted loss of approx. $0.22 per share for Q1 2024.

For the full year of 2024, net yields, in constant currency, are expected to be up approx. 8.5% from the previous year, with occupancy returning to historical levels. Capacity is expected to be up 5.4% from the prior year. Carnival expects adjusted EPS of approx. $0.93 for the full year.